As we age, discussing finances with family members becomes increasingly important, yet it's often a challenging topic. Open communication about financial matters, long-term care, and legacy wishes ensures everyone has a unified understanding and is prepared for the future. However, these conversations can be uncomfortable, and every family faces individual challenges when introducing sensitive subjects.

"Financial discussions between aging parents and adult children don't have to be a source of stress," says Kevin McCloud, Vice President - Wealth Advisor at First Business Bank. "By approaching these conversations with empathy and a clear plan – often involving a checklist — families can work together to create a solid financial foundation for their loved ones' later years."

What Should Your Financial Checklist Include?

A financial checklist can help guide the conversation between loved ones, McCloud said, focusing on retirement income sources and expenses. This knowledge can help align perceptions and expectations between aging parents and their adult children.

According to a report based on a survey conducted by AAG, 62% of adult children are concerned about how inflation is affecting their parents' finances and 35% expressed worry that their parents will become a financial burden.

By openly discussing the impact of inflation and other economic factors, families can work together to adjust budgets, explore cost-saving measures, and potentially reassess investment strategies to help protect their parents' financial well-being in the face of rising costs. These conversations can also lead to a better understanding of any financial assistance that may be needed, allowing families to plan accordingly and ensure their loved ones maintain their quality of life despite economic challenges.

"It's never too early to begin discussing finances across generations," McCloud said. “Often, there's a gap between reality and the perception adult children have of their parents' finances. Sharing information about retirement plans, pensions, and anticipated costs can prevent misunderstandings and allow more effective planning."

Review current assets and income sources

Review current assets and income sources

- Savings accounts

- Investments

- Retirement accounts (401(k)s, IRAs)

- Social Security benefits

- Pensions

- Real estate holdings

- Business interests

- Valuable personal property

- Vehicles

- Other significant assets or sources of income

- Assess current and future expenses

- Regular living expenses

- Travel and leisure needs

- Hobbies and entertainment

- Healthcare costs

- Potential long-term care needs

- Discuss and update important documents

- Wills

- Trusts

- Power of Attorney (financial and healthcare)

- Advance healthcare directives

- Digital accounts and passwords

- Review insurance policies

- Health insurance

- Life insurance

- Long-term care insurance

- Evaluate housing situation and future needs

- Current home maintenance and accessibility

- Potential need for assisted living or nursing care

- Discuss legacy and estate planning wishes

- Identify key financial contacts and advisors

- Plan for potential incapacity or cognitive decline

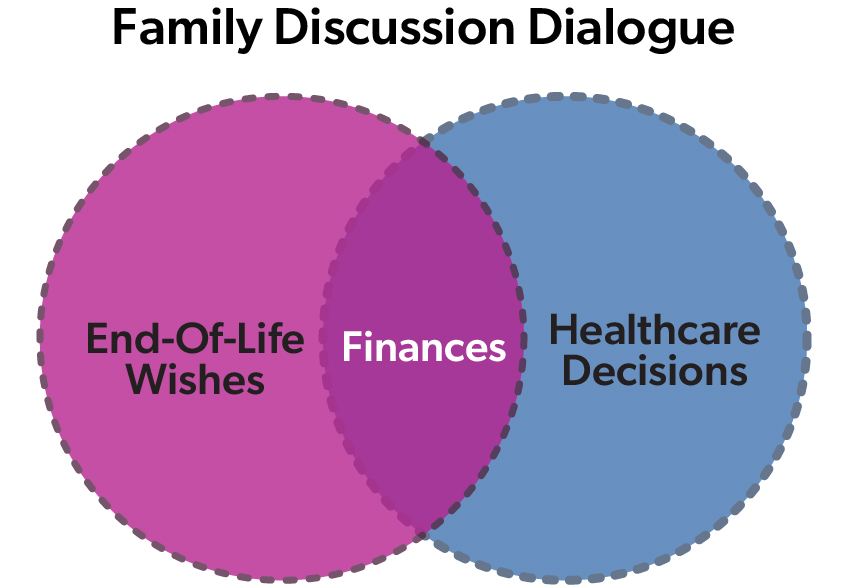

How Do Finances, Healthcare, and End-of-Life Wishes Intersect in Family Discussions?

Finances are linked with healthcare decisions and end-of-life wishes in a complex way. Open dialogue ensures that everyone's preferences are understood and respected, paving the way for comprehensive planning that encompasses all aspects of aging.

McCloud emphasizes the importance of financial and healthcare directives in these conversations. "Having a living will and durable power of attorney for healthcare in place is a critical part of financial planning as we age," he said. "Discussing these documents with your family ensures that your wishes are clear and can be honored when needed."

McCloud emphasizes the importance of financial and healthcare directives in these conversations. "Having a living will and durable power of attorney for healthcare in place is a critical part of financial planning as we age," he said. "Discussing these documents with your family ensures that your wishes are clear and can be honored when needed."

Durable power of attorney (POA) for finances also is an important document to discuss with family. “Many times, an elder family member is unable to make financial decisions and this document allows for a trusted person to handle financial matters during incapacity,” McCloud said. “Sometimes the trusted person is the same as the POA for healthcare, but often is someone else. The separation of duties can be valuable in achieving family harmony and allows for people with different backgrounds and skillsets to help the family in the best way possible.”

Addressing end-of-life care preferences is another vital aspect of the checklist. "It's important to share values and preferences regarding end-of-life care with your family," McCloud advised. "This helps loved ones prepare mentally for the plans you've set in place and can alleviate stress during difficult times."

Legacy planning is also a key consideration. "Wills and trusts are important tools for ensuring your wishes are carried out," he explained. "Involving your family in the legacy planning process can provide clarity and prevent potential conflicts down the line."

How Can Families Navigate Changing Roles and Responsibilities as Parents Age?

