Preparing For Retirement

The quick onset of market volatility due to COVID-19 has taught us that having a financial plan, periodically reviewing it along with sticking to the original financial plan, is as critical now as ever. You know and understand how important it is to plan for your retirement, but where do you begin? One of your first steps should be to estimate how much income you’ll need to fund your retirement. That’s not as easy as it sounds because retirement planning is not an exact science. Your specific needs depend on your individual goals and many other factors.

Use Your Current Income as a Starting Point

It’s common to discuss desired annual retirement income as a percentage of your current income. Depending on whom you’re talking to, that percentage could be anywhere from 60% to 90%, or even more. The appeal of this approach lies in its simplicity, and the fact that there’s a fairly common-sense analysis underlying it. Your current income sustains your present lifestyle, so taking that income and reducing it by a specific percentage to reflect the fact that there will be certain expenses you’ll no longer incur (e.g., payroll taxes) will, theoretically, allow you to sustain your current lifestyle. While you are still in your accumulation phase and considering your retirement date, try living off the specific percentage of income you think you need while you are still receiving a paycheck. This will give you a great idea of just what these financial demands look like in retirement and give you the flexibility to make any changes while still receiving a paycheck.

The problem with this approach is that it doesn’t account for your specific situation. If you intend to travel extensively in retirement, for example, you might easily need 100% (or more) of your current income to get by. It’s fine to use a percentage of your current income as a benchmark, but it’s worth going through all your current expenses in detail, and really thinking about how those expenses will change over time as you transition into retirement.

Your annual income during retirement should be enough (or more than enough) to meet your retirement expenses. That’s why estimating those expenses is a big piece of the retirement planning puzzle. But you may have a hard time identifying all your expenses and projecting how much you’ll spend in each area, especially if retirement is still far off. To help you get started, here are some common retirement expenses:

- Food and clothing: to match your retirement plans

- Housing: Rent or mortgage payments, property taxes, homeowners’ insurance, property upkeep and repairs

- Utilities: Gas, electric, water, telephone, internet, and digital entertainment

- Transportation: Car payments, auto insurance, gas, maintenance and repairs, and public transportation

- Insurance: Medical, dental, life, disability, and long-term care

- Health care costs not covered by insurance: Deductibles, co-payments, and prescription drugs

- Taxes: Federal and state income tax, capital gains tax

- Debts: Personal loans, business loans, and credit card payments

- Education: Children’s or grandchildren’s college expenses

- Gifts: Charitable and personal

- Savings and investments: Contributions to Individual Retirement Accounts (IRAs), annuities, and other investment accounts

- Recreation: Travel, dining, hobbies, leisure activities

- Care for yourself, your parents, or others: Costs for a nursing home, home health aide, or other type of assisted living

- Miscellaneous: Personal grooming, pets, club memberships, and gym or health club memberships

The average annual rate of inflation over the past 20 years has been approximately 2%. Don’t forget that the cost of living will go up over time and keep in mind that your retirement expenses may change from year to year.

For example, you may pay off your home mortgage or your children’s education early in retirement. Other expenses, such as health care and insurance, may increase as you age. To protect against these variables, build a comfortable cushion into your estimates (it’s always best to be conservative). Finally, tap the knowledge of the Private Wealth team of experts to help you with your estimates to make sure they’re as accurate and realistic as possible.

Am I Saving Enough?

Am I Saving Enough?

