This article guides you through FedNow, its benefits, and explores how it can enhance your operations and transactional capabilities. We'll also address potential hazards of FedNow instant payments for Private Banking clients and Business Banking clients, use cases to illustrate the potential of FedNow, and insights into how to effectively prepare your staff, helping them transition smoothly into this new era of instant payments.

Explore this article with these links

- What is FedNow?

- How Can Private Banking Clients Use FedNow?

- How Can Business Banking Clients Use FedNow?

- When Can First Business Bank Clients Access FedNow?

- Get Help With Fed Now

In the ever-evolving digital landscape, transactions are more than the exchange of goods and services for money. They're about speed, efficiency, and the seamless integration of technology into our daily lives and business operations.

In the ever-evolving digital landscape, transactions are more than the exchange of goods and services for money. They're about speed, efficiency, and the seamless integration of technology into our daily lives and business operations.

As an individual or business leader trying to stay ahead of the curve, the Federal Reserve's FedNow® Service should be on your radar. FedNow has the potential to revolutionize our perception of payment transactions, making them faster and more efficient than ever before.

What Is FedNow?

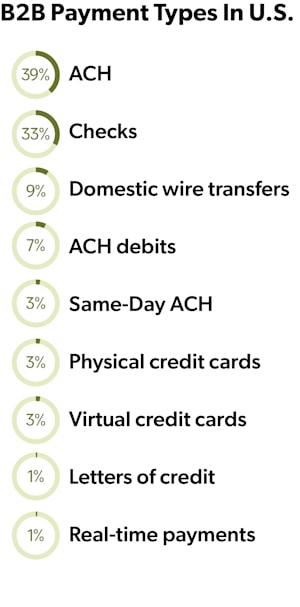

After its survey showed that three-quarters of respondents already use mobile payments to send or receive payments, the Federal Reserve committed to develop FedNow, a federal instant payment service that provides clearing and settlement for participating banks to facilitate instant payments.

FedNow is not an app or a currency — it’s a payment rail that allows anyone — people, government entities, and organizations — to send and receive payments in real-time, 24 hours a day, 7 days a week.

When Did FedNow Launch?

When FedNow was announced in 2019, the Fed gave itself a five-year timeline. However, it moved up launch date after a pilot project with several participating financial institutions went well and launched in July 2023.

How Can Private Banking Clients Use FedNow?

With the adoption of FedNow, Private Banking clients can embrace a new level of convenience and immediacy in their financial transactions. No longer restricted by traditional mail, bank hours, or waiting periods, individuals can send and receive payments almost instantly, 24/7, 365 days a year.

Whether paying bills, transferring money to friends or family, or making purchases from businesses, FedNow allows these transactions to occur in real-time, dramatically reducing the delay previously associated with such operations.

How Can Business Banking Clients Use FedNow?

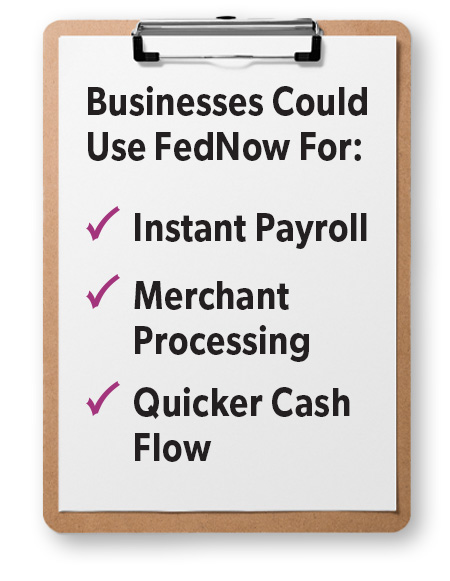

Alan McAfee, Chief Banking Operations Officer at First Business Bank, predicts that within two or three years, FedNow will be a commonly used payment choice for payroll, merchant processing, and more.

Payroll with FedNow

“I know it will be used and valued in certain industries,” McAfee said. “There are use-cases that make a lot of sense, like with independent contractors and as an immediate payroll option to get paid on the spot. That would attract employees in today’s competitive market — instant payroll might even become table stakes for some businesses.”

“I know it will be used and valued in certain industries,” McAfee said. “There are use-cases that make a lot of sense, like with independent contractors and as an immediate payroll option to get paid on the spot. That would attract employees in today’s competitive market — instant payroll might even become table stakes for some businesses.”

He explains that Automated Clearinghouse (ACH) payments work very well for employee payroll for many businesses, but others benefit from more flexibility.

