As more companies set invoice payment terms from 30 to 60 to 90 days, the payment delay can damage your company’s ability to operate and grow. Getting the right type of financing is one of the most important decisions that can make or break any business. When seeking to improve working capital, business leaders often compare invoice factoring or invoice financing vs a line of credit from a bank.

These two financing methods differ in their benefits and structures, which can have dramatic implications on your company’s cash flow, taxes, operations, and competitiveness. This is especially true for small, emerging businesses and seasonal businesses, where access to the right type of capital is essential to growth.

While both invoice factoring and a line of credit offer access to cash flow for businesses, they have several differences in terms of how they work, their cost structures, and the flexibility they provide. Let’s discuss them to give you a better idea of what might work for your business.

How Invoice Factoring Works

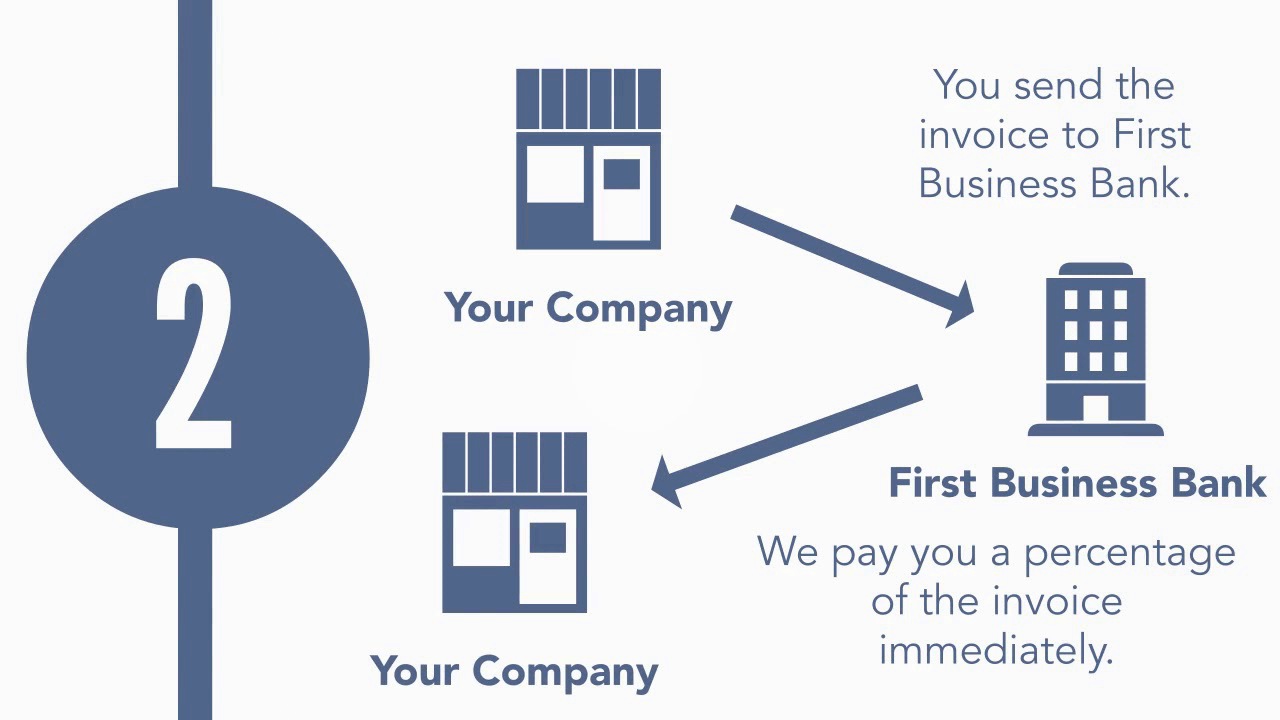

Invoice factoring (also called accounts receivable financing) is one of the easiest financing sources to secure. It is a financial transaction where a business sells its accounts receivable (invoices) to a third-party factoring company at a discount. In exchange, your business gets upfront cash from the factoring finance company immediately, which you can use to pay your bills, make payroll, buy supplies, or reinvest in your business. The factoring finance company then collects on your invoices from your customers to be repaid.

The benefit of factoring is that you don’t have to wait for payment and it’s easier to get a factoring facility than to get a loan. Unlike with loans, your company’s creditworthiness is less important to the factoring finance company than the creditworthiness of your customers. That’s why factoring can be a good option for companies that sell to well-established, stable businesses but might have long payment terms.

The Basics Behind Factoring

Factoring provides immediate access to cash, which can help businesses manage cash flow issues, especially if you’re dealing with slow-paying customers or businesses with long payment cycles.

Collateral: Factoring is based on the creditworthiness of the business's customers, rather than the business itself. The invoices serve as collateral.

Cost: Factoring typically involves fees based on a percentage of the invoice amount, which can be higher than the interest rates on a line of credit.

Flexibility: Factoring is generally less flexible compared to a line of credit, as the funding is tied to specific invoices.

Impact on credit: Factoring typically doesn't affect the business's credit score directly, as it's an asset sale rather than a loan.

