As the year draws to a close, it’s an excellent time to consider making year-end gifts to both individuals and charities. Thoughtful planning can maximize the impact of your generosity and provide significant tax benefits. The right gifting strategy depends on your financial situation, family dynamics, and long-term wealth transfer goals. Here are some strategies to consider.

How To Make Year-End Gifts To Individuals

Whether supporting a grandchild's education, helping with medical expenses, or providing financial assistance to family members, there are several tax-efficient ways to give meaningfully to loved ones.

- Annual Exclusion Gifts. You can give up to $18,000 per recipient in 2024 without incurring gift tax. Married couples can double the gift through “gift-splitting” for a total of $36,000 per recipient. This is a great way to transfer wealth to children and grandchildren.

It may be more beneficial to gift cash for annual exclusion gifting rather than appreciated assets because a noncash gift made during the donor’s life is transferred with a carryover basis. The individual receiving the asset would then have to realize and pay any applicable capital gains tax upon sale of the asset. - Tuition and Medical Expenses. Payments made directly to educational institutions or medical providers on behalf of someone else are not subject to gift tax and do not count against your annual exclusion.

- 529 Plan Contributions. Contributions to a 529 college savings plan can be front-loaded with up to five years’ worth of annual exclusion gifts, allowing you to contribute up to $90,000 ($18,000 x 5 years) per beneficiary in a single year without gift tax consequences. Contributions are often deductible from state income tax, as well.

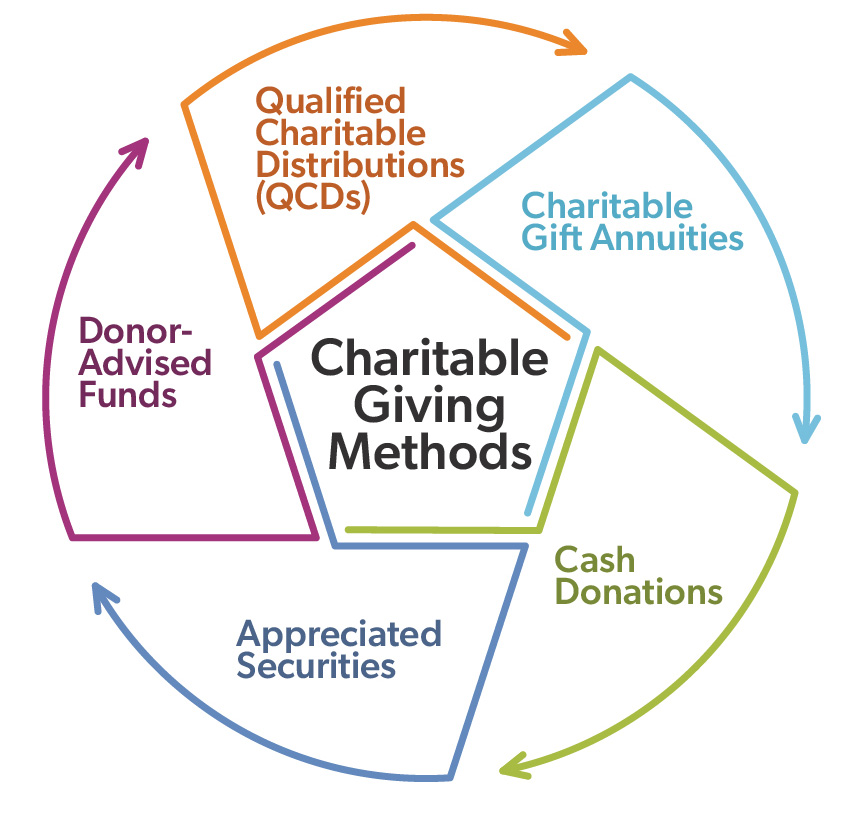

How To Make Year-End Gifts To Charities

Unlike gifts to individuals, charitable donations can provide immediate tax deductions while supporting meaningful causes. Organizations often offer multiple ways to structure giving.

Cash Donations. Cash gifts are straightforward and can be deducted up to 60% of your adjusted gross income (AGI) if given to a qualified public charity.