“ACH works really well for payroll because you upload payments for hundreds of employees at once and two days later it appears in every employee’s account,” McAfee said. “If you’re a fintech employing independent contractors, FedNow will turn that upside down.”

Merchant Processing With FedNow

Merchant processing, which includes all the services and processes involved in accepting and processing credit card payments at your business, is another option with FedNow, he said.

“Right now, many businesses take credit cards,” McAfee said. “They batch at the end of the day and settle a day or two later through ACH. With FedNow it can be instant, receiving payment the same day. That can really improve cash flow.”

Faster Cash With FedNow

People paying recurring bills often schedule them through their bank’s online banking solution, such as BillPay. FedNow allows businesses a different way to pay.

“Once it’s the norm, it’ll become another option to pay,” he said. “In the traditional BillPay world, if I want to pay my gas and electric bill, I schedule it. Sometimes it goes as a check and reaches the merchant in a few days. If you’re running late, though, with FedNow you could pay instantly, potentially paying an extra fee to pay that way to avoid larger late fees.”

FedNow may also allow the federal government to quickly disperse funds to individuals. “For instance, in a dire situation like a hurricane, emergency or insurance money could be sent to individuals immediately,” McAfee said.

Business refunds to individuals and other businesses could happen quicker, as well, leading to higher satisfaction ratings.

When Can First Business Bank's Clients Access FedNow?

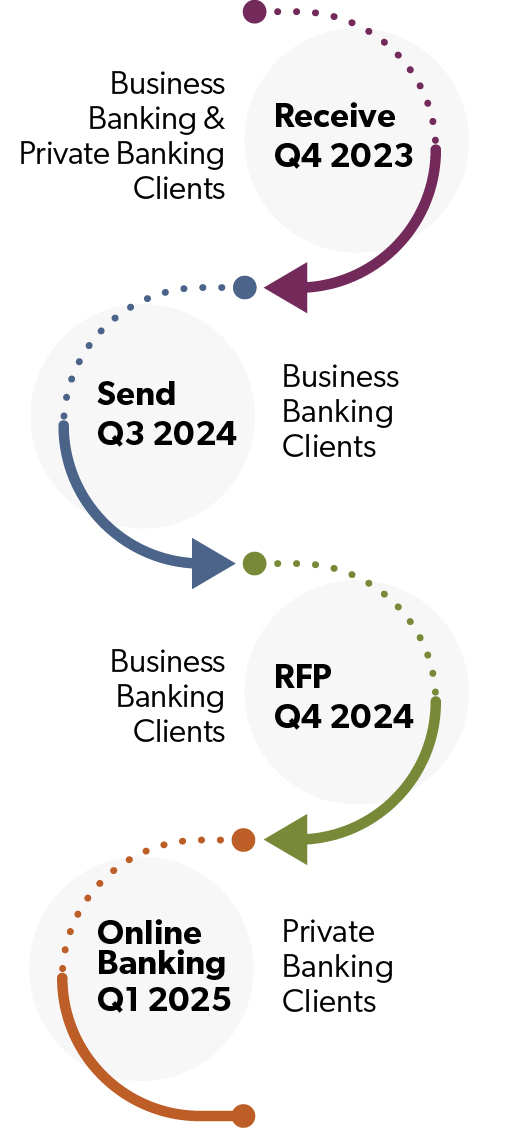

FedNow capabilities will be rolled out in sequential phases: receiving, sending, and Request for Payment or RFP. We will announce additional details before each FedNow capability rolls out.

FedNow Receiving Capabilities

The ability to receive FedNow payments began in late 2023 for First Business Bank’s Business Banking and Private Banking clients. To receive FedNow payments, the person or organization sending you a payment needs sending capabilities.

FedNow Sending Capabilities

Projected timelines indicate First Business Bank’s Business Banking clients can start sending FedNow payments in Q3 of 2024.

FedNow RFP Capabilities

We estimate that First Business Bank’s Business Banking clients will be able to use FedNow for Requests for Payment (RFP) in Q4 of 2024. We will notify clients through a splash page in Business Online Banking and Online Private Banking. At that time, we will also update this webpage with details.

FedNow Online Private Banking Capabilities

Projected timelines show that First Business Bank’s clients can expect to use FedNow through Online Private Banking platforms in early 2025.

What Are The Basics of FedNow?

When did FedNow launch? The service launched in July 2023, and banks can choose to roll it out as their providers make it available.

Does FedNow ever close, like the Federal Reserve? FedNow is an instant payment service that’s designed to be available around the clock every day of the year. Unlike ACH and wire transfers, you can receive or send FedNow payments at any time.

