The U.S. Small Business Administration (SBA) supports business growth, guaranteeing billions in financing annually, including for business acquisitions. Recently the SBA updated its SBA 7(a) program to create new opportunities for Change of Ownership business acquisition financing.

These changes come at an important time, given the expected surge in business transitions. Over the next 10 to 15 years, the Service Corps of Retired Executives (SCORE) estimates that 12 million businesses will change hands — commonly called the “silver tsunami.” To support this small business acquisition boom, the revised loan program now allows complete and partial SBA acquisition financing, offering greater flexibility and accessibility.

For those already operating a business, acquiring an existing business — even a competitor — with an SBA 7(a) loan can be a more efficient and stable way to expand. According to Forbes, about 20% of new businesses fail within their first year, and 50% by the fifth year. Buying an established business allows you to sidestep common pitfalls like running out of capital or lack of market demand. Instead, you’re buying a proven business model with existing cash flow, an established customer base, and proven market viability.

For those already operating a business, acquiring an existing business — even a competitor — with an SBA 7(a) loan can be a more efficient and stable way to expand. According to Forbes, about 20% of new businesses fail within their first year, and 50% by the fifth year. Buying an established business allows you to sidestep common pitfalls like running out of capital or lack of market demand. Instead, you’re buying a proven business model with existing cash flow, an established customer base, and proven market viability.

Let’s take a closer look at using SBA 7(a) loans for a small business acquisition.

What Are The Benefits Of Using An SBA Loan For Business Acquisition?

Banks, credit unions, and other lenders provide SBA loans for business acquisitions to both new and experienced business owners. These loans come with a federal guarantee of up to 85%, encouraging lenders to offer more attractive SBA loan acquisition terms, like a longer time to repay the loan, flexible payment terms, and lower down payment requirements, making it easier for people to buy businesses and expand through mergers or acquisitions.

Expanding your business by acquiring one with SBA loans can be surprisingly accessible. If you're considering buying a company with the same NAICS code as your existing business, you may qualify for 100% financing — potentially acquiring another company with no money out of pocket.

For other change of ownership scenarios, the SBA typically requires just 0% to 10% down, significantly less than traditional business loans. Additionally, seller financing can be incorporated, further reducing the upfront capital needed.

Let’s look at other benefits of SBA acquisition financing loans:

- Loan Amounts: SBA 7(a) loans can go up to $5 million, making them suitable for a wide range of business acquisitions.

- Interest Rates: SBA loans typically have competitive interest rates, which can be either fixed or variable.

- Repayment Terms: Terms can extend up to 10 years for most acquisitions, or up to 25 years if real estate is involved.

- Down Payment: Down payments vary by the borrower, ranging from zero down to 10% and 20%.

- Use of Funds: Loan proceeds can be utilized for acquiring a whole business, buying out a partner, or partially investing in an existing business.

- Seller Financing: The SBA often encourages seller financing as part of the deal structure.

- Longer Amortization: SBA loans offer longer amortization periods compared to conventional loans, making repayment more manageable.

- Flexible Payment Terms: These loans come with more flexible payment terms, which can be crucial during the transition period of an acquisition.

- Working Capital: Many SBA loan deals are structured with working capital to help you get through the transition period.

What Types Of Small Business Acquisitions Can You Use SBA Loans For?

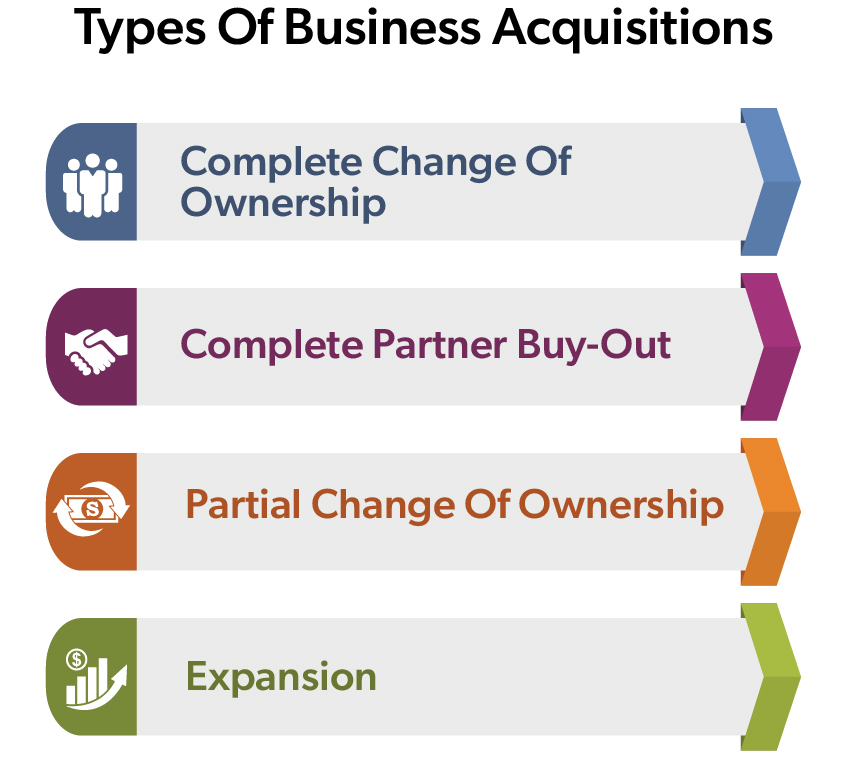

The SBA 7(a) loan program provides financing options for various business acquisition types. New buyers, existing partners, and business owners seeking to grow can find an SBA loan structure that suits their needs. Here are the main types of business acquisitions that SBA loans can finance:

Complete Change of Ownership: A new person with no current ownership, such as a manager, buys the entire business. The SBA typically requires a 10% equity injection, though seller financing may qualify for part of this requirement.

Complete Change of Ownership: A new person with no current ownership, such as a manager, buys the entire business. The SBA typically requires a 10% equity injection, though seller financing may qualify for part of this requirement.- Complete Partner Buy-Out: An existing owner purchases all shares from other owners. This could be completed with no money down if: a) Existing owners have been active in the business operation and held the same or increasing ownership for at least the past 24 months, and b) The business balance sheet for the most recent completed fiscal year and current quarter reflects a debt-to-worth ratio of no greater than 9:1 prior to the change in ownership.

- Partial Change of Ownership: A new investor acquires some, but less than 100%, of the business. Up to 10% equity injection may be required. Exceptions for less than 10% may be allowed for employee buy-ins if the business balance sheet meets SBA debt-to-worth requirements.

- Expansion: An existing business acquires another business, potentially with 0% down. This applies if the existing business is looking to acquire another business in the same 6-digit NAICS code, with identical ownership, and in the same geographical area.

This range of uses makes SBA loans valuable for both buyers and sellers, supporting business transitions, expansions, and developments across many sectors.

Each type of acquisition has different equity injection requirements, which we'll explore in the next section. These options make SBA loans valuable for both buyers and sellers, supporting business transitions, expansions, and developments across many sectors.

What Is Equity Injection And How Does It Affect An SBA Loan For Acquisition?

Equity injection is the amount of money or assets a borrower contributes to a business acquisition financed by an SBA loan. This contribution demonstrates commitment and reduces SBA lender risk.

For most SBA-backed acquisitions, the required equity injection ranges from 10% to 20% of the total project cost. The exact percentage depends on:

- The type of acquisition (full or partial)

- The industry of the business

- The borrower's experience in the field

- The overall financial strength of the deal

In some cases, like when an existing business owner buys a similar company in the same industry, the SBA may allow a lower or zero equity injection. Equity injection isn't limited to cash. The SBA accepts other forms such as business assets, real estate, and sometimes seller financing.

What Do Banks Look At When Buying A Business With An SBA Loan?

When considering an SBA loan for acquisition financing, banks and other lenders look at several data points to determine the risk and potential success of the business acquisition — and your ability to repay the loan. The SBA guarantee reduces some risk, but lenders still need to ensure the deal is sound. Here are the main areas banks focus on for an SBA business acquisition loan:

- Liquidity: Banks examine the cash and easily convertible assets available to the buyer. This shows the ability to handle unexpected expenses or temporary dips in revenue.

- Industry Management Experience: Lenders prefer borrowers with a track record in the industry they're entering. Your past success and knowledge can indicate future performance, a key consideration for SBA loans.

- Additional Outside Income Support: Having income sources beyond the acquired business can provide a safety net, especially in the early stages of ownership. This can strengthen your SBA loan application.

- Stable Historical Cash Flow to Service the Debt: Banks analyze the target business's past performance to ensure it can generate enough money to cover SBA loan payments and operating expenses.

Who Should You Consult When Considering an SBA Business Acquisition Loan?

Acquiring a business with an SBA loan often requires professional guidance. Here are key experts to consider:

- Preferred Lending Partner: A PLP lender, like First Business Bank, earns this designation from the U.S. Small Business Administration after demonstrating efficient and exceptional service to business executives.

- Acquisition Attorney: Provides legal advice and handles contracts.

- Experienced Business Broker: Helps find suitable businesses and negotiate deals.

- CPA: Assists with financial analysis and tax implications.

- Due Diligence Specialist: Can help with business valuation and investigating the business thoroughly before purchase.

- Licensing Expert: Ensures compliance with industry-specific regulations.

- Key Employees: Can provide invaluable insights during ownership transition.

For free help, contact your local Small Business Development Center (SBDC). Their advisors can help with various aspects of business acquisition, including understanding financials, SBA loan acquisition terms, and licensing requirements. SBDCs also provide workshops on topics like cybersecurity and spiffing up your business plan.

Small business acquisition loans offer a powerful tool for entrepreneurs looking to expand or enter new markets. With flexible terms, competitive rates, and the potential for significant growth, these loans can turn your acquisition dreams into reality. Reach out to our team of SBA lending experts today to explore how we can help you navigate the process and secure the funding you need for your next business acquisition.

Published: 11/20/2024