Cash Donations. Cash gifts are straightforward and can be deducted up to 60% of your adjusted gross income (AGI) if given to a qualified public charity.- Appreciated Securities. Gifts of appreciated stocks or mutual funds, owned for at least 12 months, can provide a double tax benefit: you get a charitable deduction for the full fair market value of the securities and avoid paying capital gains tax on the appreciation. Your deduction is limited to 30% of your AGI each year, but you can carry over any excess deductions for up to five additional years.

Note: Since gifts of appreciated securities can take some time to process, contact your financial advisor and coordinate with the charity as soon as possible to ensure the transfer of these securities can be completed by year-end. Be sure to retain proper documentation to substantiate the valuation of any noncash assets gifted charitably. - Donor-Advised Funds. These funds allow you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time.

- Qualified Charitable Distributions (QCDs). If you are 70½ or older, in 2024, you can make a QCD of up to $105,000 per year directly from your IRA to a qualified charity. This can satisfy your required minimum distribution (RMD) without increasing your taxable income. The charitable distribution from your IRA is not included in your AGI and thus allows a tax break even if you can’t itemize and are taking the standard deduction.

Reminder: QCDs may NOT be made from company retirement plans like a 401(k) and QCDs to private foundations or donor-advised funds are not permitted. However, these distributions may be made to other types of foundation funds, such as nonprofit endowment funds, field of interest funds, and certain donor-designated funds. - Charitable Gift Annuities. This gifting technique allows you to make an immediately tax-deductible gift to the charity of your choice while retaining the right to receive regular annuity payments during your lifetime. After your lifetime income stream stops, the remaining gift amount goes to that charity.

New: The Secure Act 2.0 now allows you to make a one-time transfer of $50,000 from your IRA to a Charitable Gift Annuity (CGA) established with a qualified charity or community foundation. This funding of a CGA will go toward satisfying your RMD requirement.

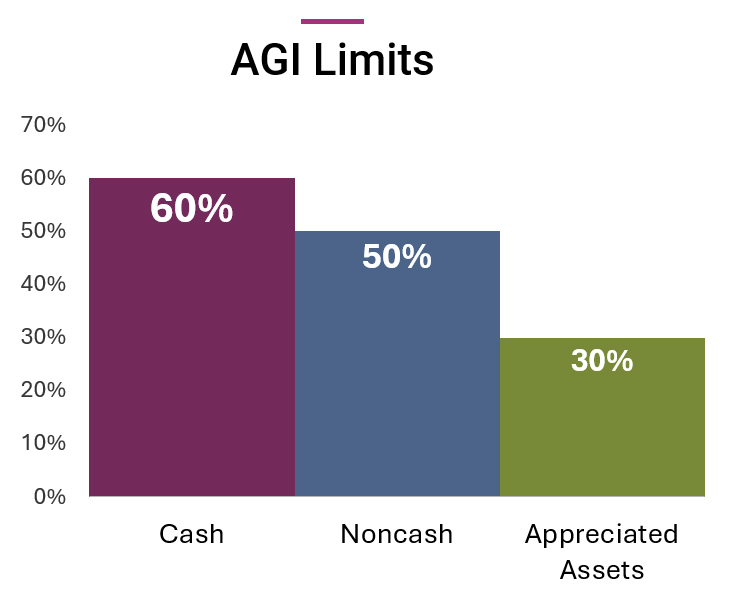

How Does Income Tax Deduction For Charitable Gifts Work?

If you itemize deductions on your income tax return, you can generally deduct your gifts to qualified 501(c)(3) organizations. These include qualifying public charities, private foundations, religious organizations, and other nonprofit entities.

- AGI Limits. The amount of your deduction for gifts to qualified charities is typically limited to certain percentages of your AGI — 60% of AGI for cash gifts, 50% of AGI for certain noncash gifts, and 30% of AGI for long-term (held for more than one year) appreciated assets, including stocks and property. Charitable deductions in excess of AGI may generally be carried over and deducted over the next five years, subject to the income percentage limits in those years.

- Bunching Strategy. The bunching strategy involves grouping multiple years’ worth of itemized deductions, such as charitable donations, into a single tax year. This allows taxpayers to exceed the standard deduction threshold and take advantage of itemized deductions for that year. For example, if you usually donate to charity annually, you could combine two years’ worth of donations into one year. This way, your total deductions for that year might surpass the standard deduction, allowing you to both have a larger charitable impact in the year of the gift, itemize, and potentially reduce your tax liability.

