Fair Market Value of Business

There are many factors that go into determining the fair market value of a business.. This article is intended to walk you through some of those items, from how to determine the fair market value of a business to the key elements that go into determining the price. Read on to learn:

- What Is Valuation? Assignment Of Price Or Dollar Value.

- What Is The Importance Of Determining Taxable Value?

- How Do You Determine the Value of a Business?

- How Do You Determine The Taxable Value Of Your Business? Find A Qualified Appraiser.

What Is Business Valuation? Assignment Of Price Or Dollar Value

The basic concept of valuation is to determine a justifiable dollar value or price for a total or partial interest in your closely held business. It is the process of answering the question, "How much is your closely held business worth?" Business valuation plays a critical role in determining gift and estate tax liability and/or the appropriate selling price for an interest. Because determining the fair market value of a business is so important, you should be very careful when selecting an appraiser.

What Is The Importance Of Determining Taxable Value?

There are many legal and tax related reasons for determining the taxable value of a business. These reasons include:

Business Valuation for Estate Purposes

Business valuation is a critical component to your estate or business succession planning. Your business may be your largest asset, and if you plan to engage in either one of these types of planning, at some point you will need to determine the taxable value of your business interest. An incorrect value (i.e., one that is underestimated) could cause you to miss out on tax-saving strategies, while a value that is inflated could result in an investment of time and money in unnecessary planning.

The IRS Is Very Interested In Taxable Value

Perhaps a key reason to be concerned about determining the taxable value of your business is the Internal Revenue Service (IRS), which is always on the lookout for sales at below and even above fair market value. If you sell something for less than the fair market value of business, the IRS could deem the transaction a combination sale and gift and charge you gift tax on the difference between the value you received and the value the IRS calculated. Likewise, a sale at above fair market value could be deemed a gift (subject to gift tax) from the buyer to you.

Your Tax Liability Depends On It

The fair market value of your business bears an important and direct relationship to the amount of tax you will owe, whether it be capital gains tax resulting from a sale, gift tax on shares you have given away, or estate tax on property you own at your death. If the value determined by the IRS is different than the value your tax was calculated on, you (or your estate) could be liable for additional tax.

Why A Valuation Might Be Needed? May Be No Active Market To Set Price

The valuation of large, publicly traded companies such as those found on the New York Stock Exchange is usually set by the buyers and sellers in the market through active trading. This price is generally accepted as the fair market value of business. With a closely held business, however, there isn't an active market for the stock, so determining the fair market value of the business becomes much more challenging. A determination of the value of your business should be conducted for gift or estate tax purposes or to engage in the sale of your business.

Determining Taxable and Fair Market Value Will Determine Capital Gain

When you sell your business, the difference between your basis and the price you receive is your capital gain. Your gain must be reported and is subject to capital gain tax. A properly conducted business valuation can ensure that the price at which your interest is sold represents fair market value and that your tax liability is correct.

Sale Of Business To Family Member To Be Closely Examined By IRS

You may be selling your business interest to a family member. You should be aware that the IRS tends to carefully examine this type of sale in search of disguised gifts. If the IRS determines a higher value for your business than the sale price you used, you might very well be liable for gift tax on the difference between the two values. Further, it usually takes a couple of years before the IRS challenges the value, and your additional tax liability may be compounded by accrued interest and penalties. A valuation by a qualified appraiser could avoid this potential problem.

Business Valuation Creates Fair Sale Of Business To Outsider

If you are planning to sell your business to a non-family party, you may want to receive the highest amount possible. An independent evaluation may help you to achieve this objective while at the same time assuring the buyer that the price being paid is fair. Without a valuation from an independent, qualified appraiser, it might be harder to attract buyers due to the perception that the business is being overvalued by the seller. The timing and circumstances of the sale will also have an impact on the value. A forced liquidation or sale (one where the money is needed fast) will generally result in a lower valuation and price received.

