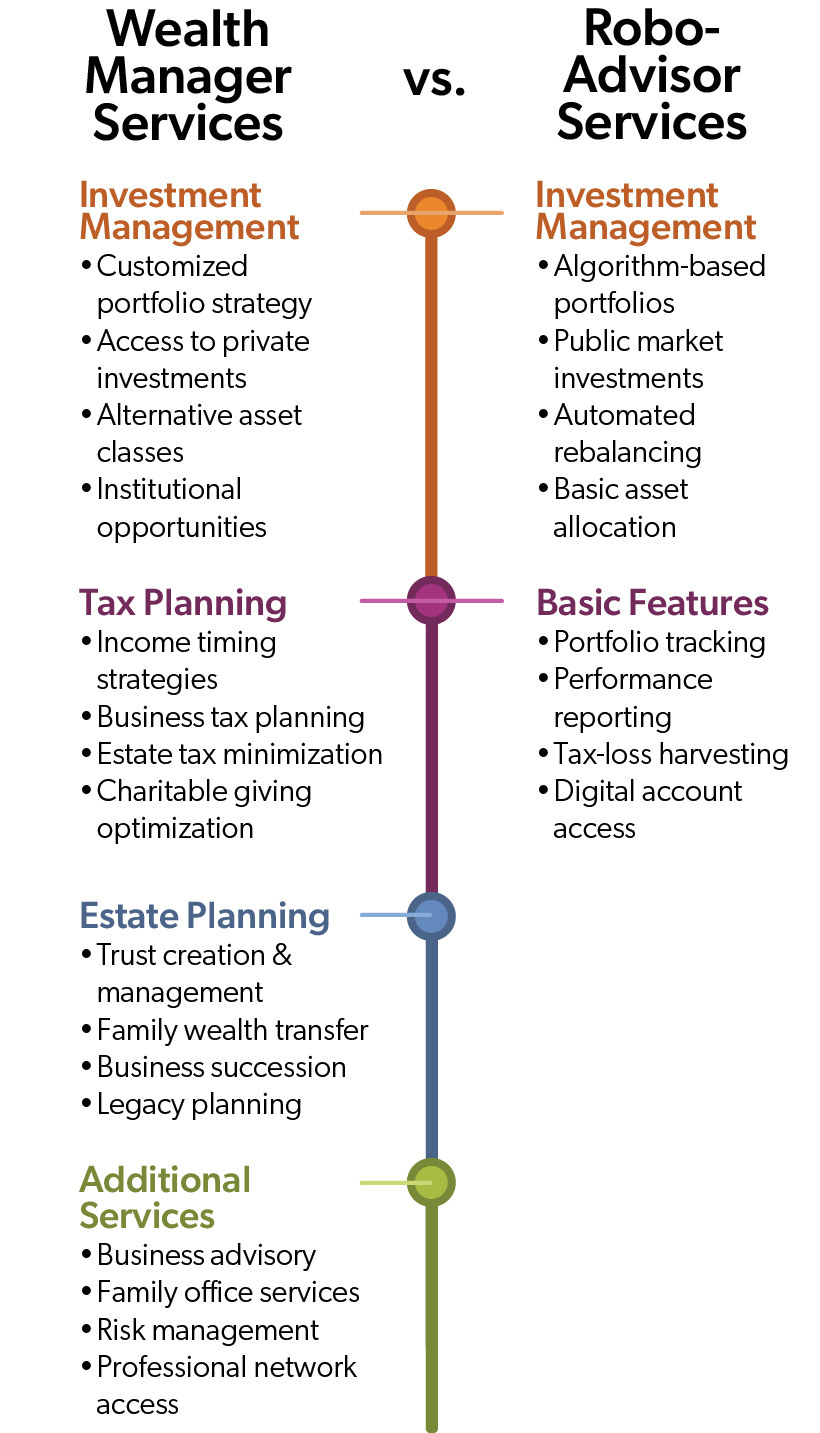

With automated investment platforms gaining popularity, many investors are investigating the differences between wealth managers and robo-advisors. Robo-advisors offer algorithm-driven portfolio management for investing. These platforms use set criteria to rebalance portfolios and build investment strategies based on risk tolerance surveys, giving investors a tech-focused option for basic management.

