It was Christmas Eve and the whole family was gathered around the computer looking at the online gift catalog of an international charity. My parents asked their grandchildren, “Should we give a heifer, a goat, a flock of chickens, clean water, or send a girl to school with our donation?” So many exciting choices and different ways to help! Without knowing it, even the youngest children were getting involved in the family tradition of charitable giving, while the elder generation was engaged in passing on their values and creating a philanthropic legacy.

Embracing Generational Philanthropy

Many assume that a family must have extreme wealth to engage in legacy planning. But, in fact, you can create a philanthropic legacy without being ultra-rich. At its heart, philanthropy is about intentional, systematic giving to promote the common good in a way that is expressive of one’s deepest values. Charitable giving tends to be about providing resources during one’s lifetime directly to individuals or organizations, and perhaps responding on a one-off basis to requests for gifts from religious, educational, or other meaningful non-profit organizations. Philanthropy, on the other hand, is the more strategic process of long-term giving with the objective of solving an entrenched problem or generating societal change. Therefore, creating a philanthropic legacy is less about the amount of family wealth, and more about about the self-definition and values-based purpose behind a family’s pattern and plan for giving.

Let’s be clear, there is nothing wrong with one-time charitable giving to meet an immediate need! Over 60% of U.S. households donate each year to charity, which makes the United States the most generous (per capita) country in the world. Donors can just give cash, or they can take advantage of many creative and tax-advantageous ways to structure their charitable gifts during life, such as giving Qualified Charitable Donations from an IRA, gifting low-basis stock to a charity, or donating real estate or other unique assets to a community foundation (just to name a few). However, it’s worthwhile to note that over 85% of charitable donations made at death come from the wealthiest 1.5%. This underscores the point that many of us who are generous during life shy away from planning for what will happen with our wealth at death. Perhaps this comes from a reluctance to engage in estate planning conversations at all (60% of Americans don’t even have a will). But, by embracing the concept of “legacy planning,” families at all levels of wealth can move from being ad hoc donors during life into a new phase of high-impact philanthropy, bringing generations together over a shared vision of values and priorities.

Let’s be clear, there is nothing wrong with one-time charitable giving to meet an immediate need! Over 60% of U.S. households donate each year to charity, which makes the United States the most generous (per capita) country in the world. Donors can just give cash, or they can take advantage of many creative and tax-advantageous ways to structure their charitable gifts during life, such as giving Qualified Charitable Donations from an IRA, gifting low-basis stock to a charity, or donating real estate or other unique assets to a community foundation (just to name a few). However, it’s worthwhile to note that over 85% of charitable donations made at death come from the wealthiest 1.5%. This underscores the point that many of us who are generous during life shy away from planning for what will happen with our wealth at death. Perhaps this comes from a reluctance to engage in estate planning conversations at all (60% of Americans don’t even have a will). But, by embracing the concept of “legacy planning,” families at all levels of wealth can move from being ad hoc donors during life into a new phase of high-impact philanthropy, bringing generations together over a shared vision of values and priorities.

