The death of a loved one can be a very difficult time, made harder by a seemingly endless list of things to do. Many people don’t know what to do when a spouse dies, but good planning can help ease the burden.

It’s especially important to know what to do financially after the death of a spouse. Financial planning and investment management can prepare you for the long term in securing your financial future. But organizing finances, bills, and records ahead of time will make the immediate responsibilities easier to manage as well.

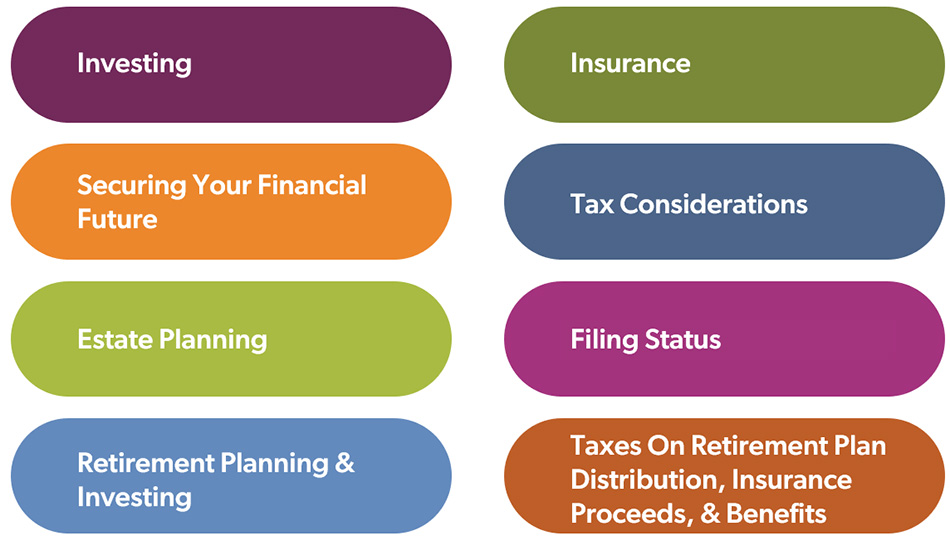

This guide will cover several financial (and non-financial) aspects of what to do when a spouse dies, including:

- Organizing Financial Records and Contacts

- Addressing Immediate Needs, Expenses, Bills, and Insurance Claims

- Handling Short-Term Financial Concerns

- Planning Financially for the Long Term

- Getting Answers to Your Financial Questions

Organizing Financial Records and Contacts

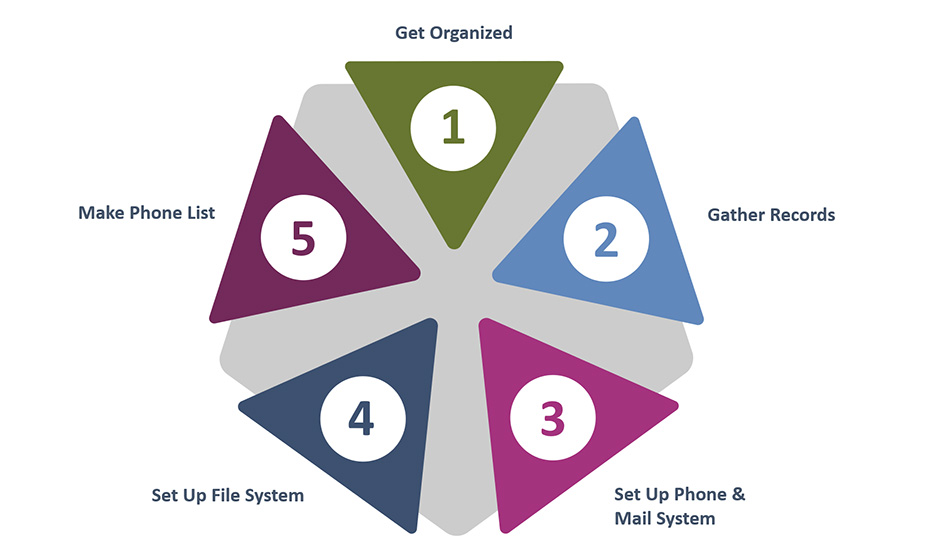

1. Get Organized

Even if you've always handled your family's finances, you may be overwhelmed by the number of financial matters you have to settle in the weeks or months following the death of a spouse. While you can put off some of these tasks, others require immediate attention. If you're uncertain where to start, begin by organizing financial records. You'll have to find the records and paperwork you need to apply for Social Security survivor benefits, set up systems to organize those records and other information you receive, and determine your short-term need for income. Afterwards, you'll be ready to start settling your financial affairs with the help of personal and professional advisers.

