While receiving inheritance money might seem positive, consider that statistics show nearly one in three Americans who inherit money lose it within two years. With an experienced Wealth Advisor’s help, you can avoid the same fate and put a solid strategy into place on what to do with inheritance money. You’ll need to consider some complex issues, including tax benefits and estate consequences, to maximize the value of your inheritance money for your family’s future. Here are a few items to consider if you receive a financial inheritance.

Immediate Inheritance Decisions

After you receive notice of a bequest, consider the possibility that other beneficiaries may contest the will if your inheritance is more than theirs. On the other hand, if you’re on the other side of the equation, you may decide to contest it. Also, if you don’t want or need the inheritance money, you have the option to disclaim the bequest.

Be aware that some states allow no-contest clauses, which means if you contest the will and lose, you will receive nothing from it.

Assess Your Financial Situation

It’s important to determine your overall wealth once you receive inherited money. Before you spend or give away any money or assets, decide to move, or leave your job, your Wealth Advisor should help you decide what to do with inheritance money. Start by conducting a cash flow analysis and determining your net worth as a first step toward planning your financial strategy. Your strategy will partly depend on whether you have immediate access to — and total control over — the assets or if they’re being held in trust for you. In addition, you need to know what types of assets you’ve inherited (e.g., cash, property, or a portfolio of stocks).

What Happens When You Inherit Money From A Trust?

When you inherit money and assets through a trust, you receive distributions according to the terms of the trust, so you won’t have total control over the inheritance as you would if you’d received the inheritance outright.

A trustee, who is named by the person who set up the trust, oversees the trust and manages it. Trustees are often your parents or another family member, a family friend or advisor, an attorney, or a bank representative. The trust document might outline the trustee’s duties, how trust assets will be managed, and how and when trust income and assets will be paid to you.

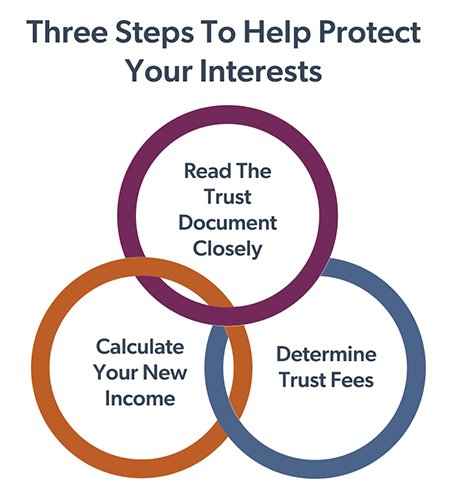

These to-dos will help protect your interests as a beneficiary of a trust and help guide you on what to do with an inheritance:

- Read the trust document closely. You have rights to the trust document, so if you aren’t provided a copy, have an attorney get it for you. Review it with the help of an estate attorney or Wealth Advisor to ensure you understand the terms. It might be an irrevocable trust that cannot be changed or a revocable trust that can be changed. You should also pay attention to what’s prohibited when deciding what to do with an inheritance — for example, sometimes trusts prohibit beneficiaries from borrowing against the trust, prevent beneficiaries from paying creditors with trust assets, or prohibit creditors from going after a beneficiary’s share of the trust.

- Calculate your new income. Work with a Wealth Advisor to figure out if income from the trust can meet your needs. For instance, an experienced professional Wealth Advisor will help you determine if you’re invested in long-term growth stocks or non-rental real estate or if the trust’s investments can provide income now with rental real estate or money market funds. Your trustee can provide income statements to calculate this accurately.

- Determine trustee fees. Especially if the estate is large, you may be able to negotiate trustee fees after comparing them with average trustee fees in your state or county.

Working With A Trustee

Some trusts dictate that the trustee must distribute all the income to the beneficiary every year, which can be simple and conflict-free.

Other trusts give more discretion to trustees to decide when and how much trust income to distribute. You’ll find this process a lot easier when you embrace open communication with the trustee. Work with your Wealth Advisor to set up a sound financial plan and budget, and carefully prepare requests for trust distributions if a cost is beyond the normal distribution. Working with the trustee is in your best interest, as, in most states, they are difficult to replace, and they aren’t usually penalized if the trust performs poorly.

Make sure to follow how the trustee handles trust investments, instructing your Wealth Advisor, lawyer, or accountant to review the trustee’s investment strategy. Talk with the trustee about their strategy if your advisor determines that the trustee’s investment strategy doesn’t meet your needs or, worse, is unsound.

What To Do With A Large Windfall Inheritance

If you inherit a large amount of cash, you can manage the money yourself or hire a professional Wealth Advisor to do it. Deciding what to do with a large inheritance, even if you normally handle your own finances, can be precarious and stressful for even the most fiscally conservative. Making immediate decisions about what to do with inheritance money, especially if you’ve endured the loss of a close relative, may not be in your best interest. It’s most wise to consider your long-term financial health. Meet with a Wealth Advisor and formulate a financial plan that considers your current lifestyle, future goals, and tax implications to create a sound financial strategy.

Making Decisions About Stock Inheritances

When inheriting stock through a trust or outright, you’ll need to decide whether to hold on to it or to sell it. This, too, depends on your wealth plan and investment strategy and what type of stock it is. With the stock inheritance, if you now own a controlling interest in a company, you need to decide how active you want to be running the company. In other situations, you might inherit stock that doesn’t fit your portfolio, so you might decide to sell it.

Inheriting Real Estate

Real estate comes with more decisions about keeping it, selling it, moving there, or renting it. Making money off the real estate, as you sell or rent it, will have tax ramifications, as well. Inheriting real estate with other beneficiaries may require the other owners’ agreement to sell or court action to sever the property.

