When we first begin working with business clients, most of them approach their deposits as an afterthought. Typically, no one at the client's previous bank has ever mentioned deposits because they are more concerned with their loans. So you can imagine that business leaders are often surprised at how much time and energy their First Business Bank Treasury Management team puts into their deposits.

Why is the experience so different? The truth is your deposits are a revenue-generating opportunity for your business, but many banks don’t see them that way. Let’s understand a little more about why.

Why Most Other Banks Focus on Loans

Banks and credit unions usually have a large branch network handling the significant retail/consumer side of their business, and another handling businesses. The retail/consumer side often involves large quantities of deposits (direct deposit payroll), and consumer loans, such as mortgages, lines of credit, car loans, and more.

Banks and credit unions usually have a large branch network handling the significant retail/consumer side of their business, and another handling businesses. The retail/consumer side often involves large quantities of deposits (direct deposit payroll), and consumer loans, such as mortgages, lines of credit, car loans, and more.

The business side of these banks prioritizes making loans because it’s the most profitable for them. To fund the loans, they have a steady flow of deposits from the consumer side, so they typically ignore business deposits.

Why First Business Bank Focuses on Your Deposits

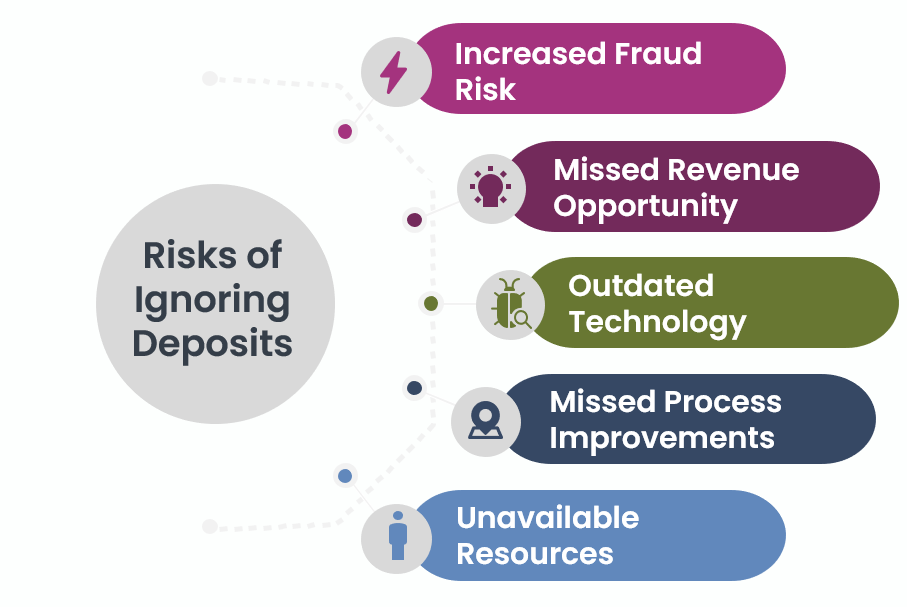

First Business Bank, founded more than 30 years ago as a bank built for businesses, does not have a large source of consumer deposits to fund loans. Our bank funds loans through business deposits, so that’s one reason why they’re attractive to us. However, our focus on deposits is not just for our bottom line. There are several important consequences for businesses when banks ignore businesses’ deposits, including:

- Increased risk of fraud. When banks ignore your business’s deposits, they’re not proactively informing you about the latest fraud prevention technology to help you protect your business. Loans are not a source of fraud, so they overlook these important tools that can help you avoid hassle, wasted time, and devastating fraud loss.

- Missed revenue opportunities. For businesses with liquidity, there are several ways to structure your cash management strategy, especially in a rising rate environment, that can create a significant amount of revenue for you from your deposits. In case studies, we recently outlined how we helped a client make more than $50,000 on their deposits that their previous bank had never mentioned.

- Stuck with old technology. New banking tech and updates are released all the time and rolled out for businesses to improve reporting, automate and streamline processes, and improve efficiency. When banks only focus on loans, you may never know if there are new products or updates to products that can help your business.

- Missed process improvement suggestions. When you work with First Business Bank, your business has access to one of the largest Treasury Management teams that exists in a bank our size. With this expertise, you have access to regular Treasury Management reviews, which are complimentary, annual reviews that suggest ways you can improve your entire financial operations and the ROI of these suggestions.

- Difficulty finding a real person to ask. Even if you don’t want to implement process improvements, a large Treasury Management team at First Business Bank means you have access locally to an experienced team that can help you with any situation that arises. Many of our experts are career bankers with an in-depth network and history in specific industries, and they often help clients with non-financial questions and recommendations, such as recommending experts to help a client buy real estate.

Why Business Leaders Trust First Business Bank

As a business leader, you likely focus your business on what you do best. Similarly, at First Business Bank, our business model allows us to hire experienced business banking experts who are encouraged to build long-lasting relationships with clients. To do this, we strongly believe in providing value to our clients in any way we can, including with their deposits.

If you have deposits just sitting in your business account, collecting some dust, why not schedule a complimentary Treasury Management review with us? There’s nothing to lose and everything to gain – you might even get a relationship with a bank that proactively finds ways to make you more money.