Jump To 15 Frequently Asked Estate Planning Questions

Estate planning is more than simply planning for the passing of assets at your death. A proper estate planning process also helps you manage and preserve your assets while you are alive. How you wish your assets to be handled develops over time. Your estate plan is never really “finished” because your planning needs change depending on your age, family status, health, wealth, lifestyle, life stage, goals, and many other factors.

To help you better understand what estate planning might mean for you, we have put together some estate planning guidance for people in different stages of life. Because the estate planning process can be somewhat complex and everyone’s situation is unique, please consult professionals, particularly an estate planning lawyer and trust expert, about your specific situation.

Estate Planning Guidance For New Adults Turning 18

You might think that 18 seems a bit young to begin the estate planning process, but no one can predict the future. Incapacity through injury or illness can strike anyone at any time. If that happens, without the proper estate planning documents in place, your family may have difficulty acting on your behalf.

You might think that 18 seems a bit young to begin the estate planning process, but no one can predict the future. Incapacity through injury or illness can strike anyone at any time. If that happens, without the proper estate planning documents in place, your family may have difficulty acting on your behalf.

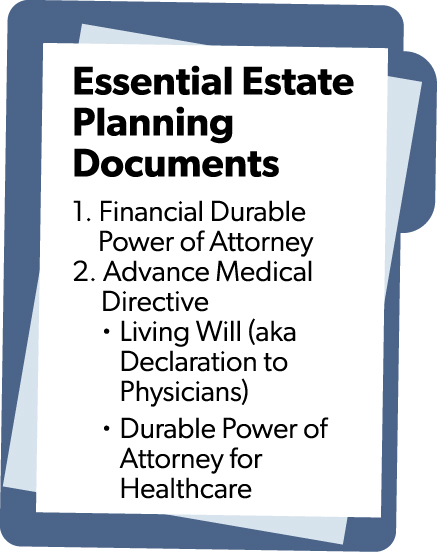

All adults aged 18 and over should consider having, at a minimum, these essential planning documents:

- Financial Durable Power of Attorney: This legal document lets you name someone to manage your assets and make financial decisions for you in the event you become incapacitated.

- Advance medical directive: The two main types of advance medical directives are (1) Living Will, also known as a Declaration to Physicians, and (2) Durable Power of Attorney for Health Care, also known as a health care proxy. Forms for medical directives vary from state to state, so consult your estate planning attorney to be sure you have the appropriate forms in place.

These estate planning documents give your loved ones peace of mind, minimize stress, and reduce potential conflicts among family members.

Young And Single Adult Estate Planning Guidelines

For those of you who are young and just starting out, you may not have built much of an estate yet. You may be newer to the workforce and haven’t had the time or assets to make major investments and purchases. For those who might not be quite so young or new to the working world, if you are single, your financial situation may still not be overly complex.

However, if you have material possessions, like a car, an inheritance, or property, you should work with a lawyer to draft a legal will. If you don’t, you won’t be able to control what happens to those possessions in the event of your death or incapacity. Those assets will likely go to your parents, and that might not be what you want. A will allows you to leave your possessions to anyone you choose — whether it’s your sibling, best friend, significant other, or favorite charity.

Some assets, such as bank or investment accounts, can be made payable or transferrable on death through the use of beneficiary designations. This may provide a simple way to ensure these assets pass directly to the heirs of your choice. In many states, you can add these types of designations to your house or even your car title.

Also, as you participate in your employer’s retirement plan, be sure to fill out those beneficiary designation forms so the assets will transfer according to your wishes. Remember to do likewise with any employer-provided life insurance.

Estate Planning Considerations For Unmarried Couples

Things get a bit more complicated for those of you who have decided to be together forever but haven’t quite made things official. While it might seem obvious that you’d want your life partner as your heir, that won’t be possible unless you have a legal will and/or trust in place. The law does not see your partner as a legal relative, so your assets may instead end up passing at your death to unintended family members, leaving your partner with nothing.

There are some other basic estate planning options for certain types of assets. For example, you could share ownership of certain property — such as a house or car or a bank account. If you own the property or accounts as joint tenants with rights of survivorship, when one of you dies, the jointly held property will pass to the surviving partner automatically.