2. Gather Records

To settle your spouse's estate or to apply for life insurance payout or government benefits, you'll need a number of documents. Locating these documents (and applying for certified copies of some of them) should be your first step in organizing financial records.

- To apply for life insurance payout, you'll need a certified copy of your spouse's death certificate (and possibly their life insurance policy).

- To apply for Social Security survivor benefits, you'll need to provide proof of death (a death certificate), proof of marital relationship (a marriage certificate), and proof of age (a birth certificate).

3. Set Up A Phone And Mail System

After the death of a spouse, you may have difficulty concentrating on tasks, partly because of grief and stress and partly because you simply have too much to do. To keep track of details, set up a phone and mail system to record incoming and outgoing calls and mail. For phone calls, keep a sheet of paper or a notebook by the phone and write down the date of the call, the name of the caller, and a brief description of what you talked about. For mail, write down who sent each piece, the date you received it, and the date you sent mail in return, if at all.

4. Set Up File System

You know the importance of setting up a filing system if you were ever frustrated because you couldn't find an important document when you needed it. You'll be organizing your financial affairs in many different areas, so set up a file for each topic you are working on. For instance, you may want to set up separate files for estate records, insurance, government benefits, tax information, important documents, child-care information, and credit accounts. Anytime you receive a letter or important document, put it in the appropriate file. If you can't keep the original, make a copy. In addition, remember to keep copies of any letters you send out. It might be a good idea to go to a copy center and mail things weekly to save time.

Example(s): Mary Beth got a letter from her insurance company requesting more information on a claim she had filed for her spouse's hospital stay shortly before his death. She sent the company the information the next day. A few weeks later, she got a letter from the hospital demanding payment from her because her insurance company refused to pay the claim because of a lack of information. After calling her insurance company again, Mary Beth realized that they had never received the letter she had sent them regarding the claim. Fortunately, she had a copy in her insurance file and was able to get it to them right away.

5. Make A Phone List

If you don't already have one, you should make a list of the names and phone numbers of organizations, professional advisers, and friends, and keep it handy. For example, the list may include the numbers of your health insurance company, your attorney, your financial adviser, your insurance agent, and friends who can give you advice.

Addressing Immediate Needs: Expenses, Bills, and Filing Insurance Claims After the Death of a Spouse

6. Evaluate Short-term Income And Expenses

You may have some immediate expenses to pay when your spouse dies, such as funeral costs, transportation costs, and regular bills. Start by making a list of all debts you will have to pay in the next 30 days. Then determine whether you have enough money to pay those debts. If you do not have sufficient emergency cash saved up, don't panic. If you know money will be coming in from a life insurance payout or an estate settlement, there are several ways to proceed.

First, use credit cards to pay what you can, or consider taking a cash advance against the card, if necessary. You may be able to get a life insurance payout within a few days, and you may be able to delay other expenses for 30 days or more by negotiating with creditors. This will give you the chance to apply for the death benefits to which you are entitled and to find out when you will be likely to receive them.

Tip: If you decide to use credit cards, use those with the lowest interest rate first, and watch out for cash advance fees or other charges.

7. Do These Things Right Away When a Spouse Dies

Getting expert advice when you need it is essential if you want to make good financial decisions. After all, you are probably doing many things for the first time, such as filing a life insurance claim or settling an estate. Who should you contact after the death of a spouse?

- Attorney: In fact, an attorney is one of the first people you might contact after your spouse dies because they can help you go over the will and start estate settlement procedures.

- Funeral Director: Your funeral director can also be an excellent source of information and may help you get death certificate copies and apply for Social Security and veterans' benefits, among other things.

- Financial Advisors: You may also wish to contact a financial planner, accountant, or tax adviser for help with your finances.

- Support System: And don't overlook the help of other widows or widowers; having been through it before, they may be able to provide you with valuable information and support.

8. Notifying Others After Your Spouse Dies

It's a personal decision who you notify when your spouse dies. You will probably want to contact first the people who are close to you and anyone who may help you with funeral preparations. Then you'll want to contact people or groups who will help you file for death benefits to which you are entitled, such as your spouse's employer, life insurance companies, and government agencies. Finally, you may want to contact important financial advisers, then creditors. Remember, you don't necessarily have to notify everyone yourself; ask a friend or family member to help you. Use the suggestions in the table as a guide, making modifications where you see fit: When you notify an individual or organization that your spouse has died, make sure you understand what to do next. For example, letting the Social Security Administration know that your spouse has died is not the same thing as applying for survivor's or parent's benefits. You'll still have to file a claim (in most cases) and provide supporting documentation. In addition, while you shouldn't feel pressured to notify others, some time limitations do exist. For more information, see Questions & Answers.