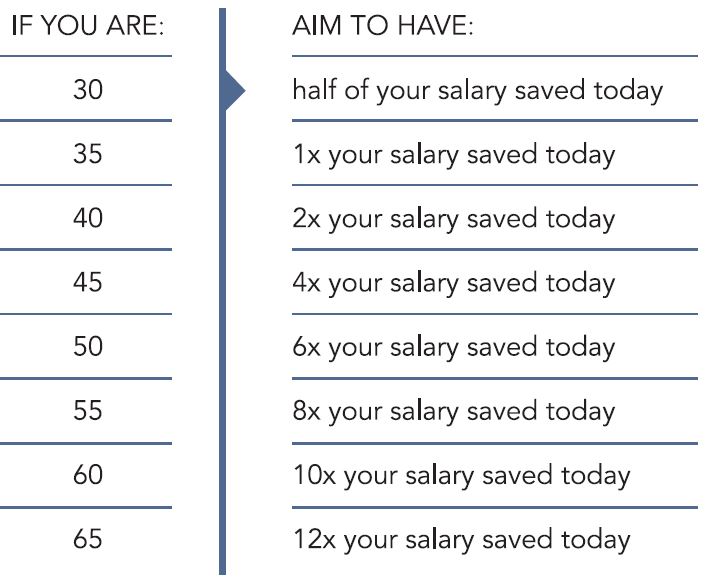

One the most common questions, it’s also very broad because everyone’s personal situation is extremely different. Taking into account all of these questions we are addressing, there is also a very simple guideline that you should try to accomplish at each stage of your life. If you have not obtained this savings level at your specific age, consider increasing your current contribution amount and continue to systematically save this amount going forward. If you fall behind, understand that you are not alone, but do not delay taking action. Investing effectively and sticking to the plan takes a great deal of discipline.

Decide When You’ll Retire

To determine your total retirement needs, you can’t just estimate how much annual income you need. You also should estimate how long you’ll be retired. Why? The longer your retirement, the more years of income you’ll need to fund it. The length of your retirement will depend partly on when you plan to retire. This important decision typically revolves around your personal goals and financial situation. For example, you may see yourself retiring at 50 to get the most out of your retirement. Maybe a booming stock market or a generous early retirement package will make that possible. Although it’s great to have flexibility to choose when you’ll retire, it’s important to remember that retiring at 50 costs more than retiring at 65.

Estimate your life expectancy The age at which you retire isn’t the only factor that determines how long you’ll be retired. The other important factor is your lifespan. We all hope to live to an old age, but a longer life means you’ll need to fund more years of retirement. You may even run the risk of outliving your savings and other income sources. To guard against that risk, you’ll need to estimate your life expectancy. You can use government statistics, life insurance tables, or a life expectancy calculator to get a reasonable estimate of how long you’ll live. Experts base these estimates on your age, gender, race, health, lifestyle, occupation, and family history. But remember, these are just estimates. There’s no way to predict how long you’ll live, but with life expectancies on the rise, it’s probably best to remain conservative and assume you’ll live much longer than you expect.

Identify Your Sources Of Retirement Income

Once you have an idea of your retirement income needs, your next step is to assess how prepared you are to meet them. What sources of retirement income will be available to you? Sources of retirement income may include a 401(k) or other retirement plans, IRAs, annuities, and other investments. The amount of income you receive from those sources will depend on the amount you invest, the rate of investment return, and other factors. In addition, although there is some legislative uncertainty, you can likely count on Social Security to provide a portion of your retirement income. To get an estimate of your Social Security benefits, visit the Social Security Administration website (ssa.gov). Finally, if you plan to work during retirement, your job earnings will be another source of income. It is very important to analyze all sources of income and the tax implications of each source. Withdrawing money in the most tax-efficient way possible is an important part of your retirement plan with which one of our financial advisors can assist you years before retirement.

Once you have an idea of your retirement income needs, your next step is to assess how prepared you are to meet them. What sources of retirement income will be available to you? Sources of retirement income may include a 401(k) or other retirement plans, IRAs, annuities, and other investments. The amount of income you receive from those sources will depend on the amount you invest, the rate of investment return, and other factors. In addition, although there is some legislative uncertainty, you can likely count on Social Security to provide a portion of your retirement income. To get an estimate of your Social Security benefits, visit the Social Security Administration website (ssa.gov). Finally, if you plan to work during retirement, your job earnings will be another source of income. It is very important to analyze all sources of income and the tax implications of each source. Withdrawing money in the most tax-efficient way possible is an important part of your retirement plan with which one of our financial advisors can assist you years before retirement.

Remember, investing and preparing for retirement is just like every other resolution that we put off until “someday.” The sooner you can start, the less of a sacrifice it will be tomorrow.

Make Up Any Income Shortfall

If you’re lucky, your expected income sources will be more than enough to fund even a lengthy retirement. But what if it looks like you’ll come up short? Don’t panic — there are often steps you can take to bridge the gap. Our team can help you figure out the best ways to do that, but here are a few suggestions:

- Try to cut current expenses to save more money for retirement

- Shift your assets to investments that have the potential to substantially outpace inflation (but keep in mind that investments that offer higher potential returns may involve greater risk of loss)

- Lower your expectations for retirement so you won’t need as much money

- Plan to work part time during retirement for extra income

- Consider delaying your retirement for a few years (or longer)