Married Couples Seeking Estate Planning Guidance

If you do have the marriage certificate, it doesn’t always mean your estate will automatically transfer to your spouse if you pass away without an estate plan. Each state has its own laws regarding the distribution of assets, and your spouse might end up sharing your estate with other family members.

Most states are “common law” states, which allow each partner to own assets individually. However, some states are “community property” states, which dictate that each spouse owns half of all assets and income.

While Kansas and Missouri do not have community property laws, Wisconsin, which is technically known as a “marital property” state, falls in the “community property” category. Working with professionals who understand the specifics of ownership estate law in your state will help you ensure that your assets go exactly where you want them.

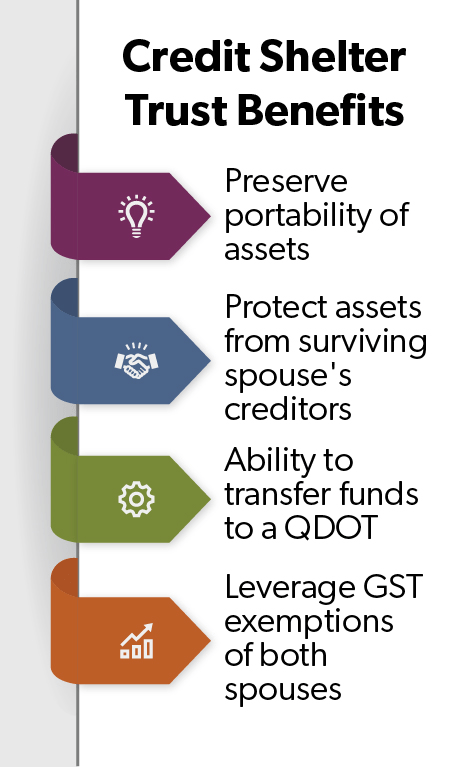

“Portability” rules can allow your surviving spouse to use both of your unified credits to reduce or avoid potential estate taxes at the second death, so it might be tempting to leave all your assets to your spouse through a simple bequest. However, trust planning may suit your goals better because you can plan for more than tax avoidance. You may want to consider forming a credit shelter trust upon the first spouse’s death. This type of planning can be advantageous for several reasons:

“Portability” rules can allow your surviving spouse to use both of your unified credits to reduce or avoid potential estate taxes at the second death, so it might be tempting to leave all your assets to your spouse through a simple bequest. However, trust planning may suit your goals better because you can plan for more than tax avoidance. You may want to consider forming a credit shelter trust upon the first spouse’s death. This type of planning can be advantageous for several reasons:

- Credit shelter trust planning can preserve portability (the opportunity to preserve the first spouse’s unified credit exemption for use at the death of the second spouse), which might otherwise be lost if the surviving spouse remarries and is later widowed again.

- The trust can protect assets from the reach of the surviving spouse’s creditors.

- Portability does not apply to the generation-skipping transfer (GST) tax, so the trust may be needed to fully leverage the GST exemptions of both spouses.

- Married couples with one spouse who isn’t a U.S. citizen have different planning concerns. Non-citizen spouses cannot receive the marital deduction — although in 2023 a $175,000 annual exclusion is allowed. If you meet certain requirements, a transfer to a qualified domestic trust (QDOT) will qualify for the marital deduction.

Family Estate Planning Process With Children

If you’re married and have children, you and your spouse should each have your own will. A will is vital for a parent because a will is the document that allows you to name a guardian for your minor children. If you both pass away and have failed to name a guardian in your wills, a court may not appoint the person you would have selected.

Also, without a will, some states dictate that at your death some of your property will go to your children and not to your spouse. Your minor children could inherit your assets directly, and the surviving parent could be required to seek court permission to manage the money for them. You may also want to consult an attorney about establishing a trust to manage your children’s assets if both you and your spouse die while they are young.

Life insurance is another key component of a solid plan for parents, as your surviving spouse may not be able to support the family alone and may need to replace your earnings, not to mention plan for minor children’s education.