Transfer Of Business Under Buy-Sell Agreement

If you have a buy-sell agreement for your business, you already have a buyer for your interest upon the occurrence of certain events. If correctly done, your buy-sell may have been specially drafted to establish taxable value. The terms of your buy-sell may require a periodic valuation of the business. When an interest changes hands under the agreement, a valuation is needed for the price exchanging hands, which sets the tax basis for the buyer and the capital gain of the seller.

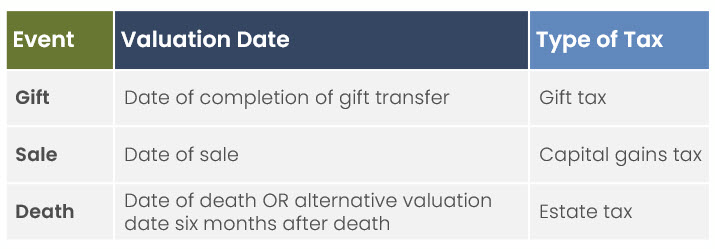

Transfer Of Interest By Gift

Part of your estate planning strategy may be to transfer your business interest by gift. Gifts of a certain size are not subject to gift tax. In order to determine if you must pay gift tax (and, if so, how much), you need to know the value of the gift. Any time a business interest is transferred by gift, a valuation should be conducted to document the gift tax value and reduce the risk of the IRS changing the value of the gift upon a later audit. Tip: Do the valuation as closely as possible to the date of the gift.

Estate Tax Purposes

A business valuation may be required when an owner dies. A valuation at this point can ensure that all applicable discounts are reflected in the value. It is also of major importance in determining the estate tax liability. The last thing your estate needs is to be subjected to an IRS audit and have poor (or no) documentation of the business valuation used in the estate tax return. If the business has a buy-sell agreement, a valuation may be needed to calculate the price at which the interest will be sold to the buyer named in the agreement.

Valuation Issues Appraisal Versus Value

An appraisal is the process of determining value and represents an opinion. The result of the appraisal analysis is the assignment of a value based on a specific point in time. There is no one process and generally no one definitive value for a business. It is possible for a business to have different values, depending on the purpose of the evaluation and the interpretation of the criteria examined. Because there is no single method or definition, it is important that the appraisal report contain a specific definition of value and the assumptions used in the analysis.

How to Determine the Fair Market Value of Business

There Are Multiple Approaches To Determining Fair Market Value of Your Business

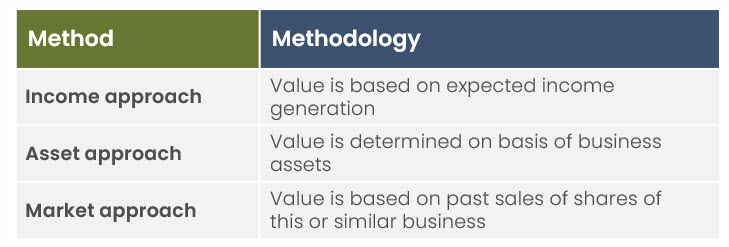

There is more than one way to approach a business valuation. The nature of the business itself may indicate that one way is more appropriate than another, and while there are general rules, it is still more art than science. Furthermore, appraisers are at their own discretion in determining if intangibles, fair market values or liquidation values will be used. Appraisers using the same named approaches may use different techniques to determine the value. As a result, sometimes multiple, independent valuations are conducted, and an average result is used. The table below shows three common valuation methods:

Valuation May Be Discounted

The value of certain ownership interests may be discounted (reduced), depending on certain conditions. Sometimes, a minority stock interest in a closely held corporation is granted a discount for estate tax purposes when it is included in the owner's gross estate. The discount is granted because the minority interest itself carries no ability to influence corporate decisions or policy, which in turn reduces its marketability to anyone but the controlling shareholders. A minority interest that cannot influence policy but is large enough to represent a swing vote could have a valuation discount disputed by the IRS.

