As you plan for retirement and making cherished memories with those you love most, it's equally important to consider the possibility of needing long-term care. According to the U.S. Department of Health and Human Services, about 70% of people turning 65 today will need some type of long-term care during their lives.

While the thought of long-term care may be worrisome, proactive long-term care planning can help you feel more prepared. In this article, we'll explore how to pay for long-term care, the ins and outs of long-term care insurance, the costs associated with various types of long-term care, and other essential considerations related to long-term care planning and its financial implications.

What is Long-Term Care?

Long-term care includes services and support that help people of all ages with chronic illnesses, disabilities, or other conditions that affect their ability to perform independent, daily activities. Long-term care helps people with bathing, dressing, and eating, as well as medical care and other tasks.

"Long-term care is a critical aspect of planning for the future," said Anthony Ursetti, Vice President - Wealth Advisor at First Business Bank. "It's essential to understand what long-term care entails and the various situations that may require it, so you can be better prepared to handle the financial implications."

People may need long-term care due to:

- Age-related risks: As people age, sometimes they experience physical or cognitive decline that may affect their safety and ability to care for themselves independently.

- Chronic medical conditions: People with some diseases, such as Alzheimer's disease, Parkinson's disease, or heart disease, could require ongoing care and support.

- Disabilities: Individuals with physical or mental disabilities may need long-term care to support their quality of life.

- Accidents or sudden illnesses: Unexpected events, such as a stroke, surgery, or injury, can lead to a need for long-term care during the recovery process and beyond.

While we might initially categorize long-term care for older adults, sometimes younger people need it, too.

What Are The Types of Long-Term Care?

Types of long-term care include a broad range of services for personal care and medical needs, which can be provided in different settings, depending on the level of care needed and personal preferences. According to the National Institute on Aging, there are several common types of long-term care:

- Adult day care: Offers daytime care, social interaction, and activities for adults who need assistance or supervision during the day.

- Assisted living: Assisted living facilities provide housing, meals, and personal care services for individuals who need ongoing help with daily activities but don't require round-the-clock medical care.

- Home health care: Nurses, therapists, or other licensed healthcare workers provide medical care and help with daily tasks at home.

- Hospice care: Hospice provides comfort and support to individuals with terminal illnesses, typically in their own homes or in hospice facilities.

- Nursing home care: Nursing homes offer long-term care that includes 24-hour supervision, medical attention, and help with daily activities.

- Skilled nursing care: Long-term care provided by healthcare specialists designed to treat specific medical conditions or assist in recovery after a hospital stay.

- Self-directed care: In some cases, people choose to manage their own long-term care services, hiring and supervising their own caregivers.

Long-term care is very personal and the type you may need depends on your specific situation, preferences, and overall health. Keep all options in mind when discussing them with your loved ones and planning for long-term care to make decisions that are right for you.

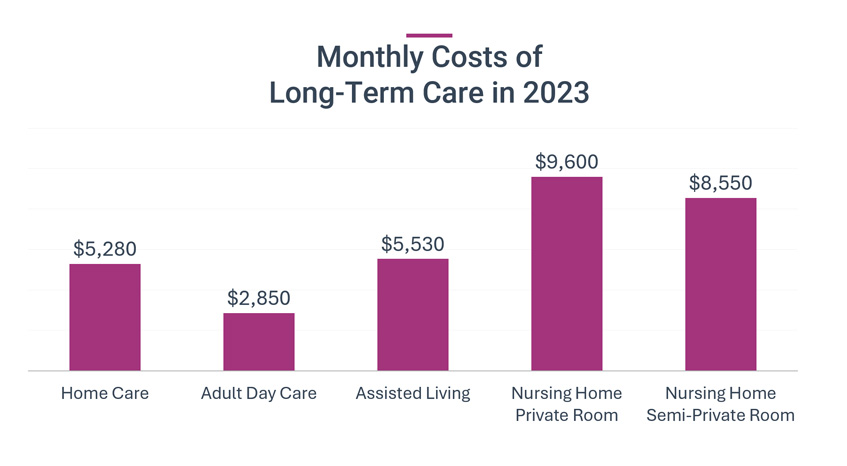

What Are the Costs of Long-Term Care?

Inflation and a shortage of skilled staff in the long-term care industry are driving costs of long-term care. Of course, the price of long-term care services varies by type of service and where you live. According to recent data, here are the median costs of long-term care in the United States:

- Home care: A non-medical home health aide costs about $33 per hour or $1,320 per week (assuming 40 hours of care).

- Adult day services: $95 per day.

- Assisted living facilities: $5,350 per month or $64,200 annually.

- Nursing home care:

- Private room: $320 per day or $116,800 per year.

- Semi-private room: $285 per day or $104,025 per year.

"We're seeing significant increases in long-term care costs due to inflation," Ursetti said. "According to a reputable organization that tracks these long-term care costs, the price of a home health aide has risen by as much as 10% over the past year. Even assisted living facilities have seen a 1.4% increase, bringing the national median cost to $64,200 annually. These figures can vary based on your location and the specific services you require."