Steps To Create A Philanthropic Legacy

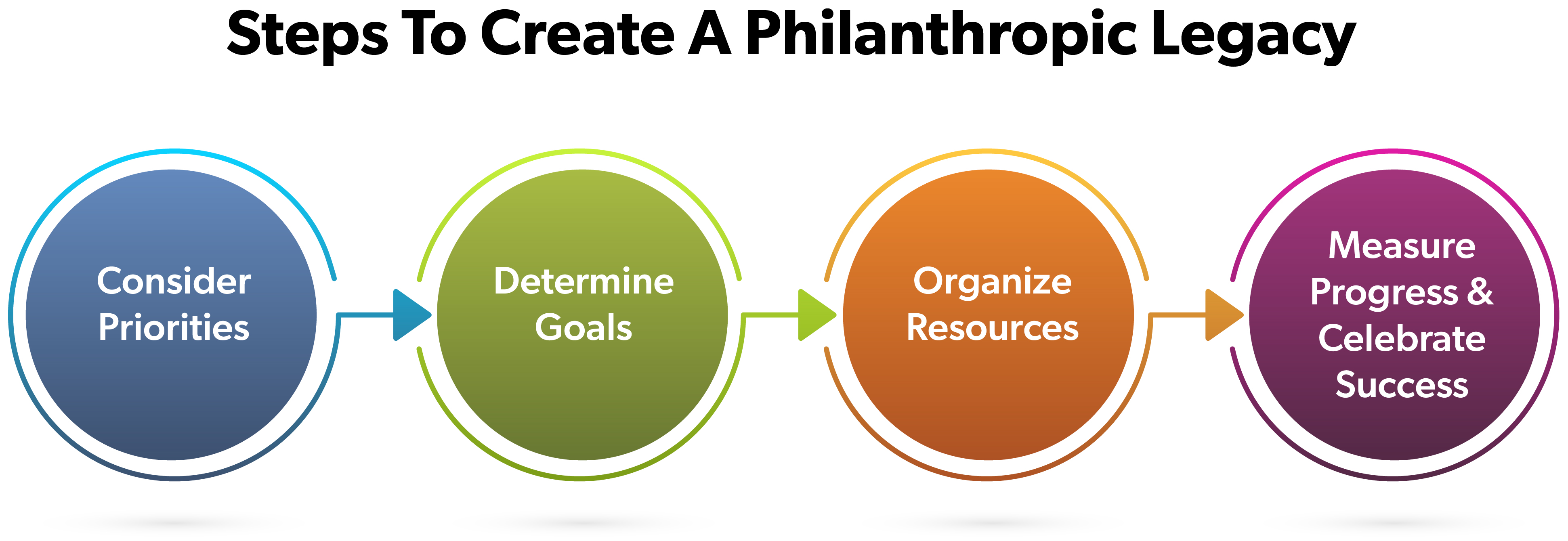

So, after you’ve decided to make a generational philanthropic impact, what are the specific steps in crafting a philanthropic legacy plan?

1. Consider your long-term giving priorities. Philanthropy is personal! Spend time thinking deeply about your values and beliefs, determine why you support the charities you do, and identify the organizations you think will have the most impact on the causes you embrace. Don’t be afraid to involve your children and grandchildren in the conversation, even if they have charitable priorities that, at first, seem different from yours. Honest conversations about values ultimately tend to lead to a unified vision and established set of philanthropic priorities. This, in turn, allows families to create a sustainable framework for inter-generational giving through family foundations, charitable trusts, coordinated planned gifts, or other giving strategies.

2. Determine your goals and what success looks like. It is important to be as specific as possible and to set goals that are clearly defined and not overly complicated. This may require getting organized, doing some research, and learning more about the organizations and causes your family has supported in the past. Decide how success will best be achieved by bringing together a professional team that includes your wealth and investment advisors, your estate planning attorney, and tax professionals. This advisory group will help your family think through the tax, legal, investment, and other technical aspects of accomplishing your charitable priorities. Solutions may range from the simple – such as outright bequests, charitable gift annuities, donor-advised funds, and naming charities as beneficiaries of insurance and IRA assets – to more complex options such as charitable trusts and private family foundations.

3. Organize the resources, other than money, to engage in legacy planning that gets results. Your family may wish to adopt creative approaches to promote a strong shared philanthropic foundation and vision. For example, create family rituals around giving at the holidays, at a child’s birthday, or other important occasions. Find time to volunteer together at community service projects that you are passionate about. Perhaps you could plan to accompany a child or grandchild on a “volunteer vacation” or service trip of a lifetime!

Allow the youngest family members some autonomy to propose their own ideas for family gifts, as this leads to engagement and a sense of common purpose. Community foundations offer an efficient way to create smaller, purpose-focused funds to which multiple family members can contribute. For families with greater wealth, a private foundation makes an ideal vehicle for creating a legacy of coordinated family giving.

4. Decide how you will assess and measure progress and celebrate achievements. Who will evaluate the impact of your giving over time? Will your family meet regularly to determine the impact of your giving and to plan further legacy giving? How involved will you or other family members need to be in managing any trusts or foundations that have been created? Consider delegating investment, governance, and oversight duties to a corporate trustee like First Business Bank so that you and your family can focus your efforts on working with the charitable grantees, donating your time, or lending your talents and expertise to the organizations you believe in.

In summary, every family can engage in the process of philanthropic legacy planning. This process involves much more than just making generous current gifts, or even including a charity in the ultimate disposition of one’s estate. Leaving a philanthropic legacy requires defining one’s own charitable priorities and then communicating, cooperating, and coordinating with the next generation. Individuals who align their values, passions, and interests with their charitable giving practices will maximize the impact of their wealth and share a rich tradition of giving for generations to come.