9. Pay Bills

When you're grieving, it's easy to forget to pay bills. Whenever you receive one in the mail, put it in a safe (but visible) spot so that you won't forget to pay it. You may want to set up a log to record what bills you've received and what payments you've sent out. If you get any letters or phone calls from creditors asking for money, don't ignore them. Contact the creditor right away and arrange for payment.

Caution: Be aware, however, that some con artists will contact the recently widowed and ask them to pay for items that their deceased spouse supposedly ordered before his or her death. Or they will send phony invoices for services that were supposedly rendered in connection with the spouse's death. Before sending money to any creditor, get a written statement of the charges and investigate the claim to make certain it's genuine.

10. Filing Insurance Claims

Life insurance benefits are not automatic; filing insurance claims when a spouse dies is required. If you have an insurance agent, contact them to begin filing a life insurance claim. If you don't have an agent, contact the company directly. Although most claims take only a few days to process, contacting an insurance agent should be one of the first things you do if you are the beneficiary of your spouse's policy. Remember that your spouse may have owned other policies in addition to a primary individual life insurance policy. Check with your spouse's employer, look through records, and contact creditors to see if your spouse owned any group life insurance policies.

11. Begin Settling Your Spouse's Estate

Locate your spouse's will as soon as possible, and make sure that you have the most recent copy of it. If your spouse named you as executor of the estate, you may want to contact your attorney for help. If someone else was named executor, you will want to oversee settlement of the estate because decisions made during settlement will affect your future. Settling an estate may be simple or may take months, but you should begin doing right away.

12. Arrange For Child Care

If your spouse cared for your young children while you worked or if you need part-time care so you can begin settling your affairs, you may have to find reliable child care now. If you don’t know where to start, ask your support system. They likely have recommendations for child care or can reach out to others for leads. Most areas have information and referral centers that can give you information at little or no cost. They will evaluate your needs and refer you to day-care centers or family day-care homes that can care for your children. They don't make recommendations but will give you advice on state licensing regulations and choosing quality day care. An organization called Child Care Aware at (800) 424-2246 can help you locate the child-care resource and referral agency in your area.

Things You Can Put Off Until Later

13. Planning To Move From Your Home

You may be tempted to move from the home you shared with your spouse. The home may be too large for you now, too expensive, or too filled with memories. However, you'll be wise to wait until you have more time to consider all of the consequences of moving and potentially selling real estate.

14. Buying Things

You may be tempted to buy things using the proceeds from a life insurance payout. While some spending might make you feel good, don't spend money impulsively. When you are grieving, you may be especially vulnerable to sales tactics. When considering a large purchase, step back. Let a few days pass to see if you still want to purchase the item.

15. Selling Possessions Or Giving Them Away

Selling or giving away your spouse's possessions can be emotionally difficult. However, there's no rush. Although others may be pressuring you to sell your husband's car, for example, or your children may be asking for favorite items that belonged to their father, don't sell or give away anything until you are ready. You may sell the possession for less than it is worth, or you may resent caving into the demands of others. Ask others to wait a few weeks or until you are ready.

Example(s): A week after Rosa's husband of 30 years died, her oldest son, Nick, asked if he could have his father's toolbox. Afraid that her other son, Jim, would resent her giving away his father's possessions without being consulted, Rosa wisely asked Nick to wait until she had some time to clear up other matters before she gave the toolbox to him. A few weeks later, she was able to sit down with both sons to calmly divide up her husband's possessions.

Caution: Don't assume that everything your spouse left behind is yours to sell or give away. You are legally forbidden to sell or give away property until a court has awarded it to you because there may be claims against the estate or taking or an inventory may be necessary.

16. Giving Money Away Or Making Loans To Others

If you received a large life insurance settlement or were the beneficiary of a large estate, family members may ask you to give them money or loan it to them. While you probably want to help your family, don't act without reviewing your own financial state. What seems like a large sum of cash now may easily dwindle away in the future if your expenses exceed your income. Before giving away money or lending it to anyone, analyze your resources, income, debts, and future needs, either by yourself or with your financial adviser. Be as generous as you can, but don't neglect your own needs and obligations.

