Jump To 10 Frequently Asked Questions About Financial Planning

As a young professional establishing yourself in your career and working towards long-term financial goals, it can be difficult to know what goes into a strong financial plan. Here are some key components of a strong financial plan that can help you build a solid foundation for your financial future.

Identify Assets and Liabilities

What have you accumulated thus far on your long journey to retirement? This may include retirement accounts, real estate, life insurance and other investment assets. In addition, how much and where are you continuing to save? Tax efficiency is a key component to your saving strategy and determining how best to save is an important part of the plan. Debt can be a healthy part of your financial life, but analysis of rates and the appropriateness of debt, along with a repayment plan are also important discussion points.

Save And Build An Emergency Savings Fund

An emergency fund is a savings account that's set aside specifically for unexpected expenses, such as medical bills or car repairs. Building an emergency fund is an important part of a strong financial plan, as it can help you avoid going into debt when unexpected expenses arise. Aim to save at least three to six months' worth of expenses in your emergency fund, and keep the money in a separate, easily accessible account.

An emergency fund is a savings account that's set aside specifically for unexpected expenses, such as medical bills or car repairs. Building an emergency fund is an important part of a strong financial plan, as it can help you avoid going into debt when unexpected expenses arise. Aim to save at least three to six months' worth of expenses in your emergency fund, and keep the money in a separate, easily accessible account.

Protect Your Assets

Protecting your assets is an important part of a strong financial plan. This might include purchasing insurance policies to protect against unexpected events, creating a will and estate plan, and exploring legal structures to minimize taxes. By taking steps to protect your assets, you can ensure that your wealth is preserved for future generations.

Identify Clear Financial Goals

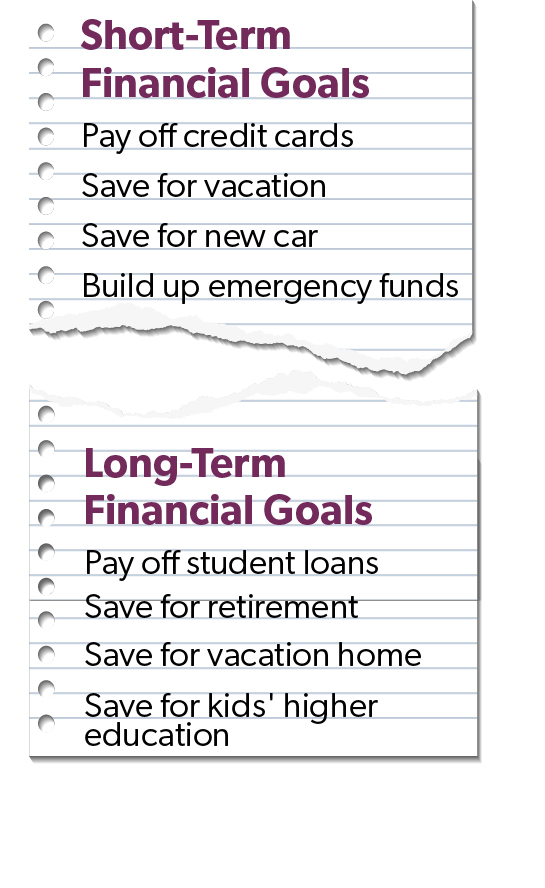

The next step in creating a strong financial plan is to set clear financial goals. These goals should be specific, measurable, and achievable. They might include short-term goals like paying off credit card debt or saving for a vacation, as well as long-term goals like saving for retirement or buying a home. By setting clear goals, you'll be able to create a plan that aligns with your priorities and helps you achieve the financial future you want.

The next step in creating a strong financial plan is to set clear financial goals. These goals should be specific, measurable, and achievable. They might include short-term goals like paying off credit card debt or saving for a vacation, as well as long-term goals like saving for retirement or buying a home. By setting clear goals, you'll be able to create a plan that aligns with your priorities and helps you achieve the financial future you want.