However, wealth managers provide a holistic, personalized approach that goes beyond investment selection. They take the time to understand each client’s full financial picture and personal priorities, which often include complex areas like tax strategy, business succession planning, estate planning, and philanthropic giving. Wealth managers act as trusted advisors, helping clients make decisions that align with their overall financial well-being and long-term aspirations.

This distinction — wealth managers vs robo-advisors — shapes everything from day-to-day investment decisions to the big-picture strategies that are designed to preserve wealth across generations. The benefits of a personalized, relationship-based approach often outweigh the simplicity of an automated platform, making wealth managers an invaluable resource for achieving long-term financial success.

What Unique Benefits Do Wealth Managers Offer High-Net Worth Clients?

Wealth managers bring unparalleled value through a coordinated and sophisticated approach that automated platforms simply can’t match. For high-net-worth clients — especially those with businesses, diverse income streams, or substantial assets — this means a truly comprehensive approach including:

Wealth managers bring unparalleled value through a coordinated and sophisticated approach that automated platforms simply can’t match. For high-net-worth clients — especially those with businesses, diverse income streams, or substantial assets — this means a truly comprehensive approach including:

Tax Optimization: Wealth managers create tax-efficient strategies by carefully timing income, optimizing charitable giving, and making smart choices on investment placement. For business owners, this can include considering expansion opportunities, planning for succession, or navigating a potential sale — all while minimizing tax impacts.

Estate Planning and Wealth Transfer: Passing wealth to the next generation requires balancing family dynamics with long-term goals. Wealth managers develop personalized plans that honor client values and reduce estate tax liabilities. From trusts and family gifting to charitable structures, they help clients make thoughtful choices for efficient asset transfer across generations.

Beyond traditional portfolio management, wealth managers open doors to private equity deals, alternative investments like direct real estate holdings, and other exclusive opportunities typically reserved for institutional investors. Their close understanding of each client's financial picture, business interests, and wealth priorities allows them to adapt strategies quickly as markets shift.

How Does the Financial Planning Process Differ with a Wealth Manager?

Wealth managers go beyond the standard questionnaires you see with robo-advisors, conducting detailed discovery to understand each client’s full financial landscape. Through several in-depth conversations, they uncover insights into family dynamics, business goals, personal values, and long-term ambitions, laying the groundwork for truly personalized strategies.

Wealth advisors’ financial analysis extends beyond the typical portfolio review, connecting every part of a client’s financial life. By examining business interests, real estate, investment portfolios, and insurance, wealth managers spot opportunities and risks that automated systems might miss.

The financial planning process with wealth advisors generally includes:

The financial planning process with wealth advisors generally includes:

- Initial Discovery Meeting

- Data Gathering & Analysis

- Strategy Development

- Plan Presentation & Refinement

- Implementation

- Regular Review & Updates

At every stage, wealth managers use sophisticated scenario planning, coordinating with other advisors and experts. Acting as quarterbacks for their clients' financial teams — collaborating with attorneys, CPAs, and business consultants — they ensure that each decision aligns with the client’s broader financial goals. This comprehensive, client-centered approach highlights an important limitation of robo-advisors: automated systems simply cannot capture and consider the unique aspects of a client’s holistic wealth.

What Are The Limitations of Automated Investment Management?

While algorithm-based investing with robo-advisors might work for basic portfolios, high-net-worth clients often have assets that automated platforms struggle to evaluate. Business ownership interests, commercial real estate, and private equity demand sophisticated analysis that goes well beyond standard calculations.

For those with international holdings, cross-border investments introduce unique challenges. High-net-worth individuals with global business interests or multi-currency assets require expertise in geopolitical issues, currency fluctuations, and international tax considerations — nuances automated systems can’t effectively address.

Standard risk tolerance questionnaires also overlook crucial factors like business cash flow needs, anticipated liquidity events, and family gifting plans. Wealth managers apply their experience in interpreting market trends and economic signals to make well-informed adjustments, bringing particular value during times of economic uncertainty.

How Do Wealth Managers Address Emotional and Behavioral Aspects of Investing?

Market volatility affects even the most experienced investors, emotionally speaking. With their long-term, trusted client relationships, wealth managers know when a client may be on the verge of reacting emotionally to market swings. They offer historical perspective and sound advice to help clients avoid rash decisions they might regret. In meetings, wealth managers pick up on subtle cues about clients’ concerns and comfort, building an invaluable foundation of trust in uncertain times.

