When businesses need new equipment, but their working capital is tied up elsewhere, equipment financing is a smart, strategic solution. Understanding what goes into approval can mean the difference between a quick 'yes' and a frustrating denial.

Getting approved to finance business equipment depends on three key factors:

- Business and personal credit profile

- A company's operational history

- How the equipment will benefit the business

Financing business equipment can be very straightforward and quick, with approvals granted often in under two hours from application completion. For application-only business equipment, First Business Bank streamlines the process to only require a simple application to get started.

The approval process requires meeting set criteria, but it's simpler than many business leaders imagine. Let’s walk through how to get approved when financing business equipment, starting with the credit factors that carry the most weight in approval decisions, then covering the documentation you might need for more extensive, higher-value equipment acquisitions.

What Credit Do You Need To Finance Business Equipment?

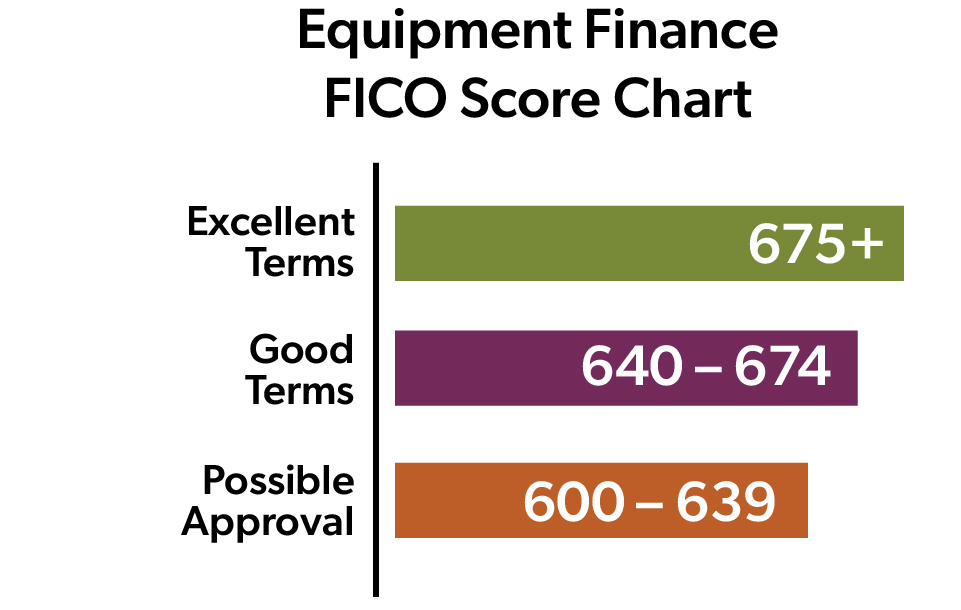

As we mentioned, application-only financing for business equipment is fairly simple, requiring just a short application. Lenders evaluate both personal and business credit history to compile a complete picture of your creditworthiness. Below are some questions to review to see if your credit worthiness will be viewed positively to finance business equipment.

Personal Credit:

- Do you know what your personal FICO score is? The higher the better.

- Have you made all your required payments on time?

- Do you have a history of borrowing with similar terms to the current request?

- Do you have available revolving credit? Or are all your credit cards maxed out? The more available revolving credit, the better.

- Are you a homeowner? Homeownership reflects positively on your credit and can demonstrate ties to the community where your business is located.

Time in Business:

How long has your business existed? The more time in which a business has been in operation is reflected positively on the credit profile. Companies with less time in business, typically under two or three years, can be viewed as still in the “Start Up” phase of the business life cycle. As such, additional documentation, down payments, or increased rates may be required.

How long has your business existed? The more time in which a business has been in operation is reflected positively on the credit profile. Companies with less time in business, typically under two or three years, can be viewed as still in the “Start Up” phase of the business life cycle. As such, additional documentation, down payments, or increased rates may be required. - Has your business changed significantly? Significant changes in a business's operations can also impact the view on a business's longevity. A material change in ownership/management, relocation, or expansion into a different industry/market can affect the view of the credit worthiness of the business.

Business Credit:

- Does your business have a history of borrowing with similar terms to the current request? This is especially important as the requests become larger.

- Is the amount of recent debt taken out by the business excessive? Excessive debt is relative to each business and depending on the amount, additional documentation such as bank statements or financial statements may be required to show the business has the cash flow to service the current debt levels.

- Don’t have any past business borrowings? Perhaps you have just taken out personal loans in the past rather than a business loan. Don’t worry, that does not make you unqualified. However, additional documentation may be required to complete your credit review, such as bank statements, financial statements, or tax returns. Recent credit activity is weighed heavily by lenders. They assess late payments, new debt, and how you manage your obligations. A few old late payments are less concerning if you've since improved your credit, but recent delinquencies or rapid debt increases raise concerns.

Other factors can bolster the credit profile of an application. Strong public presence for the business, such as a website and positive customer reviews are an indicator of a successful operation. Depending on the industry of the applicant, the public profile of the company can be an important factor in assessing the credit worthiness of the business.

What Paperwork Is Required To Finance Business Equipment?

