Retirement planning may seem like a distant goal for many young adults, but it's never too early to start thinking about your financial future. In fact, the earlier you start planning for retirement, the better off you'll be in the long run. Whether you're fresh out of college or already established in your career, here are some tips for retirement for young adults to help you get started.

Start Saving For Retirement As Early As Possible

The most important thing you can do for your retirement plan is to start saving as early as possible. The power of compound interest means that the earlier you start saving, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time. To get started, set a savings goal for yourself and make it a priority to save that amount each month.

If you can, try to save 15% of your income each year for retirement. As this is a long-term investment, let’s look at the historical performance of the stock market to get an idea of how this money can grow over time.

The average annual return of the S&P 500 over the past 30 years is just over 9.64%, assuming dividends are reinvested. Even adjusting for inflation over this period (Consumer Price Index), the annualized return is 6.96%.*

Plugging these numbers into a retirement savings calculator (we used the 401k Retirement Calculator on bankrate.com) tells us that a young adult, at 30 years old, making a $52,936 annual salary and saving 15% in a traditional 401(k), factoring in a 2% annual salary increase, no employer contribution, and an average annual return of 6.96%, will have $1,701,383 at age of 65, or $2,499,726 if they work until age 70.

Pretty impressive, right? What this requires is very simple, but so very hard: self-discipline. The way to think about it is like this: pay yourself first. When you get a job and look at your salary, remove 15%, and then make your budget. If you can save 20%, all the better! The key is to live not on what you make if you can — that’s living paycheck to paycheck with no plan for the future. When you live on 80-85% of what you make, and save the rest, retirement planning as a young adult will allow you to retire on your terms and in your time.

Maximize Contributions To Your Retirement Accounts

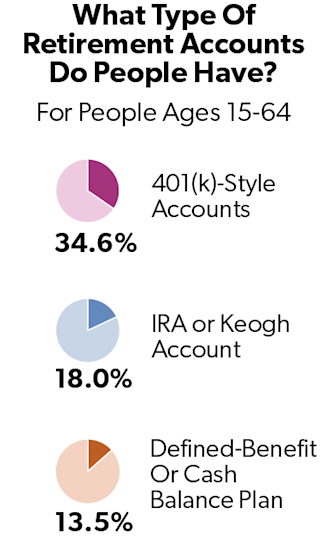

If you have access to a retirement account, such as a 401(k), be sure and take advantage of it, particularly if your employer offers any kind of matching contribution. If you don’t have an employer plan available to you, but you have earned income, contribute to an IRA. Whatever your situation, it’s important to maximize your contributions.

If you have access to a retirement account, such as a 401(k), be sure and take advantage of it, particularly if your employer offers any kind of matching contribution. If you don’t have an employer plan available to you, but you have earned income, contribute to an IRA. Whatever your situation, it’s important to maximize your contributions.

For 2024, the IRS set the employee contribution limit for 401(k) plans at $23,000, or $30,500 if you’re age 50 or older, while the limit for IRA contributions is $7,000, or $7,500 if you’re age 50 or older.

If you're able to contribute the maximum amount to your retirement accounts each year, you'll set yourself up for a comfortable retirement. If you can't contribute the maximum amount right away, aim to increase your contributions each year until you reach the limit.

What Are The Benefits Of Investing In A Roth IRA?

Most employer plans now offer a Roth option, and there is a Roth IRA available as well, although subject to certain income limits. A Roth contribution is made with after-tax dollars, so there is no current income tax deduction for the contribution.  The benefit, however, is that not only will those dollars grow tax free, but they will also never be subject to income tax when taken out in retirement. Roth is typically an attractive option if you are in a relatively lower income tax bracket at the time you are making the contribution, but may not be as attractive if you are in a higher income tax bracket at the time of contribution, as the present tax deduction becomes more valuable. It is important to talk this through with an experienced financial advisor who specializes in retirement advice for young adults to help you look at the big picture and see what makes the most sense for your situation.

The benefit, however, is that not only will those dollars grow tax free, but they will also never be subject to income tax when taken out in retirement. Roth is typically an attractive option if you are in a relatively lower income tax bracket at the time you are making the contribution, but may not be as attractive if you are in a higher income tax bracket at the time of contribution, as the present tax deduction becomes more valuable. It is important to talk this through with an experienced financial advisor who specializes in retirement advice for young adults to help you look at the big picture and see what makes the most sense for your situation.

Why Young Adults Shouldn’t Access Retirement Funds Early

Professionals also recommend saving for emergencies outside of your retirement funds because accessing your retirement funds before the age of 59 ½ typically comes with a 10% penalty on top of the ordinary income tax consequences. Do not tap into your retirement funds for a down payment on a house or your children’s education — keep the retirement assets for retirement.

You can set up a 529 savings plan to save for education; these are funded with after-tax dollars that grow tax free and are not subject to income tax if the money is used to pay for qualifying education expenses. You should also set up separate after-tax savings for things like a down payment on a house and emergency savings.

