There’s something to be said about looking back instead of looking forward. However, our SBA Lending team reached a milestone that should not go unrecognized. Here's a little more about the hard work and culture that contributed to it.

SBA Team United Nationwide

Early in 2022, First Business Bank reached the Top 100 SBA Lenders in the nation, maintained that standing throughout 2022, and carried their success into 2023. This may not seem like a huge accomplishment depending upon your perspective, but it’s a great testament to our SBA business development team, our SBA credit team, and our SBA closing team who all worked together as one to make it happen.

Early in 2022, First Business Bank reached the Top 100 SBA Lenders in the nation, maintained that standing throughout 2022, and carried their success into 2023. This may not seem like a huge accomplishment depending upon your perspective, but it’s a great testament to our SBA business development team, our SBA credit team, and our SBA closing team who all worked together as one to make it happen.

Since First Business Bank added SBA Lending 10 years ago, our team has worked with businesses nationwide, helping small-and-medium-sized businesses access federally backed funding so they can grow. Although some of our SBA employees are primarily located in one of our four banking offices, many are spread out all over the United States.

Working remotely can be challenging, but the culture and structure of First Business Bank help our team to communicate and collaborate on another level. Our committed team members work well together, and although we’re not the largest team, SBA Lending is a tight network. Word gets around if you’re a great place to work, and we’ve started seeing the positive results of building a reputation as a cohesive, strong team all working on behalf of our clients.

Leading in Client Satisfaction

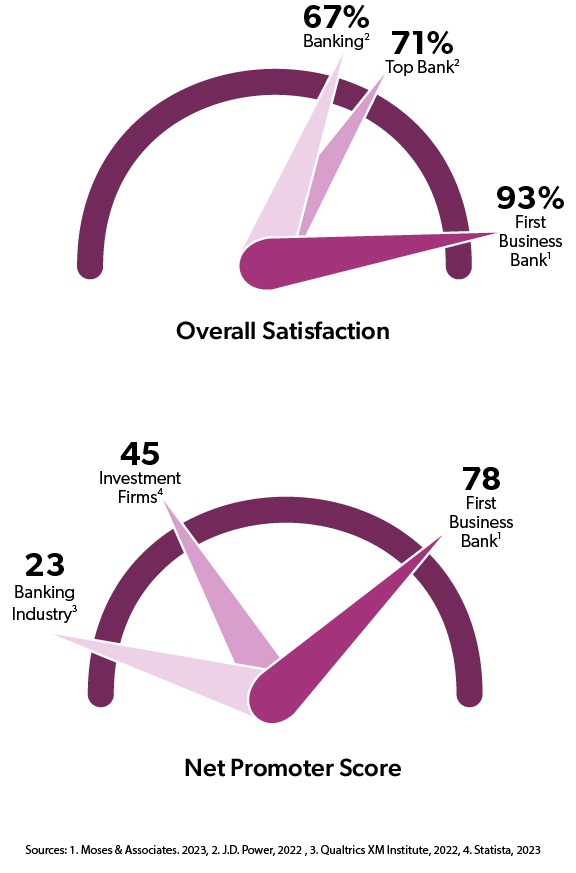

Not surprisingly, cultivating and retaining engaged employees also shows in our client survey. Most recently, First Business Bank received a 93% client satisfaction rating, which means 93% of all clients who completed the survey rated us a 4 or 5 on a 5-point scale. For context, J.D. Power lists the top bank’s client satisfaction rating as 71% and 67% for banking overall.

Not surprisingly, cultivating and retaining engaged employees also shows in our client survey. Most recently, First Business Bank received a 93% client satisfaction rating, which means 93% of all clients who completed the survey rated us a 4 or 5 on a 5-point scale. For context, J.D. Power lists the top bank’s client satisfaction rating as 71% and 67% for banking overall.

Similarly, our Net Promoter Score (NPS), which measures how likely clients are to recommend us to others, easily outpaces those of other investment firms and banks. Our latest NPS score was 78, compared to 45 for leading investment firms and 23 for banks.

Bank Director magazine also named First Business Bank #2 Best Bank in the nation among those with $1 billion to $5 billion in total assets, a recognition we could not achieve without our dedicated, driven SBA employees.

Exceptional Market Position

Built on more than 30 years of experience, First Business Bank’s business model embraces businesses, business owners, and investors. That focused energy is a significant advantage for our SBA team, where what we’re doing on a day-to-day basis really matters. It’s central to the bank’s mission, so that helps unite our purpose, as well. Being an SBA expert in some other banks that serve everyone can feel sometimes like you’re an outsider, but not here, where the focus is on business.

That concentration on business helps us attract experts in business lending who want to work and advance their careers with professionals. This, in turn, raises our employee satisfaction scores and our client satisfaction scores. They all work together to create a synergy that fuels our SBA team’s success.

Accessible Leadership

Another key part of the success of our entire organization is the accessibility of our senior leaders who often work closely with our team. As a result, they really get a sense of how involved our SBA experts are with our clients’ business operations, plans, and their loans. Validation of our work by senior leadership is a powerful motivator for our team. That’s a differentiator here because it’s not always easy to come by at other banks, where senior leaders are walled off from the details of SBA loans.

Everyone at First Business Bank is proud of our SBA team's journey, accomplishments, and recognize the hard work it takes to get there. It’s all worth it when you cross the finish line for small businesses — the backbone of our economy. Let us know if our team can help you reach your goals.

Last updated: 11/17/2023