Investment products are not insured by the FDIC, are not deposits, and may lose value.

As investors, many of us didn’t sign up for the emotional investing roller coaster ride we’ve been on throughout the past few years. In fact, one study shows that 66% of investors have made an “impulsive or emotionally charged investing decision they later regretted” and almost half (47%) report having trouble keeping emotions out of investing. Staying level-headed and sticking to your plan as the markets drop is very challenging, but steadying strategies can help you handle market volatility financially and psychologically, so you make fewer emotional investing decisions.

Keep these strategies in mind to avoid an emotional investing decision that might impact your long-term goals. Your Wealth Advisor at First Business Bank is always here to answer questions about your portfolio, so please consider them a resource, as well.

Plan Out Your Investing Strategy

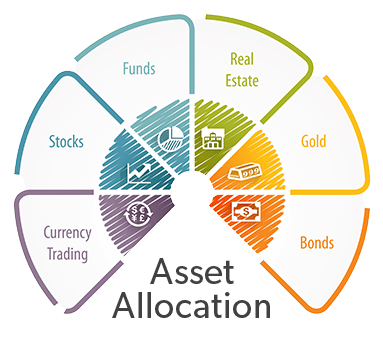

A successful investment strategy starts with an asset allocation—a mix of assets with different characteristics, including stocks, bonds, cash equivalents, and alternative assets—appropriate for the portfolio’s long-term objective. The asset mix should reflect reasonable expectations for risk and returns and use diversified investment strategies to avoid exposure to unnecessary risks.

Recognizing that turbulence in the market happens, your investing strategy can include guidelines with that in mind. For example, the core-and-satellite approach implements buy-and-hold principles for most of your portfolio combined with tactical investments based on a shorter-term market outlook. Diversification also sometimes works to offset risks of certain holdings. While it may not guarantee profits or prevent losses, diversification can help.

The fundamentals of sound investing include solid asset allocation. A diversified portfolio is so important because the strong performance of some investments may offset others’ poor showing. However, even with an appropriate asset allocation, some parts of a portfolio may struggle at any given time. Timing the market is difficult under the best circumstances, but swinging, volatile markets can make it worse, magnifying the impact of making a wrong decision just as the market is about to move in an unexpected direction. Ensure your asset allocation is appropriate before making drastic changes to minimize emotional investing.

Know Your Investments & Why You Own Them

Documenting your original reasons for making specific investments can ground your emotions when turbulence happens. This allows you to examine the reasons again to evaluate whether they are still valid, regardless of the current market situation. And, if you understand how an investment fits in your portfolio, you might also consider buying more when the price is down.

This is an opportunity to find out the why behind your holdings — particularly important information when we hit market turbulence, especially if you consider swapping one investment for another.

Compare Against Overall Market Benchmarks

Asset allocations is the primary driver of portfolio returns that we can control. With a well-diversified portfolio that includes multiple asset classes, try comparing overall portfolio performance to benchmarks. That way, you have a better sense of whether your investments are performing well in comparison to a peer group and are less likely to make an emotional investing decision.

What Goes Around Comes Around Again

The financial markets are historically cyclical, so even if you miss out on selling at a peak or buying at a low point, recognize that the opportunity most likely will come around again. Long-term investors adhere to thoughtfully considered plans with balanced asset allocation — that does not mean a volatile market is time to turn this on its end with emotional investment decisions.

Learn From Emotional Investing Errors

When everyone is up during bull markets, it’s easy to build your confidence. However, the rough patches really create savvy investors who learn through trial and error. Experience is the best education in investing. Perhaps one of your recent investing decisions now seems unwise — sometimes all you can do is take a tax loss, learn from the experience, and take the knowledge gained forward to your future decisions. Working with a Wealth Advisor at First Business Bank can help as you have the benefit of their experience, as well.