Estate Planning Guidance For Blended Families

If either of you has children from a previous marriage, a simple will often is insufficient because it opens the possibility that your biological children can be cut out of your spouse’s estate down the road. If you leave everything to your spouse, your spouse is under no obligation to leave anything to your children. Consult your state’s specific laws for married couples.

You may consider a trust structure that will allow you to put certain assets in trust that can provide income to your spouse during life while preserving principal to pass to your children at the death of the surviving spouse. Well-drafted trusts can safeguard assets for each spouse’s children at the death of the first spouse and can help prevent family conflict after your death.

An immediate bequest through your will or trust can be a good option for ensuring that specific assets, especially sentimental items, go directly to your child.

Pre-Retiree Estate Planning Tips

If you’re in your 40s or 50s, you may be feeling comfortable, having accumulated some assets and wealth. At this point, the estate planning process begins to overlap with retirement planning. Neither of these is more important than the other — caring for yourself in old age is every bit as important as providing for your beneficiaries when you die.

Although Social Security may still be viable when you retire, those benefits alone likely won’t provide enough income for your retirement years. If you haven’t already been saving in your employer’s retirement plan or other deferred vehicles, such as traditional or Roth IRAs, you should consider taking advantage of those strategies. That way you’ll be better positioned to remain comfortable for decades to come.

If you haven’t already worked with a financial planner, it’s smart to do so. A financial planner can assist you in defining your retirement goals and in determining what steps you can take now to put you on the right track for the years to come.

Estate Planning Guide For The Wealthy And Worried

Depending on the size of your estate, you may need to be concerned about estate taxes. Whether your estate will be subject to state death taxes depends upon its size and the tax laws in effect in the state where you reside.

For 2023, the federal gift and estate tax basic exclusion amount is $12,920,000. Estates over that amount may be subject to tax at a top rate of 40%. After 2025, the exclusion amounts are scheduled to drop roughly in half to their pre-2018 levels, meaning estate taxes could become much more of a concern.

Similarly, for 2023, the Generation-Skipping Tax (GST), which is imposed upon wealth transfers made to grandchildren (and beyond), is also $12,920,000 with a top tax rate of 40%. In 2025, the GST exclusion amount will also be reduced by about half.

Your tax planner may also guide you through tax-efficient strategies for charitable giving. For example, you may direct up to $100,000 annually directly from your traditional IRA to charity if you are over 70½. If you are taking Required Minimum Distributions (RMDs) and you direct a gift from your IRA to a qualified charity, that gift, referred to as a Qualified Charitable Distribution (QCD), can satisfy your RMD but is not included in your taxable income. You may also consider giving highly appreciated assets to charity; the charity can realize the full value of those assets, while you will avoid capital gain.

Gifting to family members or other potential heirs during your lifetime is another way to decrease a potentially taxable estate. As of 2023, you may give up to $17,000 annually to anyone you wish without any tax implications or reporting requirements. Together with your spouse, that can mean up to $34,000. In addition to those amounts, you can pay educational or medical expenses on anyone’s behalf, provided those payments are made directly to a provider.

As your estate grows in size and complexity, it becomes more important to seek the counsel of experts on an ongoing basis.

Estate Planning Guidance For Older Adults Or Those With Declining Health

If you are an older adult or have significant health issues and you haven’t yet put an estate plan in place, now is the time. If your plan consists of a will or you don’t have a plan at all, consider setting up a revocable living trust along with a financial durable power of attorney and a health care directive. If you do have a plan in place but it’s been a while since you’ve looked it over, take a look to make sure it’s up to date. Many financial institutions will not recognize or honor what they deem to be a “stale” Durable Power of Attorney (DPOA). Powers of Attorney are very state-specific, especially if it has been more than ten years or if you have moved states, so be sure to update that DPOA.

Talk with your family about your wishes and make sure they have copies of your important papers or know where to find them when they need them. In this era of technology, you should make plans for your digital assets as well, so important documents, photos, or funds are not lost.

Reviewing Your Estate Plan

Reviewing your estate plan will give you peace of mind and may alert you to any other potential changes that might be necessary. Although there’s no firm rule about how often you should review your estate plan, you should conduct a review whenever a major life event occurs or at least every five years.

Reasons you should do a periodic review include:

- You wish to change the guardian for your children, or your children have reached adulthood.