How A Line Of Credit Works

A line of credit is a type of loan from a bank, lender, or credit union that gives you access to a set amount of funds you can borrow from as needed for your operations. A line of credit allows you to draw on the available funds at any time, up to a limit.

A line of credit is more difficult to get than a factoring finance facility and the process takes longer because it involves underwriting you and your business by the bank approving the line of credit. In fact, according to the Federal Reserve’s report “Small Business Credit Survey,” full approval rates on loans, lines of credit, and cash advance applications declined from a high of 62% in 2019 to 53% in its latest survey in 2023.

Once your line of credit is approved, you can access the funds by writing a check or using a debit card that's linked to the account, transferring the money to your checking account, or using online banking services. You can borrow as much or as little as you need from the available credit limit, and you can use your line of credit for any business expenses.

You will need to make payments on the line of credit. Depending on the terms you agreed to, you may need to make minimum payments or pay off the entire balance each month. As you repay the money you borrowed, the funds become available again.

Keep in mind that you'll pay interest on the money you borrow from your line of credit, typically at a variable interest rate. In recent years, as interest rates have risen, so have variable interest rates on bank lines of credit. The interest rate may be lower than fees for factoring or the interest rate you pay with credit cards, but it can fluctuate over time.

The Basics Behind Lines of Credit

A line of credit is a flexible, low-cost financing solution offered by many financial institutions. It’s most often used by companies with solid assets, a history of success, and predictable cash flow to fund growth or cover unexpected expenses.

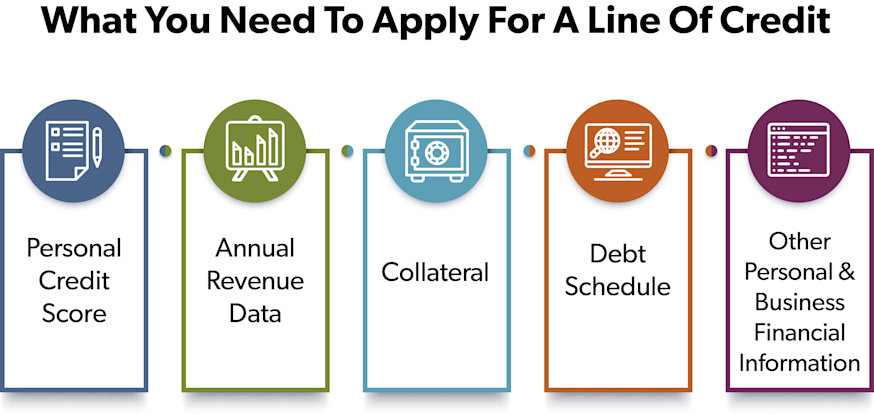

You apply for a line of credit, and the bank or lender evaluates your creditworthiness, income, and other financial factors to determine whether you qualify. If you are approved, the lender sets a credit limit based on your application and credit history.

Collateral: Lines of credit can be secured or unsecured. Secured lines of credit require collateral, while unsecured lines of credit are based on the business's creditworthiness.

Cost: The cost of a line of credit involves interest on the borrowed amount, which is typically lower than factoring fees.

Flexibility: A line of credit offers more flexibility, as businesses can access funds as needed and for various purposes, not tied to specific invoices.

Impact on credit: Borrowing and repaying a line of credit can affect the business's credit score, as it's a loan and the activity is reported to credit bureaus.

Overall, a line of credit can be a flexible and convenient way to access funds when you need them, but it's important to use it responsibly and make sure you understand the terms and fees associated with the account. However, many companies find it difficult to secure this type of financing because of more stringent financial requirements.

Comparing Invoice Factoring vs A Line of Credit

Factoring and a line of credit can help businesses manage their cash flow, but they work in different ways and have distinctive features. Main differences between invoice factoring vs a line of credit include:

Funding Source: Factoring involves selling your invoices to a third-party (the factor) at a discount, in exchange for immediate cash. In contrast, a line of credit is a bank loan for a set amount of funds that you can borrow from as needed.

Repayment: Factoring is not a loan, so there is no repayment involved. The factor collects payment directly from your customers, and you receive the remaining amount of the invoice value, minus the fee. With a line of credit, you borrow funds and must repay them according to the terms of the loan agreement, typically with interest.

Creditworthiness: Factoring is often available to businesses with less-than-perfect credit, as the factor is more interested in the credit history of your customers. However, a line of credit usually requires a good credit score and other financial criteria to qualify.

Usage: Companies typically use factoring to improve cash flow by accelerating payments from customers, whereas a line of credit can be used for a wider range of purposes, such as purchasing inventory, covering operating expenses, or financing new projects.

Cost: Factoring fees can be higher than a line of credit's interest rate, as the factor assumes some of the risk and must cover its costs. Even if a line of credit's interest rate is lower, it can increase over time, whereas factoring fees are typically fixed.

Overall, while factoring and a line of credit provide businesses with cash, they serve different purposes and are suited for different financial needs. Carefully evaluate the terms and costs of each option before choosing the best one for your business based on your specific needs, credit history, and the industry you’re in.