Guiding Families Through Financial Conversations

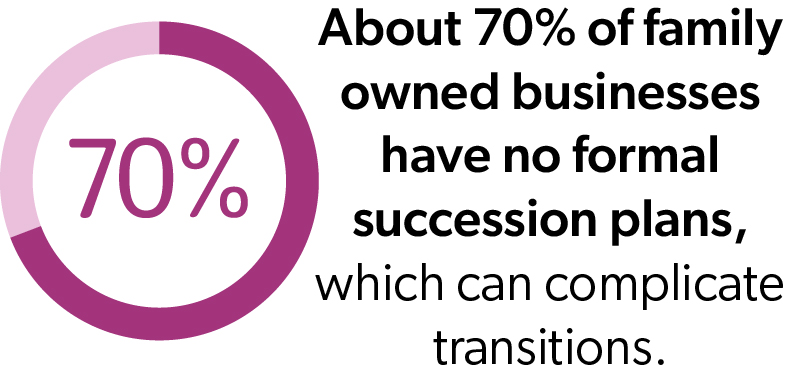

Wealth managers also help families navigate tricky or complex conversations. Acting as objective experts, they encourage and lead open discussions on topics like inheritance, business succession, and wealth transfer. Their guidance is particularly helpful in sensitive areas, such as unequal inheritances or business leadership changes.

Wealth managers also help families navigate tricky or complex conversations. Acting as objective experts, they encourage and lead open discussions on topics like inheritance, business succession, and wealth transfer. Their guidance is particularly helpful in sensitive areas, such as unequal inheritances or business leadership changes.

Education is a core part of the relationship with a wealth advisor, as well. By breaking down complex strategies into clear, actionable insights, wealth managers help clients feel confident in their decisions and understand the thinking behind each recommendation.

What Technology Do Wealth Managers Use to Enhance Their Services?

Today’s wealth managers blend sophisticated technology with personal expertise to offer truly comprehensive service. Advanced financial planning software allows them to quickly model a range of scenarios, while artificial intelligence and machine learning reveal deeper market insights. Unlike robo-advisors, which depend solely on these tools, wealth managers interpret these insights and adapt them to each client’s unique priorities and assets.

While investors can see how their portfolio is doing through secure client portals, with on-demand access to portfolio updates and performance reports, wealth managers go further. They explain how the numbers align with each client’s goals. They also employ high-security measures to safeguard sensitive information, ensuring that clients’ data remains protected. Digital tools help wealth advisors streamline tax optimization and estate planning, allowing them to focus on strategic guidance rather than routine tasks.

How Do Fees and Performance Compare Between Wealth Managers and Robo-Advisors?

The fees for robo-advisors vs wealth advisors each reflect the type of service investors receive. Robo-advisors generally charge between 0.25% and 0.50% of assets under management for basic portfolio oversight, while wealth managers’ fees range from 0.75% to 1.50% for more comprehensive guidance. Many wealth managers offer flexible fee structures, often combining asset-based fees with flat rates for specific services or adjusting fees for larger portfolios.

When comparing performance, it’s important to look beyond standard investment returns. Wealth managers add value through tax-efficient strategies, smart asset location, and access to exclusive private investments. Their advice on business decisions, estate planning, and wealth transfer often provides financial benefits that far outweigh their fees.

What Does the Future Hold for Wealth Management in a Tech-Driven World?

As technology progresses, wealth management is evolving while staying rooted in personal relationships. Modern tools help streamline routine tasks, freeing wealth managers to focus on complex planning and strategic guidance. Many firms are also adopting hybrid models, blending automated platforms for basic tasks with professional advice for more intricate planning — an approach that resonates with younger generations.

While enhanced data analytics and predictive modeling have the potential to improve portfolio management and risk assessment, they complement rather than replace the insight and expertise wealth managers bring to client relationships.

As wealth shifts to younger generations, communication methods and service delivery are adapting. Digital meetings and mobile apps now support traditional interactions, allowing tech-savvy clients to access personal guidance for important financial decisions. This balance between technological convenience and human wisdom positions wealth managers to serve clients effectively for years to come.

High-net-worth individuals benefit most from a blend of advanced technology and seasoned guidance to manage their complex financial lives. The strongest wealth management partnerships combine digital efficiency with personalized advice for nuanced decisions. This balanced approach allows clients to enjoy the advantages of technological innovation while relying on trusted relationships to achieve long-term financial success.