Valuation Can Be Disputed

A lot of factors can affect the value of a business. Disputes between taxpayers and the IRS involving the valuation of property occur relatively frequently. To complicate things, even the IRS acknowledges that there is no one, true, fair market value for a closely held business, so the area is open to interpretation. Moreover, not only might the valuation be subject to dispute, but inaccurate valuations for tax purposes could be subject to civil and criminal penalties.

Timing Is Important in Determining the Value of a Business

Transactions are valued by the IRS on the date of the transfer. To reduce the chance of the IRS calculating a value that differs greatly from the value you paid tax on, your valuation should be determined (and documented) as closely to the transaction date as possible.

Tip: It is important to get an accurate appraisal of the value of a business interest any time the business is transferred as a result of lifetime gift, sale, or bequest.

Different Definitions Of Value Fair Market Value

Fair market value (FMV) is the price at which property would change hands between a willing buyer and a willing seller (who are independent, nonfamily members), where both parties have reasonable knowledge of the relevant facts, and neither party is under any compulsion to buy or sell. This is the definition frequently used by the IRS.

Fair Value

Fair value is different from fair market value, and as used here, it is different from the accounting definition. In business valuation, fair value is a statutory standard generally applied in cases involving dissenting shareholders and sometimes in suits involving corporate dissolution, merger, sale, or auction. The determination of fair value is usually applied to minority interests when the minority shareholders believe they won't receive full consideration for their shares under the merger, sale, or dissolution. The minority shareholders have their shares appraised and receive an amount of cash equal to the fair value in exchange for the shares.

Investment Value

Investment value is specific to an owner (or prospective owner) and includes consideration of factors such as the owner's knowledge, abilities, related business interests, and expectation of earning potential and risk. A business will likely have different investment values to different people, depending on specific factors (i.e., the value is in the eyes of the beholder).

Intrinsic Or Fundamental Value

Intrinsic value is a term that carries different meanings to different professionals. In some cases, it is used to refer to fair market value, fair value, investment value, or even some other type of value. Sometimes it is used to refer to the analysis of an investment banker, security analyst, or financial manager or analyst. The point is, this term has several meanings and interpretations, so it is very important that any valuation including this term have a very specific definition of its usage.

Going Concern Value

A going concern value considers factors specific to the business, both physical and intangible. Consideration is given to the existing infrastructure, goodwill, reputation, trained workforce, licensing, and/or plant capabilities of the business. The valuation is based on the assumption that the business will continue to be a viable operating entity and as such should bear a higher value than the sum of the values of its collective assets.

Liquidation Or Breakup Value

Liquidation value is a determination of the proceeds (net of selling costs) realized if a company ceased operating and sold off the assets. There are two types of liquidation, and the specific situation will affect the valuation. An orderly liquidation involves the sale of assets over a period of time to maximize proceeds. A forced liquidation, on the other hand, means selling the assets as quickly as possible (often by auction) and often at a lower value than might otherwise be achieved if more time were available.

Book Value

Book value is an accounting term that can apply to a specific asset or an entire company. An asset's book value equals the historical cost minus any allowances for depreciation, amortization, or unrealized losses. The book value for a company is the shareholders' equity, calculated from the balance sheet as the excess of total assets over total liabilities.

How Do You Determine The Taxable Value Of Your Business?

It's important to find a qualified appraiser. Determining the value of your business is not something you should attempt on your own, especially in light of the fact that the IRS could challenge your valuation. There are appraisers who specialize in determining the value of businesses. Your CPA may even be one of these specialists or know someone who is.

Don't Use An Old Appraisal

You may have had your business appraised in the past for another purpose. As tempting as it might be, don't use an old appraisal now. The purpose of the appraisal can affect the valuation assigned, and time can change the factors that go into the appraisal calculation.

More About Business Valuations

Valuing your business is part art and part science. For more about how experts value businesses, why you'd need a business valuation, how to prepare for one, and more, check out our podcast episode, "What Is Business Valuation & When Do I Need It?"