As family dynamics shift, adult children often take on more responsibility for their parents' well-being. This transition can be a delicate process, requiring open communication and careful planning.

"It's important for aging parents to feel comfortable asking for help when they need it," McCloud said. "This might involve requesting assistance with financial tasks or daily living activities. While it can feel like a role reversal, it's a natural part of the aging process and can strengthen family bonds when approached with understanding."

This role reversal can be particularly challenging for some individuals, often men, who may struggle with relinquishing control. "It's very hard to completely give up control and also very hard to share that information with their children," he explained. "Often in these situations, when parents and adult children aren't communicating, the kids seem to have a distorted perception because their parents might be painting a picture that's a little prettier than reality."

Setting clear boundaries and expectations is crucial when family members step into caregiving roles. "Open discussions about what each person can realistically offer in terms of time, resources, and emotional support are essential," McCloud noted. "This helps maintain healthy relationships and prevents burnout."

As caregiving needs increase, families may need to consider professional help. "There often comes a point when professional financial advisors or elder care specialists become necessary, especially when planning for long-term care," he said.

McCloud emphasized the importance of discussing long-term care preferences before they become an immediate necessity. "Try to make the decision before you have to make the decision and before someone is forced to make it for you," he advised. "Discuss when the best time might be to make that transition, how to pay for it if you don't have insurance, and prepare emotionally for these changes."

In some cases, more formal arrangements may be necessary. "We sometimes see situations where a family member, like a niece, might have guardianship for an aunt," McCloud said. "It's important to understand how to manage these responsibilities effectively, especially when there's no corporate trustee involved."

What Should You Avoid in Financial Discussions ?

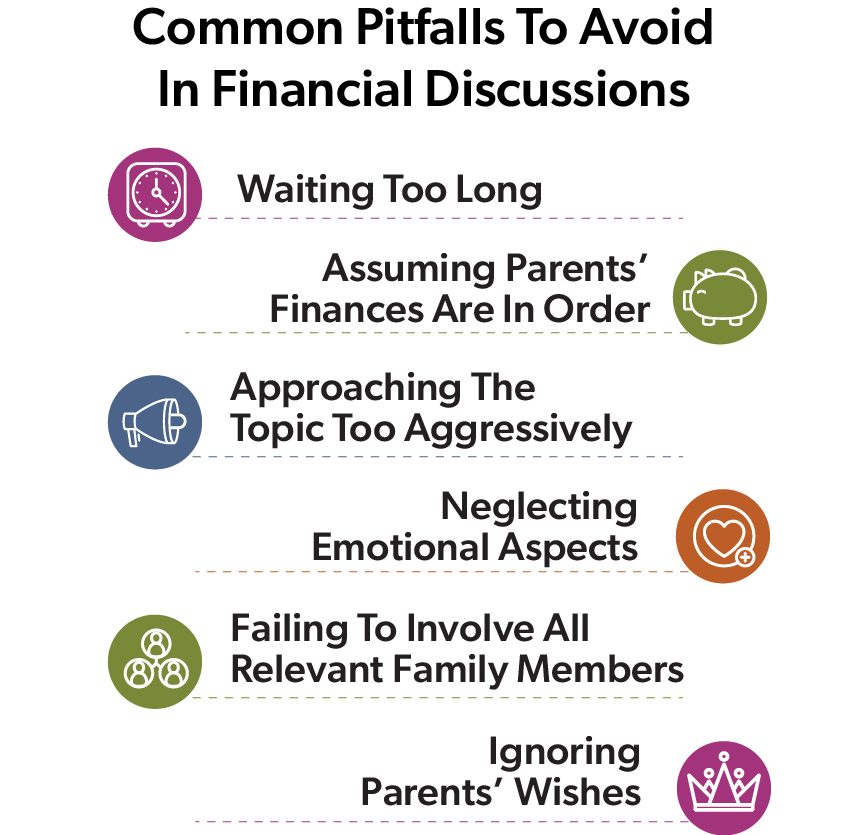

While open communication is crucial, there are several common mistakes families should be aware of when discussing finances with aging parents:

Waiting too long: "One of the biggest mistakes I see is families waiting until a crisis occurs to have these conversations," McCloud cautioned. "It's much better to start these discussions early, when everyone is healthy and clear-minded."

Waiting too long: "One of the biggest mistakes I see is families waiting until a crisis occurs to have these conversations," McCloud cautioned. "It's much better to start these discussions early, when everyone is healthy and clear-minded."- Assuming parents' finances are in order: "Adult children often assume their parents have everything figured out financially," he said. "This assumption can lead to unpleasant surprises later on."

- Approaching the topic too aggressively: "Coming on too strong can make parents feel defensive or threatened," McCloud advised. "Instead, approach the subject gently and express your concerns lovingly."

- Neglecting emotional aspects: "Finances aren't just about numbers," he explained. "There are often deep emotions tied to money and independence. Be sensitive to these feelings during your discussions."

- Failing to involve all relevant family members: "Leaving out siblings or other key family members can lead to misunderstandings or conflicts down the line," McCloud said. "Try to include everyone who should be part of these conversations."

- Ignoring parents' wishes: "While you may not agree with all of your parents' decisions, it's important to respect their autonomy," he emphasized. "The goal is to support and guide, not to take over."

By avoiding these common obstacles, families can have more productive and harmonious discussions about finances as parents age.

As we navigate the complexities of aging and financial planning, open communication remains the cornerstone of successful family dynamics. Whether you're an aging parent or an adult child, it's never too late to engage in comprehensive financial planning. By creating an aging parents finances checklist, discussing healthcare directives, addressing long-term care preferences, and openly communicating about changing roles and responsibilities, families can work together to ensure a secure and harmonious future for all generations involved.