Invest Your Money Wisely

Investing is an important part of building long-term wealth, but it's imperative to do so wisely. Consider working with a financial advisor to create a diversified investment portfolio that aligns with your financial goals and risk tolerance. Avoid making impulsive investment decisions based on emotions or short-term market fluctuations. Investment allocation and sticking to a long-term plan are the most important aspects of your investment strategy.

Are You Saving Enough for Retirement?

Even if retirement seems far off, it's important to start saving early to take advantage of long-term growth and build a solid nest egg. When analyzing your financial plan while you’re working, it’s vital to determine if you are saving enough to meet your needs in retirement. You may discover that you are currently falling short, which may require higher savings rates, working longer, adjusting your retirement plans, or a combination of these strategies. Or you may discover that you are over-saving for retirement or can afford to retire earlier than expected. Regardless, it’s a powerful thing to know how you are performing in your retirement preparations.

Be Patient and Periodically Revisit the Financial Plan

Overall, creating a strong financial plan takes time and effort, but it's well worth it in the long run. By setting clear financial goals, creating a budget, building an emergency fund, paying off debt, saving for retirement, investing wisely, and protecting your assets, you can build a solid foundation for your financial future.

A professional financial planner works with you to help guide your progress and set goals with you. Remember that taking small steps consistently over time adds up to considerable progress towards your financial goals. By prioritizing financial planning and taking action towards your goals, you can set yourself up for long-term success and financial security. This exercise should not be a set-it-and-forget-it activity. You will experience job changes, family situations, economic changes beyond your control, and unexpected curves in the road. Adjustments need to be made along the way to ensure a healthy financial life and scheduling check-ups to review is key for success.

10 Most Common Questions About Financial Planning

Financial planning can be complex and overwhelming, and it's not uncommon for people to have questions about how to manage their finances effectively. Here are the top 10 most common questions people ask about financial planning:

What is financial planning?

Financial planning is the process of creating a comprehensive plan that outlines your financial goals, budget, savings, investment, retirement, and risk management strategies.

How Do I Create A Budget?

Creating a budget involves tracking all of your income and expenses over a period of time, categorizing your expenses, and creating a plan that aligns with your financial goals.

What's the best way to save money?

The best way to save money depends on your financial goals and personal circumstances. Some effective strategies include setting up automatic savings, prioritizing high-interest debt repayment, and minimizing unnecessary expenses.

How Should I Invest In Stocks And Bonds?

Investing in stocks and bonds can be complex, and it's important to do your research and seek out professional guidance. Consider working with a financial advisor to create a diversified investment portfolio that aligns with your financial goals and risk tolerance.

How much should I be saving for retirement?

The amount you should be saving for retirement depends on your age, income, and retirement goals. Consider using a retirement calculator or working with a financial advisor to determine how much you should be saving each month.

Should I pay off debt or save for retirement first?

This depends on your personal financial situation. In general, it's a good idea to prioritize high-interest debt repayment before focusing on retirement savings, but it's important to strike a balance that aligns with your financial goals.

How do I protect my financial assets?

Protecting your assets involves creating an estate plan, purchasing insurance policies, and exploring legal structures to minimize taxes. Consider working with a financial advisor and attorney to create a comprehensive plan that aligns with your goals.

What's the best way to pay off debt?

The best way to pay off debt depends on your personal circumstances. Consider using the debt snowball or debt avalanche method, and focus on making more than the minimum payment each month to reduce the amount of interest you'll pay over time.

How can I improve my credit score?

Improving your credit score involves paying bills on time, keeping credit card balances low, and avoiding opening too many new credit accounts at once. You can also consider using a secured credit card or becoming an authorized user on someone else's account to build credit.

When should I start saving for my child's education?

It's never too early to start saving for your child's education. Consider opening a 529 college savings plan or other education savings account to help cover the cost of tuition, room and board, and other expenses.

Overall, financial planning is a complex and personal process, and it's important to seek out professional guidance and do your own research to make informed decisions about your finances.