These rising costs of long-term care underscore the importance of early and thorough planning for potential long-term care needs. By understanding the current costs and anticipating future increases, you can better prepare for the financial implications of long-term care.

How Long Do People Normally Need Long-Term Care?

The extent of long-term care varies widely from person to person. While some may never need any long-term care services, others may need it for years. According to data from the U.S. Department of Health & Human Services, 69% of people who use any type of long-term care do so for an average of three years.

However, some people may require care for much longer. In fact, about 20% of people over age 65 today will need long-term care for more than five years. This highlights the importance of considering various scenarios when planning for long-term care needs.

"Figures from the Department of Health & Human Services are eye-opening,” Ursetti said. “While we can plan for averages, I often recommend that clients prepare for the possibility of needing care for a much longer period. And if a medical condition enters the picture, we adjust from there."

It's worth noting that these statistics don't account for unpaid care typically provided by families and loved ones. This type of care, which usually occurs at home, lasts for an average of one year. When considering long-term care planning, it's important to think about both formal care services and the potential role of family caregivers and discuss these possibilities with them.

How Do You Pay For Long-Term Care?

As you’re planning for retirement, it’s also especially important to plan how you’ll pay for long-term care. Aside from Medicaid, which is need-based government assistance, people pay for long-term care through one of two ways:

Long-term care insurance: This specialized insurance can help cover the costs of various long-term care services. Long-term care insurance is an important option to consider as part of a comprehensive financial plan.

Personal savings: Setting aside funds for the costs of long-term care can be done through dedicated savings accounts or by earmarking a portion of your retirement savings for this purpose.

It's a common misconception that Medicare will cover any long-term care needs. In reality, Medicare's coverage for long-term care is very limited. According to the Medicare website, "Medicare and most health insurance, including Medicare Supplement Insurance (Medigap), don't pay for long-term care." Medicare only covers short-term skilled nursing facility stays after a qualifying hospitalization, and does not cover custodial care or long-term services and support for those with chronic illnesses or disabilities.

"Many people are surprised to learn that Medicare doesn't cover most long-term care costs ,” Ursetti said. This underscores the critical importance of early planning for long-term care. Consider options like long-term care insurance and strategic saving to ensure you're prepared for potential care needs without depleting your retirement savings."

How Does Long-Term Care Insurance Work?

Long-term care insurance, which has been around since the 1970s, has changed significantly over decades, addressing many of the concerns people had that initially gave long-term care insurance policies a poor reputation.

"The stigma around long-term care insurance largely stems from the limitations of older, traditional policies,” Ursetti said. “Today's hybrid long-term care insurance policies offer much more flexibility and value. They address the 'use it or lose it' concern by providing options for accessing the policy's value, even if you don't eventually end up using long-term care. This shift has made it more attractive and practical for many of our clients."

Let’s take a look at the differences between traditional and newer hybrid long-term care insurance policies to help you make an informed decision about your long-term care insurance coverage.

Traditional Long-Term Care Insurance Policies

Traditional long-term care insurance policies, popular in the late 1990s and early 2000s, often faced criticism for their "use it or lose it" nature. These policies were typically expensive, and insurers could increase premiums whenever they wanted, leading to a lack of transparency and predictability for policyholders. This, unfortunately, eroded trust in the entire long-term care insurance industry.

Hybrid Long-Term Care Insurance Policies

In response to consumer concerns, the insurance industry developed hybrid policies, which offer more flexibility and consumer-friendly features, like:

- Predictable, even premiums: Unlike traditional policies, hybrid policies generally maintain consistent premium rates.

- Age limit: Many hybrid policies can be purchased up to age 75, providing options for those who may not have considered long-term care insurance earlier.

- Cash value and death benefit: These policies often combine long-term care coverage with life insurance, accumulating cash value over time and providing a death benefit if the long-term care portion isn't used.

- Flexibility: If you don't use the long-term care benefit, you can often withdraw the cash value or leave the death benefit to your beneficiaries.

- Tax advantages: Benefits are typically paid out tax-free, and the policy's value grows tax-deferred.

- Caregiver flexibility: Many hybrid policies allow for care provided by family members or non-certified caregivers, not just professional healthcare providers.

- Cash indemnity: Many newer hybrid long-term care insurance policies pay cash indemnity benefits to the owner, where you don’t need to provide receipts or track expenses to receive benefits. This gives owners flexibility by selecting the maximum monthly benefit to pay for care with no restrictions on how the funds are used. You can receive the care that best fits your needs whether it's informal care provided by family and friends, home health care, or a hospice care facility. In contrast, reimbursement policies pay benefits up to the actual expenses incurred, subject to the policy’s monthly maximum benefit.

What Steps Should You Take When Planning for Long-Term Care?

As we've explored, taking proactive steps toward paying for long-term care can help ensure you're prepared for whatever the future may hold. Start by discussing your wishes with your family, exploring long-term care insurance options, and consulting with a Wealth Advisor to integrate long-term care planning into your overall financial strategy. By addressing these considerations early, you can gain peace of mind and maintain control over your future care decisions, allowing you to focus on enjoying your retirement years with confidence.