In recent years, the financial industry has undergone a transformation, thanks to technological advancements that make it easier for people to manage their finances remotely. Younger adults, in particular, embraced this trend, with many relying on apps and online platforms to manage their investments and banking needs. Additionally, the educational resources on personal finance helped to improve financial literacy among the younger generation.

Despite these changes, however, many people still value the personal relationship that they have with a financial advisor. In this article, we will explore how people get their personal financial information, including the younger generations. We’ll examine whether there is still a place for a personal relationship with a financial planner in an era when younger adults bank remotely, rely on tech for investing, and have improved financial literacy.

How Do People Get Financial Information To Make Decisions?

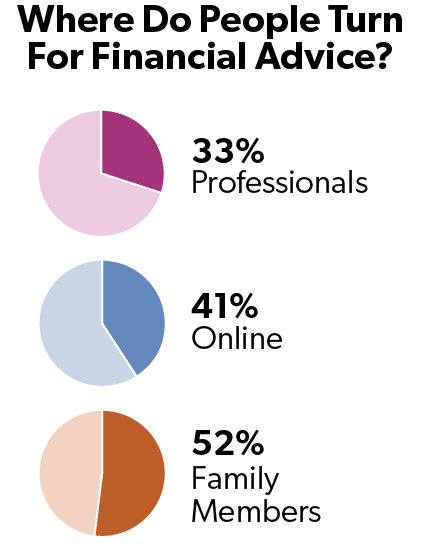

A recent study conducted by financial advisory platform intelliflo found that about one in three Americans turn to professional financial advisors for financial advice while 41% get financial advice online, and 52% get it from their family members.

A recent study conducted by financial advisory platform intelliflo found that about one in three Americans turn to professional financial advisors for financial advice while 41% get financial advice online, and 52% get it from their family members.

The younger generations of adults, Generation X (born between 1965-1980), Millennials (1981-1996), and Generation Z (1997-2012), more often get financial planning advice online. Ranking the highest, almost half (49%) of Millennials say they use digital sources, while 47% of Gen X and 44% of Gen Z seek out financial planning information digitally. Among the digital sources listed are social media, blogs, videos, podcasts, and other online sources.

The study shows these generations are seeking more, however, as 72% of Millennials and 71% of Generation Z “strongly or somewhat agree” that they have financial questions going unanswered and they’re not sure where to turn for financial advice.

The Benefits Of Working With A Financial Planner

Obviously, we are biased as our experienced Private Wealth team works with clients every day to build their wealth with comprehensive financial planning, investment management, financial advice, and more. However, we’ve had many clients say they previously thought they would handle their own financial planning but ended up experiencing numerous unexpected benefits from working with a professional financial advisor.

Getting Individual Financial Planning Advice and Guidance

One of the most significant benefits of working with a financial planner is that they can provide you with personalized financial advice and guidance. While online resources and apps can provide you with generic financial advice, a financial advisor can take your unique individual circumstances and goals into account when creating a financial plan for you.

There are countless variables that may affect your financial health over the next 10, 20, 30 or more years. Careful, attentive, customized planning can help you achieve all those important goals. You should consider everything you might need to do, including:

- Paying down debt

- Saving emergency funds

- Saving for housing or vacations

- Saving for education for children

- Saving for retirement

According to the Education Data Initiative, the average college student after graduation owes $33,500 just for their college education, and half of them still owe $20,000 20 years after starting college. It’s never too late to start working on paying it down and determining a sustainable plan that will get you to your financial goals.

A professional financial planner helps you develop a comprehensive financial plan that considers your income, expenses, debt, and savings goals. They can also help you to identify potential financial risks and provide you with strategies for managing them. A website or an app doesn’t know your situation nor common missteps people in your situation make. A financial advisor can proactively reach out as circumstances change to make customized recommendations specific to your individual needs.

Do You Have Ongoing Personalized Financial Information and Support?

Another benefit of working with a financial planner is that you have access to ongoing support. This means that you can get help with your finances whenever you need it, rather than having to rely on a one-size-fits-all approach that may not meet your needs.

A financial planner can help you to stay on track with your financial goals and can provide you with financial information and guidance on how to adjust your plan if your circumstances change. They can also provide you with support during periods of financial stress or uncertainty, such as job loss or a medical emergency.

A Financial Planner Can Hold You Accountable For Financial Decisions

While an app might be able to track your expenditures, working with a financial planner can also help you to stay accountable for your financial decisions. A financial planner can help you to set realistic financial goals and can hold you accountable for achieving them. This can be especially important for younger adults who may be just starting out on their financial journey and may need extra support to stay on track.

Staying On Track With Your Financial Investments

While many younger adults rely on technology to manage their financial investments, there is still a place for a financial planner in this area. A financial planner can help you to develop an investment strategy that is tailored to your individual needs and goals. They can also help you to manage your investments over time and adjust as needed.

A financial planner can provide you with financial advice on how to diversify your portfolio, manage risk, and make informed investment decisions. They can also help you to avoid common investment pitfalls, such as emotional decision-making and overtrading. Training in behavioral finance helps a financial planner play both the parts of emotional therapist and financial analyst to help protect clients from poor decision-making damaging their financial well-being.

Is There Still a Place for a Personal Relationship with a Financial Planner?

While many young adults are comfortable using technology to manage their finances, there is still a place for a personal relationship with a financial planner. Here are some reasons why:

Financial Planners Handle Complex Financial Situations

While technology can be helpful for managing simple financial situations, it may not be sufficient for managing more complex financial situations. For example, if you identify with any of these situations, financial planning with a personal financial planner is important to help you determine the best way forward to reach your goals:

- Self-employed

- Multiple sources of income

- Inherit money

- Significant debt

- Early retirement

Seeking Emotional Support From A Financial Advisor

Managing your finances can be stressful, and having a personal relationship with a financial planner can provide you with emotional support during challenging times. Should you suddenly lose income, the market drops, or you inherit money, your digital financial planning tool can adjust, but cannot empathize.

An expert financial planner knows you and your family very well, helps you to navigate financial challenges, and provides encouragement and support as you work toward your goals.

Taking Advantage Of Objective Financial Advice

While online resources and apps can provide you with financial advice, they may not always be objective. A financial planner, on the other hand, can provide you with unbiased financial advice that is based on your individual circumstances and goals. They can help you to make informed decisions about your finances, without being influenced by outside factors.

Financial Planning For The Long Term

Working with a financial planner can also be beneficial for long-term financial planning. A financial planner can help you develop a comprehensive financial plan that considers your short- and long-term goals. They can help you to identify potential roadblocks and provide you with strategies for achieving your financial goals over time.

Don’t Underestimate The Human Connection In Financial Planning

Finally, there is something to be said for the human connection that comes from working with a financial planner. While technology can be convenient, it can also be isolating. Working with a financial planner who understands you can provide you with a sense of connection, which can be especially important during times of financial stress or uncertainty.

In conclusion, while younger adults may be comfortable using technology to manage their finances, there is still a place for a personal relationship with a financial planner. A financial planner can provide you with personalized advice and guidance, ongoing support, accountability, and investment management. They can manage complex financial situations, provide emotional support, offer objective advice, and facilitate long-term, shifting financial goals.

Whether you choose to work with a financial planner depends on your individual circumstances and goals. However, for many people, the benefits of working with a financial planner outweigh the convenience of managing their finances solely through technology.