If you buy or finance business equipment , you’ll want to be familiar with Section 179 of the U.S. Internal Revenue Code because it could save your business money on important business equipment acquisitions.

In the past, when a business purchased equipment, the business depreciated the cost of that equipment over time using modified accelerated cost recovery system (MACRS) depreciation schedules. This delayed depreciation of the equipment also delayed the tax benefits from the equipment’s depreciation – in most cases delaying the tax benefit for several years. However, you can imagine that a business owner might make different purchasing decisions if they could get a tax benefit much faster – especially if the full tax benefit arrives the same year they purchase the equipment. That’s the goal of Section 179 of the IRS code – to accelerate the tax benefits of depreciation to provide more incentive for small businesses to purchase needed business equipment immediately.

Section 179 tax deduction is an expense deduction for business equipment, including construction equipment, industrial machinery, medical equipment, vehicles, computers, office equipment, and more, which allows qualifying businesses to deduct the cost of the business equipment as an expense in the year it is acquired instead of capitalizing it and depreciating it over a period of years.

At First Business Bank, our team of experienced equipment financing specialists help business people navigate business equipment purchases every day. The examples in this article reflect the top tax benefits we see for many businesses, but make sure to consult your accountant or tax advisor with respect to your unique business tax situation.

Section 179 Tax Deduction Savings Strategy

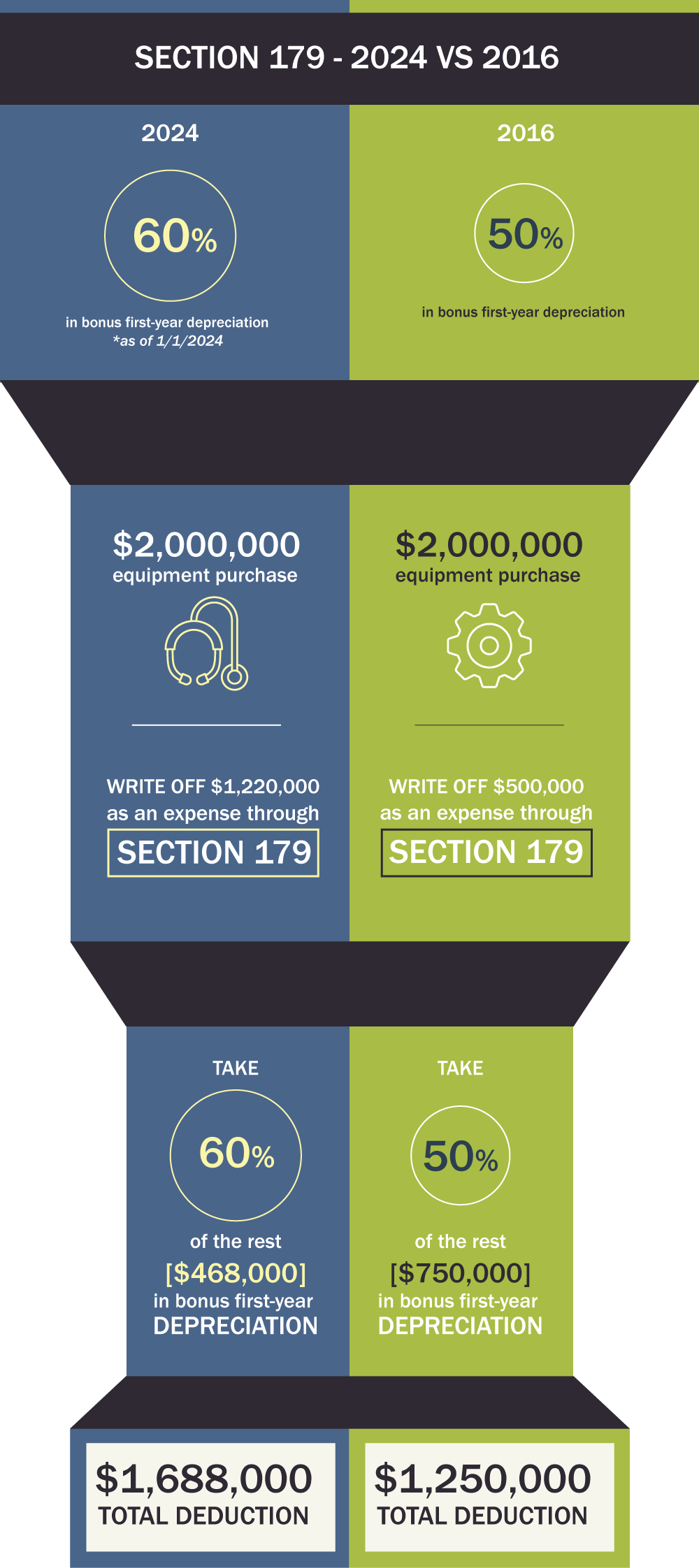

Section 179 tax deduction limits and bonus depreciation percentages change annually. For tax year 2024, Section 179 allows you to deduct $1,220,000 in used or new equipment costs. Bonus depreciation, which kicks in once you reach the Section 179 tax deduction limit, allows you to take an extra 60% in first-year depreciation.

Section 179 tax deduction limits and bonus depreciation percentages change annually. For tax year 2024, Section 179 allows you to deduct $1,220,000 in used or new equipment costs. Bonus depreciation, which kicks in once you reach the Section 179 tax deduction limit, allows you to take an extra 60% in first-year depreciation.

As an example, on a $2,000,000 business equipment purchase, your business can write off $1,220,000 of used or new equipment as an expense through Section 179 tax deduction and take 60% of the balance – an additional deduction of $468,000 - for a total deduction of $1,688,000.

Optimize Operating Costs

Through careful tax planning, and a personalized combination of Section 179 and bonus depreciation, you can strategically benefit your business in the long run. For instance, although the Section 179 tax deduction won’t allow you to create a net operating loss for your business, bonus depreciation does allow it. If you go this route, you can revisit years when you showed a profit and potentially claim a refund. Start planning your company’s growth by reaching out to our seasoned experts to learn more about Section 179 tax deduction advantages and how they can benefit your specific company.

Last Reviewed 4/23/2025