As they speak with business owners about Small Business Administration (SBA) loans, our SBA Lending experts often encounter companies with outdated or missing business plans. That leads to questions about how to make a business plan for SBA loans, so, with the help of our experienced SBA Lending team, we’ve gathered answers to common questions they hear about business plans.

Let's walk through what makes a solid business plan when applying for an SBA loan.

Why Do I Need A Business Plan To Apply For An SBA Loan?

A lot of people don’t take business plans seriously, but they are important. Putting your ideas on paper allows you to go back to your original thoughts as you're running the company to revisit your original vision for the business.

Your business plan also demonstrates to banks the strength of your business acumen, your industry experience, research skills, and due diligence — points that really matter to banks. When seeking an SBA loan, a business plan demonstrates to lenders that you have a well-thought-out strategy and an in-depth understanding of your business's operations and financials. It helps us to understand the story of your business and evaluate the feasibility and potential success of your future business plans, which increases your chances of securing an SBA loan.

SBA loans are a great choice for many smaller and medium-sized companies as they often require lower down payments and feature longer payback terms. Companies secure SBA loans through certain banks, and the Small Business Administration, part of the federal government, guarantees a portion of the loans, so the bank has more confidence to lend to these clients.

What Should A Business Plan Include?

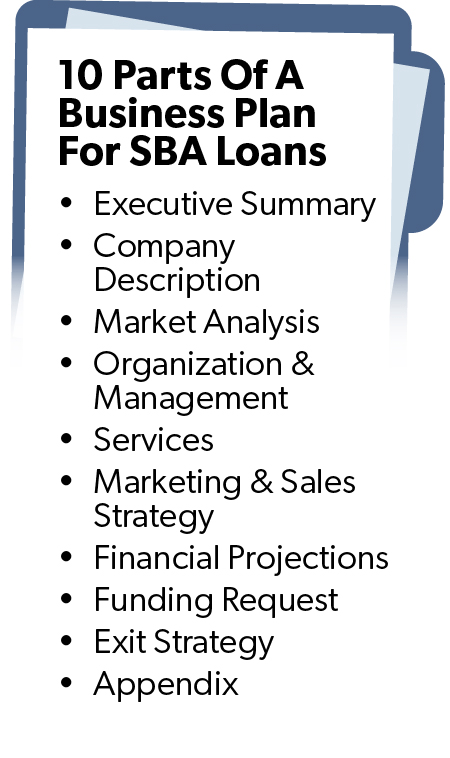

A thorough business plan for an SBA loan application usually includes these key components:

Executive Summary: A brief overview of your business, including its name, location, mission, products/services, target market, competitive advantage, financial projections, and your vision for its future. Though it appears first, it's often easier to write this part last, after you've worked out the rest of your plan.

Executive Summary: A brief overview of your business, including its name, location, mission, products/services, target market, competitive advantage, financial projections, and your vision for its future. Though it appears first, it's often easier to write this part last, after you've worked out the rest of your plan. - Company Description: This section goes into depth about what your company does, the specific services it offers, and what sets it apart from competitors. Highlight your unique selling proposition — what makes your service different or better.

- Market Analysis: Here, you'll need to provide details about your target market, including its size and demographic characteristics. You should also include an overview of your competition and how your business fits into the current market landscape.

- Organization and Management: This section outlines your company's organizational structure. It should include information about the ownership of the company, the organizational chart, and a brief biography of the key management team members.

- Services: Detailed information about the products or services you provide. If you offer different types of your product or services, be sure to include that.

- Marketing and Sales Strategy: This part should describe your strategy for attracting and retaining customers. It might include plans for advertising, public relations, and direct sales efforts.

- Financial Projections: An important section for SBA lenders, this part should include projected income, cash flow statements, and balance sheets for the next three to five years. Clearly state how the SBA loan will contribute to these projections.

- Funding Request: Describe which SBA loan you’re requesting, how much you need, how you plan to use it, and the repayment plan.

- Exit Strategy: To get the full picture of your business, SBA lenders also want to know your long-term plans for the business. This might include a potential sale of the business, a succession plan, or another strategy for ensuring the company's and lender's interests are protected.

- Appendix: This is optional, but you can use it to include any additional documents that support your business plan, such as market studies, relevant photos, letters of reference, and client surveys.

Your business plan should help convince the banker that your business is a wise investment for an SBA loan. It should be clear, concise, and compelling, painting a promising picture of your company's future.

How Should I Write A Business Plan For An SBA Loan Application?

While there’s some creative flexibility, we usually recommend clients to follow a standard structure for their business plans. The business plan template published by SCORE, a subsidiary of the Small Business Administration, is a great place to start. It’s a highly organized template that you can edit to suit your needs.

Typically, business plans start with a title page and table of contents, followed by the sections described above. Use headings and subheadings to organize information and include page numbers for easy reference.

Also make sure to use a professional and consistent design throughout the document. After you finish a draft, get feedback from others, like managers or friends, and ask them to proofread it, too.

What Financial Data Should I Include In My Business Plan For An SBA Loan?

Let’s break down recommendations for a few of the more detailed sections. The financial section of your business plan should include:

- Income Statements: Projected revenue and expenses, providing an overview of your expected sales, cost of goods sold, operating expenses, and net income.

- Balance Sheets: Projected assets, liabilities, and equity, showcasing the financial position of your business at a given point in time.

- Cash Flow Statements: Projected cash inflows and outflows, demonstrating how cash moves in and out of your business over a specific period.