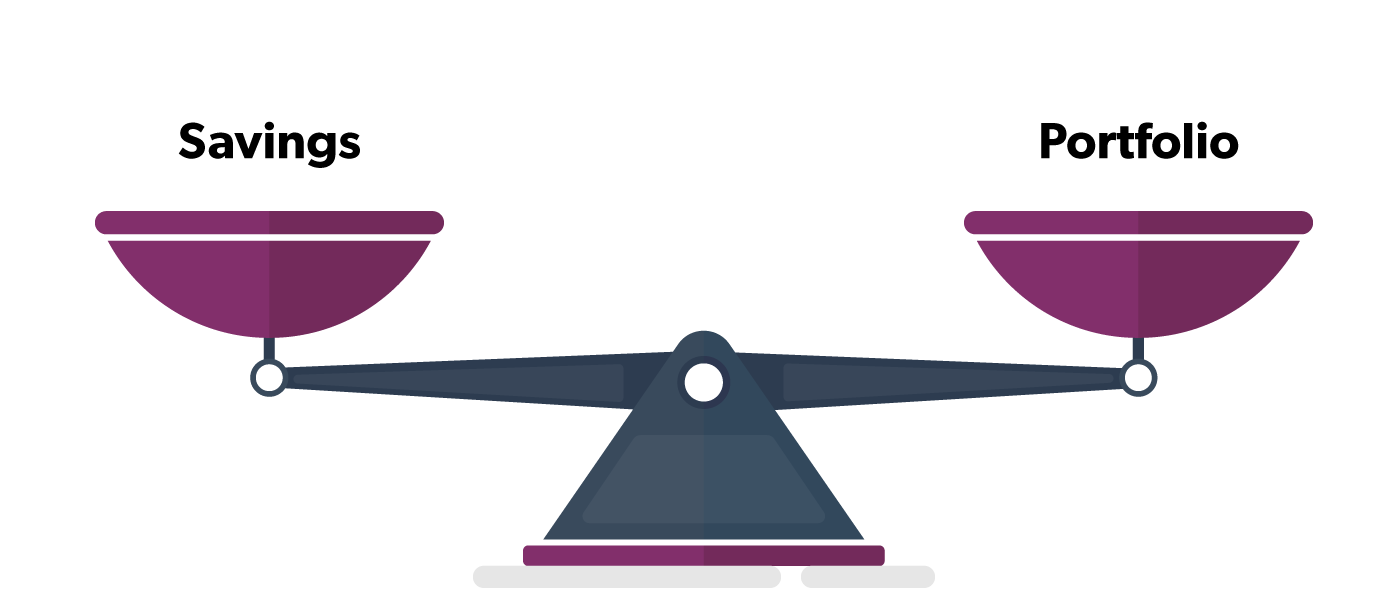

Boost Your Balance With Savings

Even if the value of your portfolio and holdings fluctuates, you can still routinely add to an account designed for your long-term goals, which may give you the fortitude needed to avoid emotional investing decisions. The goal is a healthier view of your bottom-line number where any daily losses are partly offset by new savings.

If you're using dollar-cost averaging — investing a set amount regularly despite fluctuating price levels — buying when prices are down could be an advantage. However, dollar-cost averaging doesn’t guarantee profit or prevent losses. This type of systematic investing isn’t effective if you stop when prices are down, so examine your financial and emotional ability to continue routinely investing. Finally, it may help to keep in mind that the return and principal value of your investments will fluctuate with market conditions, so shares may be worth more or less than their original cost when you sell them.

Build A Cash Cushion

You’ve maybe never thought of cash as the financial equivalent of taking deep breaths to relax, but cash can help you to make more thoughtful decisions rather than impulsive or emotional ones. By establishing appropriate asset allocation, you should have resources to prevent needing to sell stocks to meet regular expenses or, if you've used leverage, a margin call. A cash cushion paired with a disciplined investing strategy can change your perspective on market volatility. It’s possible to grow your patience even further when you have the knowledge that you're positioned to take advantage of downturns by picking up bargains.

Review Your Past Portfolio Performance

As a long-term investor, it can help to take a look back and see how far you've come. If your portfolio is down this year, it’s sometimes easy to forget the progress you made over several years. Of course, past performance is no guarantee of future returns, but, historically, the stock market has usually gone up. Considering stocks, make sure to remember that your investing strategy is only half of the equation — the other half is adhering to it. Even if you avoid losses because you’re out of the market, how will you know when to get back in? You have used your patience to build a nest egg, and looking back on it is useful to avoid emotional investing decisions.

Make Small Changes For Big Impacts

If you can’t shake the feeling that you need to make changes in your portfolio, you can change things without undertaking a total renovation. For instance, try testing the waters by directing a small percentage of one asset class to another. Or, with the new savings, you could put those into investments you feel are well-positioned for the future, leaving the rest untouched. Consider setting up a stop-loss order to prevent an investment from falling below a certain level or set an informal threshold for selling an investment. That allows you to take some gradual steps to spread out your risk over time during a period of volatility, ensuring you are not making rash emotional investing decisions that will damage your portfolio’s long-term performance.