What is the payment maximum? The maximum payment you can send through FedNow will vary with a network limit of $500,000 per payment.

What are the costs for FedNow? Like any banking service, costs per transaction to your organization will vary by financial institution. However, fees per transaction to use FedNow may be lower than some other payment services clients use, such as wire transfers.

What Are The Risks of FedNow?

For FedNow, the Federal Reserve built a secure payment mechanism bank to bank through the Fed for clearing and settlement.

“The service itself is secure and it’s a push system,” McAfee said. “So that means I push money to you – and the age-old rules apply. Know who you’re sending money to and authenticate before you send it.”

Like any instant payment service, like Venmo, Zelle, and Cash App, payment through FedNow is instant and final. That means it’s crucial to verify who you are paying before sending the money.

First Business Bank always advises clients to authenticate electronic payments before sending using a different mode of communication outside of how payment was requested. For instance, if your supplier emails you new bank information and an invoice, find their phone number on your original contract (not the email or invoice), and call them on the phone to verify the new bank information. This advice still holds for FedNow payments.

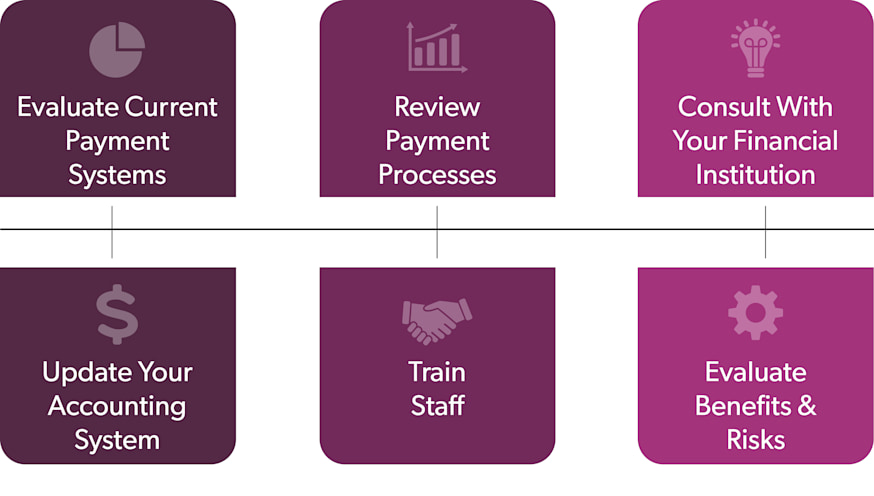

How Business Leaders Can Prepare For FedNow

To prepare for using faster payment services like FedNow, there are a few steps leaders of businesses and nonprofits can take so their organizations are ready for instant payments.

- Evaluate your current payment systems: Take a look at the payment systems that your business currently uses and evaluate their speed, cost, and security. Consider how FedNow may be able to improve upon these factors.

- Review your payment processes: Analyze your payment processes and identify any areas you could streamline or improve with FedNow. You might focus on how to reduce manual processes or automate payment reconciliation.

- Talk to your business’s financial institution: Reach out to your financial institution to learn more about their plans for integrating FedNow. Ask about their timeline for implementation and any steps that your business may need to take to prepare.

- Update your accounting and financial systems: Ensure that your accounting and financial systems are up to date and can integrate with FedNow. This may require software updates, which is always a good idea to reduce the risk of fraud, or other changes.

- Plan to train your staff: Seek training for your staff not only for FedNow, but also on any changes to your payment processes that may happen because of implementing the instant payment service.

- Consider the benefits and risks: List the potential benefits and risks of FedNow for your business. While the service offers benefits such as faster payments and lower costs, there may be risks. Your business cash flow cycle may currently rely on slower cash outflows, so paying instantly may affect your business drastically.

Both Private Banking and Business Banking clients stand to gain considerably from integrating FedNow's instant payment system into their financial routines. This groundbreaking service offers enhanced payment flexibility, operational efficiency, and a potential boost in cash flow.

Like all technologies, it requires thoughtful planning and proper training to sidestep potential pitfalls, such as accidental payments due to fraudulent activities. For business leaders, engaging your team in comprehensive training can mitigate these risks, allowing your organization to maximize the benefits of instant payments. Individuals, on the other hand, need to equip themselves with a robust understanding of the system to fully harness its benefits while staying protected.

Get Help with FedNow

If you’re looking to use FedNow, please reach out to your First Business Bank Representative for assistance. They can help you understand if FedNow instant payments are the right fit for your business or your personal finances, and when the time is right, assist you with your first transaction.

Updated: 3/13/2023