Determining Short- And Long-Term Cash Flow Goals

After creating a cash flow analysis, you should determine your near-term and long-term needs — as well as those of your family. A short-term need might be to pay off loans or credit cards, and a long-term goal might be to save for a child or grandchild’s higher education costs, purchase a second home, or travel. These questions can help you evaluate some of the obvious ones:

- Is there consumer debt or education you’d like to pay off?

- Would you like to finance the higher education of any relatives?

- Are your retirement savings in good shape, or do they need help?

- Do you want to buy a home?

- Do you plan to give to charities?

- Are you planning to bequeath money to friends or family?

- Is your current income sufficient, or could you benefit from more?

- Do you need to minimize income and estate taxes?

Taxing An Inheritance

Income taxes generally aren’t applicable to inherited assets, but your income tax will increase over time with a large inheritance because income generated by the assets may be subject to income tax. Consider minimizing your tax liability through different strategies, such as giving money to individuals or charities, investing for an inheritance growth more than income, or adopting other tax-minimizing strategies with your Wealth Advisor and accountant. You may need to re-evaluate your income tax withholding or pay estimated tax.

Income taxes generally aren’t applicable to inherited assets, but your income tax will increase over time with a large inheritance because income generated by the assets may be subject to income tax. Consider minimizing your tax liability through different strategies, such as giving money to individuals or charities, investing for an inheritance growth more than income, or adopting other tax-minimizing strategies with your Wealth Advisor and accountant. You may need to re-evaluate your income tax withholding or pay estimated tax.

You may also need to take into consideration potential transfer taxes and how to minimize them. Four common ways include:

- Setting up a marital trust

- Setting up an irrevocable life insurance trust

- Setting up a charitable trust, or

- Making gifts to individuals and/or to charities.

Investing An Inheritance

Your investment strategy may completely change after you receive inherited money because you’ll have to determine your new goals and incorporate your new assets. A few questions can help, including:

- How’s your cash flow? You might consider investments that can increase your cash flow if it’s not currently sufficient.

- Will your inheritance increase or decrease your taxes?

- Are your assets liquid, or could they liquidate quickly? Your answer might guide you to make a mix of short-term and long-term investments.

- Are your investments keeping up with or beating inflation?

- Are you on track to completely fund your retirement and other long-term goals?

- Has your risk tolerance changed?

- Are your investments diversified? Asset classes often perform differently, so spreading your assets across investment vehicles, such as stocks, bonds, and cash alternatives, can help reduce your overall risk. Remember, though, that diversification cannot eliminate market loss.

Talking about your answers to these questions can help you and your experienced Wealth Advisor come up with a new investment strategy when determining what to do with an inheritance. It’s important to remember that there’s no rush, though. You can put funds in an interest-bearing account, such as a savings account, money market account, or a short-term certificate of deposit until you’re fully sure you are making long-term, responsible choices with all the options on the table.

Evaluating Insurance Coverage

Now that you have more financial means, you should also look at your insurance coverage. You might be able to reduce your property/casualty, disability, and medical insurance coverage. At the same time, some people decide to increase their coverage to protect everything they’ve inherited and purchased with inheritance money.

Another consideration is that additional wealth increases your risk in a lawsuit, so you may want to purchase an umbrella liability policy to protect you against actual loss, large judgments, and lawyer fees. You may also need to recalculate the amount of life insurance you need to cover your estate tax liability so your beneficiaries receive more of your estate after taxes.

Estate Planning After An Inheritance

Any time your wealth shifts, it’s a good idea to revisit your estate plan, which should help you conserve money and strategize so it fulfills your goals, like minimizing exposure to potential taxes and creating financial security for your family.

First, look at your will, which determines how your assets will be distributed after your death, to make sure it reflects your wishes. Consult your attorney if you need to make changes and consider making a new will instead of adding items. Next, consider how you can best shield your estate from estate taxes. When minor children are involved, you may want to nominate a guardian or set up a trust for them.

You can also use trusts for tax-planning purposes; an irrevocable life insurance trust may minimize federal and state transfer taxes on the proceeds. If you are like many Americans, you may still have student loans to pay off, which you should strongly consider doing before paying for someone else’s education. Also consider:

- Paying off higher-rate consumer debt first (interest rates on student loans are often relatively low)

- A student’s ability to qualify for financial aid may be affected by your financial gift

- Paying the institution directly allows you to avoid federal transfer taxes

Gifting From An Inheritance

Gift giving can be a useful estate-planning strategy, and you might want to give generously to children, friends, or others when you receive inherited money. They also might ask you for a loan or a gift. Before making large gifts, wait until you have met with your Wealth Advisor or attorney. If you decide to lend someone money, draft a legal agreement to protect your rights and avoid complications. And remember that if you forgive the loan, you may owe gift taxes depending on the size of the loan. Gift taxes also come into play if you give someone money, property, or a loan with a below-market interest rate. In 2024, you can give $18,000 each calendar year to an unlimited number of people without incurring tax liability. If you meet all requirements, a married couple can make a split gift and double the annual gift tax exclusion amount — to $36,000 — per recipient per year without incurring tax liability.

It’s best to consult an experienced estate-planning attorney about making gifts and gift taxes.

Giving To Charity

According to the National Philanthropic Trust, Americans gave $499.33 billion in 2022. Also important, adults are more likely to give to charity if their parents did the same. Making planned gifts to charities can reduce your income tax, but income and other limits apply, so make sure to consult a tax professional. For estate-planning purposes, charitable gifts can help minimize the amount of transfer taxes your estate may owe. As you can imagine, there are many options to help you reach your goals. With the proper experts in place, you’ll find many of these important decisions to help manage inherited money a lot easier to make than tackling them alone.