When you need to finance high-value business equipment, or when a credit history or startup needs extra support, lenders may request additional documentation to get a better picture of the business and to evaluate if it can handle the payments.

Financial Documents To Finance Business Equipment

- Balance Sheet: Shows assets, liabilities, and equity to demonstrate financial position

- Income Statement: Reveals profitability and revenue trends over time

- Cash Flow Statement: Indicates how cash moves through the business operations

- Business Tax Returns: Typically, two to three years to verify financial history and stability

- Bank Statements: Recent statements showing cash flow patterns and account balances

- Debt Schedule: Current loans and obligations to assess total debt capacity

Additional Supporting Documents

- Equipment Quotes: Detailed specifications and pricing for the equipment being financed

- Business Plan: Required for newer businesses to explain growth strategy and projections

The key to a smooth approval process is having these documents organized and readily available. Well-prepared applications with complete financial information typically receive faster decisions.

What To Do Before Applying To Finance Business Equipment

Getting approved for equipment financing becomes much easier when you understand what lenders evaluate and come prepared. The process doesn't have to be complicated, especially for simple, application-only business equipment purchases.

Before You Apply To Finance Business Equipment:

- Check your personal (and business if possible) credit scores to understand where you stand

- Gather recent financial statements if you’re purchasing higher-value equipment

- Prepare a clear explanation of how the equipment will benefit your business operations

- Ensure your equipment quotes include detailed specifications and pricing

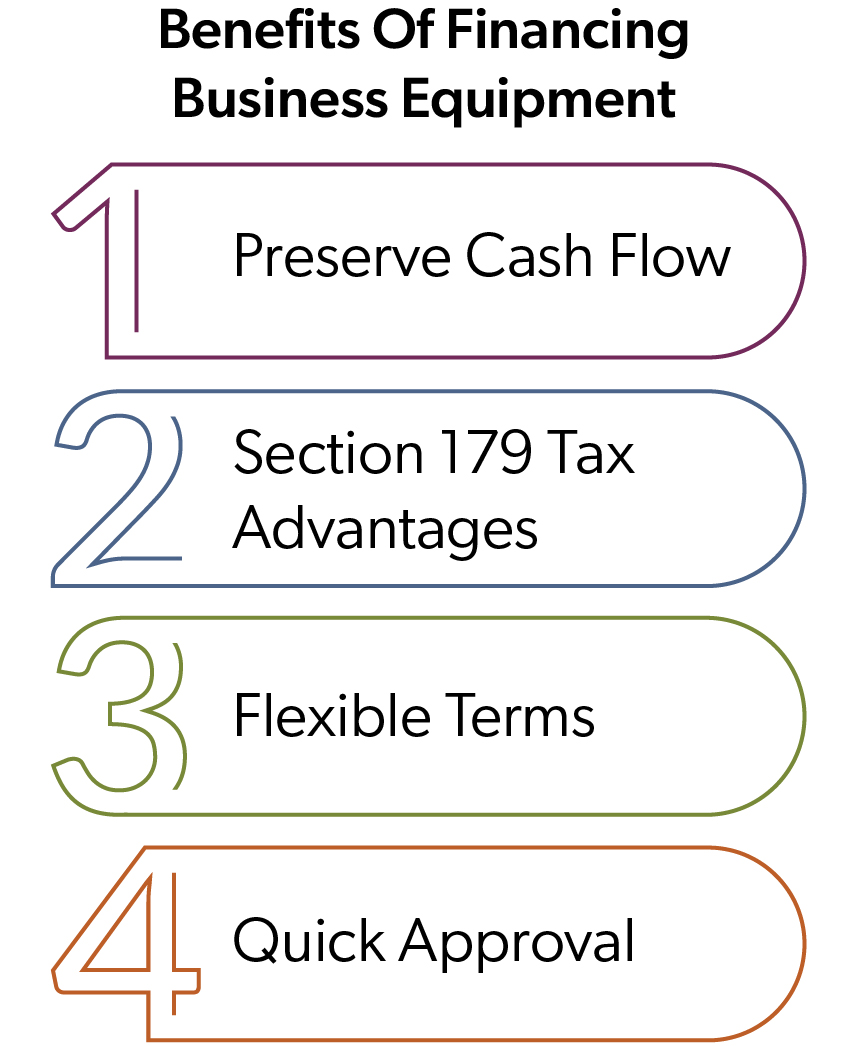

Whether you finance business equipment directly with a lender or through a broker or vendor, preparation makes a difference. Organizing your credit profile, business projections, and other documentation ready streamlines the entire process and helps to show that you're a qualified borrower. And remember that equipment financing may qualify for Section 179 tax deductions.

Whether you finance business equipment directly with a lender or through a broker or vendor, preparation makes a difference. Organizing your credit profile, business projections, and other documentation ready streamlines the entire process and helps to show that you're a qualified borrower. And remember that equipment financing may qualify for Section 179 tax deductions.

First Business Bank specializes in equipment financing for businesses at all stages, including startups. Our streamlined process for application-only equipment can deliver decisions in hours, while our comprehensive approach for larger purchases ensures you get the financing you need to grow your business.