Securing Your Financial Future Term After the Death of a Spouse

17. Investing

Your financial priority immediately after your spouse dies is not investing, but rather making sure you have enough money to pay your bills. Later, however, when you've had time to identify your financial objectives, you may want to invest part of your money. When you invest, you should look for ways to conserve your principal rather than spending it or letting inflation eat away at it. You may also want to invest to increase your principal so that you'll have more money for the future. A broker or financial adviser can help you invest wisely, but don't invest with someone you don't know well or until you have thoroughly checked out his or her references and credentials. See Questions & Answers.

18. Securing Your Financial Future

As a widow or widower, you may face financial challenges that didn't exist when your spouse was alive. You may now have less (or more) money than you had in the past or you may need to plan a new financial strategy to provide for your children.

19. Estate Planning

After your spouse dies, it's time to discuss estate planning issues with your attorney or financial adviser. Start by updating your own will. You may need to rethink how you want your assets distributed at your death and to name a new executor (if your spouse was named in your original will). You may also need to name new beneficiaries and guardians for your children (if any). In addition, it would be wise to write new estate planning documents, such as a letter of instruction, a power of attorney, a health care proxy, or a living will.

20. Retirement Planning And Investing

If you were the beneficiary of any retirement plans owned by your spouse, you may have to choose new investment vehicles if you receive the retirement plan distribution outright. If you had named your spouse beneficiary of any retirement plans that you own, request beneficiary change forms from your employer or the plan administrator. In addition, you may want to meet with your financial planner or adviser. They can help you project your retirement income requirements and formulate a new retirement-planning strategy.

21. Insurance

You'll have new insurance needs when your spouse dies. If your health insurance was provided through your spouse's employer, find out if you'll be covered automatically or if you'll receive continued coverage through Consolidated Omnibus Budget Reconciliation Act (COBRA). You may need to buy a new life insurance policy or designate a new beneficiary. Meet with your life insurance agent to discuss this.

Caution: Since you may not receive bills for health insurance under COBRA, make sure you know when, where, and how to make payments.

22. Tax Considerations

As a surviving spouse, you may have to file several tax returns, including federal and state final income tax returns, and fiduciary income tax returns. To do this, you may need to seek the advice of a tax professional.

23. Filing Status

If you meet certain requirements (including remaining unmarried and maintaining a household for a dependent child), you can file your federal income tax return as a surviving spouse for two tax years following the year in which your spouse dies. This normally means you will pay less tax than if you filed either as single or head of household. In the year in which your spouse dies, you do not file a tax return as a surviving spouse but can instead file as married, filing jointly. This way, you'll file, and you and your spouse's executor will sign the return for your spouse, following Internal Revenue Service guidelines.

24. Taxes on Retirement Plan Distributions, Insurance Settlements, And Death Benefits

You'll need to familiarize yourself with regulations on the taxation of some types of income you receive after your spouse dies. Retirement plan distributions are considered to be taxable income, while life insurance settlements and government death benefits (such as Social Security survivor benefits) are generally not considered taxable income. However, the tax consequences of Social Security survivor benefits may depend, in part, on how you choose to take the distribution or proceeds (in the case of IRAs or life insurance) or on whether your income exceeds a certain level (in the case of Social Security). Consult your tax adviser.

Financial Questions & Answers After The Death of A Spouse

1. When you receive proceeds from a life insurance policy, how should you handle the money?

First, ask your insurance company what settlement options you have. Do you have to take the money in a lump sum or can you receive it gradually? Will they deposit it in a checking account for you and let you withdraw it when you want, or will they be sending you a check? If you don't feel ready to handle the money now, you can deposit it in a simple interest-bearing account such as a savings account or a money market fund until you are able to make decisions about it.

2. Is there a deadline for filing for Social Security survivor's benefits?

Although the Social Security Administration suggests that you file for Social Security survivor benefits in the month of your spouse's death, you can wait (but not too long). Only six months of retroactive benefits can be paid, so if you don't file within that time period, you may lose benefits to which you are entitled. And if you were already receiving (or were entitled to receive) retirement plan distributions at the time of your spouse's death, you may not need to file at all after you report your spouse's death. Your benefits may be automatically converted to widower's benefits. The best thing to do is to call the Social Security Administration at (800) 772-1213 and ask for help.

3. Can you continue to use credit cards issued in your deceased spouse's name?

It depends on the company. Some may allow you to continue using the cards, whereas others may cancel the account once you notify them of your spouse's death, so you may want to notify credit card companies slowly. If you no longer have access to any of your cards, try to get one in your own name. If you are denied because you have no credit history, ask your bank about getting a secured card whereby you deposit a certain amount of money (say $1,000) in an account, and, in return, you receive a credit card with a credit line equal to your deposit. After you use the card for a while, you may be able to qualify for an unsecured card, assuming that you always pay your credit card bills on time.