If you want to take advantage of the bunching strategy but want the benefits of your philanthropy to be distributed over time, consider a gift to a donor-advised fund. This allows donors to separate the timing of their gift for tax purposes from the decision about where and when to give. You can take a large tax deduction in 2024 with the contribution to the donor-advised fund and then recommend grants to your chosen charities in 2025 and beyond. - Timing. It’s always wise to consult with a tax advisor or financial planner to tailor your gifting strategy to your specific financial situation and goals. Specifically, look at your marginal tax rate from one year to the next when timing your charitable giving. The higher your marginal rate, the more valuable the deduction! Your tax rate, in combination with other planning considerations, will help you decide on the timing of your gifts to charity.

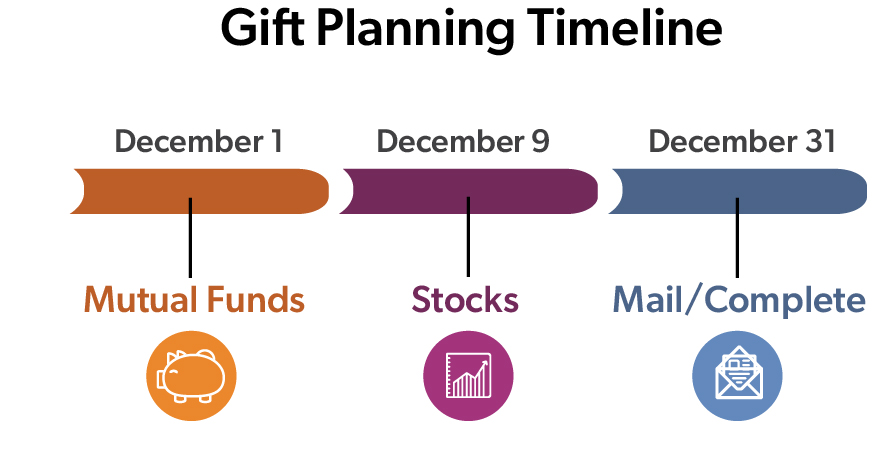

- Completed Charitable Gifts. Understanding when charitable gifts are considered "complete" for tax purposes is crucial for year-end giving strategies. Different types of donations have different deadlines and requirements for completion — missing these deadlines could result in losing the intended tax deduction for the current year.

- Mailbox Rule. For charitable contributions, the IRS considers a gift complete on the date a personal check is mailed, as long as it is postmarked by December 31. This rule applies only to donations sent by U.S. mail, as donations sent by a commercial carrier must be received and cashed on or prior to December 31.

- Gifts of Securities. We recommend you talk to your advisor no later than December 1 to initiate a gift of mutual fund shares and no later than December 9 to initiate stock gifts to charity. These gifts must be completed, and assets posted to the receiving charity’s brokerage account on or before December 31.

- QCDs from IRAs. The best practice is to work with your IRA custodian to initiate your QCDs well before year-end so that the transaction is completed, and the charity can cash the check in a timely manner. QCDs for the 2024 year must be completed by year-end. The funds must leave the IRA on or before December 31.

- Checkbook IRAs. In cases in which IRA owners make QCDs using “checkbook IRAs,” the checks must actually be cashed by the charity by year-end, or they won’t show up as a distribution for this year for tax reporting purposes. The “mailbox rule” that applies to personal checks does not apply to IRA-qualified charitable distributions.

Private Wealth experts at First Business Bank strongly feel that meaningful giving starts with understanding what matters most to you. We can help you evaluate how to best make your year-end gifts, charitable and otherwise, in a manner that furthers your personal goals while minimizing tax consequences.

Updated: 12/2/2024

The tax information provided herein is general and educational in nature and should not be construed as legal or tax advice. First Business Bank does not provide legal or tax advice. Content provided relates to taxation at the federal level only. Rules and regulations regarding tax deductions for charitable giving vary at the state level and laws of a specific state or laws relevant to a particular situation may affect the applicability, accuracy, or completeness of the information provided. As a result, First Business Bank cannot guarantee that such information is accurate, complete, or timely. Tax laws and regulations are complex and subject to change, and changes in them may have a material impact on pre- and/or after-tax results. First Business Bank makes no warranties with regard to such information or results obtained by its use. First Business Bank disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Always consult an attorney or tax professional regarding your specific legal or tax situation.