The current average U.S. life expectancy is just over 79 years, and it is projected to rise to almost 90 by the end of this century (United Nations World Population Prospects). With the rising cost of health care, and other financial uncertainties, you don’t want to run out of money in your golden years. Self-discipline with regard to retirement savings will allow you to live the retirement you want, on your terms.

Diversify Your Investments For Retirement

Investing your retirement savings in a mix of stocks, bonds, and other assets can help you achieve higher returns while minimizing your risk. This is known as diversification, and it's key retirement advice for young adults. In a well-diversified investment portfolio, return over time is ultimately a product of asset allocation. The longer the time horizon for the dollars invested, the more the asset allocation should be weighted toward equities (stocks) over fixed income (bonds and cash equivalents).

One way to diversify your investments is to invest in a target-date fund. These funds automatically adjust the mix of assets in your portfolio as you approach retirement, gradually becoming more conservative as you get older. Another option is to invest in a mix of index funds, which provide exposure to a broad range of stocks and bonds.

How To Account For Inflation In Retirement Planning

Inflation can erode the value of your retirement savings over time. To combat this, it's important to plan for inflation when saving for retirement. This means factoring in the expected rate of inflation when setting your retirement savings goals.

Historically, inflation has averaged around 3% per year, but it can vary significantly from year to year as we’ve experienced over the past several years. To protect your retirement savings from inflation, consider investing in assets that have historically outpaced inflation, such as stocks or real estate.

Don't Rely Only On Social Security For Your Retirement

While Social Security can provide some income in retirement, it's not enough to rely on as your sole source of retirement income. In fact, the future of Social Security is uncertain, and it's possible that young adults might experience reduced benefits in the future. To ensure a comfortable retirement, it's important to save and invest as much as possible on your own.

Data from the Social Security Administration show that Social Security benefits represent about 30% of seniors’ income. The average monthly Social Security benefit in February 2023 was about $1,782, which calculates to about $21,384 annually for retired adults who earn average earnings and work until retiring at age 65.

Create a Retirement Plan For Young Adults

If you’re able, working with a retirement planning professional who has experience helping young adults to create a retirement plan can help you stay on track and achieve your retirement savings goals. A retirement plan for young adults should include your retirement savings goals, your expected retirement expenses, and a plan for achieving those goals.

Although it might be decades away, your retirement planning expert can help you estimate your retirement expenses, including things like housing, food, healthcare, and travel, your income, and how much you need to save each month to reach your retirement savings goals. They can help you create a plan to invest your retirement savings, too.

Review Your Retirement Plan Regularly

Your retirement plan is not a set-it-and-forget-it proposition. You'll need to review your plan regularly to ensure that you're on track to meet your goals. This means monitoring your savings, reviewing your investment portfolio, and adjusting as needed.

As you get closer to retirement, you'll also need to adjust your plan to reflect changes in your life, such as changes in your income, expenses, or health.

Retirement planning may seem daunting, especially for young adults who are just starting out in their careers. However, by following these tips, you can set yourself up for a comfortable retirement.

How Young Adults Can Use Compound Interest To Their Advantage

To understand the power of compound interest and saving early for retirement, it’s impactful to look at the numbers, which tell the whole story.

According to the U.S. Bureau of Labor Statistics (BLS), the median wage for workers in the fourth quarter of 2024 was $61,984 per year for all workers over the age of 16, and $59,072 for all workers between the ages of 25 to 34.

A good rule of thumb is to save 15% of your pre-tax income each year for retirement. As this is a long-term investment, we want to look at the historical performance of the stock market to get an idea of how this money can grow over time.

See the chart to understand how important it is to start saving early. Pretty impressive!

| Beginning Age | Annual Salary** | % Amount Contribution | Retirement Age | Balance at Retirement |

| 30 | $59,072 | 10% | 65 | $2,135,885 |

| 30 | $59,072 | 10% | 70 | $3,589,459 |

| 30 | $59,072 | 15% | 65 | $3,203,828 |

| 30 | $59,072 | 15% | 70 | $5,384,188 |

| 40 | $70,512 | 10% | 65 | $866,854 |

| 40 | $70,512 | 10% | 70 | $1,500,066 |

| 40 | $70,512 | 15% | 65 | $1,300,281 |

| 40 | $70,512 | 15% | 70 | $2,250,099 |

| 50 | $69,472 | 10% | 65 | $254,861 |

| 50 | $69,472 | 10% | 70 | $479,036 |

| 50 | $69,472 | 15% | 65 | $382,292 |

| 50 | $69,472 | 15% | 70 | $718,554 |

*using historical returns since inception of 1/22/93 of SPDF S&P 500 (SPY) ETF, assuming no fees or capital gains taxes, and full reinvestment of dividends, through 12/31/2024

**median annual salary, Q4 2024 averages, U.S. Bureau of Labor Statistics, not seasonally adjusted, and assuming 2% annual income increase