- Your marital status changes or your children’s marital statuses change.

- You added to your family through birth, adoption, or marriage.

- Your spouse or a family member is ill, incapacitated, or has passed away.

- Your spouse, your parents, or another family member is now dependent on you.

- There is a substantial change in the value of your assets or in your plans for their use.

- You receive a sizable inheritance or gift.

- Your income level or requirements have changed.

- There have been significant changes to the tax code or other significant economic shifts.

- You are retiring.

- You have moved to a different state, and thus may be subject to different property and probate laws.

Consult Professionals For Trust & Estate Planning Guidance

While trusts offer numerous advantages, it’s essential to understand your options. Using trusts involves a complex web of tax rules and regulations, and there are up-front costs and ongoing administrative fees to consider. No matter your life stage, you should seek the counsel of an experienced estate planning professional, as well as your legal, financial, and tax advisors, to make sure that your strategies are aligned with your goals.

15 Frequently Asked Estate Planning Questions

What is estate planning?

Estate planning is the process of preparing for the transfer of your assets and wealth after death. Through the estate planning process, you create a plan that outlines how your assets will be distributed, who will manage your affairs, and how your health care will be managed if you become incapacitated.

Why is estate planning important?

Estate planning allows you to have control over the distribution of your assets in the event of incapacity or death; planning can also help you retain control of your health care if you are unable to make your decisions for yourself at the time. Planning may also help to minimize taxes and fees that your beneficiaries might experience and can ensure that your wishes are carried out after your death.

Who needs estate planning?

Everyone. Even without assets, documents like a health care directive ensure that you have a say in your care if something devastating happens. The complexity of the plan will grow as you acquire more assets and heirs.

What estate planning documents are typically included?

An estate plan typically includes a will, a trust, a financial power of attorney, and a health care directive. A marital property agreement is often part of the plan for married couples, depending on the state. Other legal documents such as real estate deeds, assignments, and asset-specific transfer-on-death directives may be required to complete the process of funding the trust.

What is a will?

A will is a public legal document that outlines how your assets will be distributed after your death. It is also used to name guardians for minor children. A will names an executor or personal representative to manage your affairs and carry out your wishes.

What is a trust?

A trust is a legal arrangement that allows you to transfer your assets to a trustee, who manages them for the benefit of your beneficiaries. Trusts are privately administered and can minimize taxes and avoid probate. There are many types of trusts, such as charitable trusts, revocable trusts, and more.

What is a financial power of attorney?

A power of attorney is a legal document that names someone to manage your financial affairs if you are incapacitated for any reason.

What is a health care directive?

A health care directive is a legal document that outlines your wishes for medical treatment if you become unable to make decisions for yourself.

What is probate?

Probate is the legal process of distributing an individual's assets after their death. Probate is a public process that varies from state to state. Depending upon your state and the complexity of assets, probate can be lengthy and expensive, so a common goal of estate planning is to avoid probate.

How can estate planning help minimize taxes?

Estate planning can minimize taxes through strategies such as gifting, charitable donations, and trusts.

What happens if I die without an estate plan?

Passing away without an estate plan often means your assets are distributed according to state laws, which may not be what you want. Your heirs may also need to go through the public probate process and pay increased taxes and fees on your estate.

How often should I update my estate plan?

Make sure to update your estate plan when there is a significant change in your life, such as a marriage, divorce, birth, death, or change in financial situation. A review every five years is recommended, and at a minimum every ten; financial powers of attorney may be deemed stale by financial institutions and not honored if they are more than ten years old.

Can I change my estate plan after it is created?

Yes, you can change your estate plan at any time by creating new estate planning documents or making amendments to your existing plan.

How do I choose an executor or trustee?

When choosing an executor or trustee, consider someone who is trustworthy, organized, and capable of managing financial and legal affairs. Assuring financial security for your family requires a trustee who can cope with the accounting, distribution, tax, and other complexities that are involved in trust administration. A professional corporate trustee can fill that role, while also providing permanence and reliability.

Do I need an attorney to create an estate plan?

An estate planning attorney helps you ensure that your plan is legally sound, compliant with the laws of your state, and tailored to your individual needs.