- Break-Even Analysis: Calculations to determine the level of sales required to cover all costs and reach a point of profitability.

- Assumptions: Detailed explanations of the underlying assumptions, such as pricing, sales growth rates, expense estimates, and other factors influencing your financial projections.

As much as you want to create a rosy picture, it’s important to provide realistic, truthful, and supported financial projections related to your business’s financial viability and ability to repay the SBA loan.

How Many Pages Should My Business Plan Be For An SBA Loan Application?

Our SBA Lending team sees all kinds of business plans – from the very slim to the very detailed, and maybe overly wordy. We generally recommend keeping your business plan concise and focused for SBA lenders. We are all busy, and it’s best to strike a balance by providing essential information we need without embellishing or adding in too much extraneous information.

Usually that ends up somewhere between 20 to 30 pages, excluding the appendix. Present your ideas clearly and succinctly, using bullet points, tables, and graphs where appropriate. The content and quality of your business plan are more important than length. Focus on providing a comprehensive and compelling overview of your business's potential, supported by solid research and financial projections.

What Goes In The Executive Summary Of A Business Plan?

The executive summary provides a concise overview of your entire plan, allowing SBA loan experts to quickly grasp the key points. Some tips for writing your executive summary for an SBA loan application:

- Keep it brief: Summaries should be max two pages long, which capture the essence of your business plan concisely.

- Highlight key information: Use your executive summary to summarize the most important parts of your business, such as your unique value proposition, target market, revenue projections, and funding requirements.

- Be persuasive: Clearly communicate the potential of your business, showcasing its profitability, growth prospects, and competitive advantage.

- Customize it: The best business plans have executive summaries that align with the priorities and interests of the particular SBA lender. Research the specific SBA loan program and emphasize how your business meets their criteria.

- Write it last: As we previously mentioned, it's often easier to write your executive summary after completing the rest of the business plan with the key points fresh in your mind.

If possible, without exaggerating, the executive summary should grab the SBA lender's attention and encourage them to dive deeper into your business plan.

How Should My Business Plan Demonstrate Its Unique Selling Proposition?

Your business's unique selling proposition sets your business apart from competitors and demonstrates its value to customers. Here are some tips to present it effectively:

- Clearly define: Identify the specific features, benefits, or characteristics that differentiate your business from competitors. What makes your product or service unique and desirable to customers?

- Explain customer value: Describe how your business solves a problem or fulfills a need for your target market. Emphasize the benefits and advantages it offers to customers, such as cost savings, convenience, superior quality, or unique features.

- Provide evidence: Support your unique selling proposition with evidence, such as customer testimonials, case studies, or market research data. Show how it has resonated with customers and led to positive outcomes.

- Highlight competitive advantage: Illustrate how your unique selling proposition helps your business stay ahead of competitors. Discuss barriers, proprietary technologies, exclusive partnerships, or factors that give you an edge in the market.

- Integrate it throughout the plan: Infuse your unique selling proposition into different sections of your business plan, such as the executive summary, company description, and marketing strategy. Consistently reinforce the unique value your business offers.

What Else Do I Need For A Business Plan?

When applying for an SBA loan, your business plan should include any research you’ve done to support your funding request. Business leaders often include often see business leaders including these types of research to support their SBA loan application:

- Market research: Detailed research on your target market, industry trends, and customer demographics. Show that there is a demand for your product or service and explain how your business will meet that demand effectively.

- Competitive analysis: Identify and analyze your competitors, their strengths and weaknesses, and how your business differentiates itself. Showcase your competitive advantage, such as unique features, pricing strategies, or customer service, and how you continue to position yourself among your competitors.

- Operational plan: Describe the day-to-day operations of your business, including your location, facilities, equipment, and suppliers. Highlight any operational advantages that contribute to the sustainability of your business.

What Goes Into The Appendix of My Business Plan For An SBA Loan?

Your business plan’s appendix should include supporting documents and information that may be relevant to your SBA loan application. While the specific requirements may vary depending on your business and the lender's request, here are some common things we see in appendices:

- Resumes: Resumes of key team members, emphasizing their relevant experience and qualifications.

- Licenses and Permits: Copies of any licenses, permits, or certifications required to operate your business legally.

- Legal Documents: Copies of your business's legal documents, such as articles of incorporation, partnership agreements, or contracts.

- Market Research Data: Detailed market research data, surveys, or studies that support your understanding of the target market and industry trends.

- Product or Service Information: Provide additional details about your products or services, such as brochures, technical specifications, or product samples.

- Letters of Intent or Agreements: If you have any letters of intent or agreements with suppliers, clients, or partners, include them to demonstrate business relationships and potential revenue streams.

- Supporting Images or Graphics: Include visuals that support and enhance the understanding of your business, such as product images, facility layouts, or marketing materials.

Remember to organize the appendix in a logical manner and reference the documents appropriately within your business plan.

When applying for an SBA loan, your business plan should do an excellent job of presenting your company and its prospects. It serves as a roadmap, showcasing your vision, strategy, and financial projections to SBA lenders.

By including key components such as a detailed company description, thorough market analysis, robust financial projections, and a persuasive executive summary, you enhance your chances of securing an SBA loan.

Customize your plan to meet the specific requirements of the SBA loan program you are applying for and provide supporting documentation in the appendix. With a strong business plan in hand, you are well-positioned to confidently approach SBA lenders with confidence.