While checks may seem archaic and dated, fraud surrounding check payments is still rampant, according to the Association for Financial Professionals’ (AFP) latest report.

Even as Federal Reserve data shows that organizations write fewer checks than ever before, criminals continue to exploit this payment method at an alarming rate. For businesses, this means strong, layered check fraud prevention measures are essential.

In this article, we’ll examine real check fraud examples and offer practical solutions to help your business prevent check fraud.

Check Fraud Example 1: Stolen Mail Leads To $47,000 Loss In Check Scam

Scenario. A fraudulent check cleared a business account two weeks prior. On examination, they discovered that while the check’s serial number was legitimate, the payee and amount was changed from the original vendor to an individual person.

- Discovery. A legitimate payment was stolen in the mail and used to create several counterfeit checks.

- Investigation. Review of check image revealed that the check was on different check stock.

- Outcome. Business incurs $47,000 loss due to the amount of time that passed between the checks clearing and discovery of the fraud, not accounting for the time spent on internal and law enforcement investigations.

Lesson learned. In this common check fraud example, Payee Positive Pay would have immediately detected the counterfeit checks, allowing timely return of the check with no financial loss. It’s also very important to review account activity daily, including check images, to find check fraud early.

Check fraud protection solution: Payee Positive Pay is a powerful check fraud solution. You electronically submit your check register to the bank. When checks are deposited, they're automatically compared to your register. If details don't match, you can receive an alert via text, email, or both text and email, to decide whether to pay or return the check.

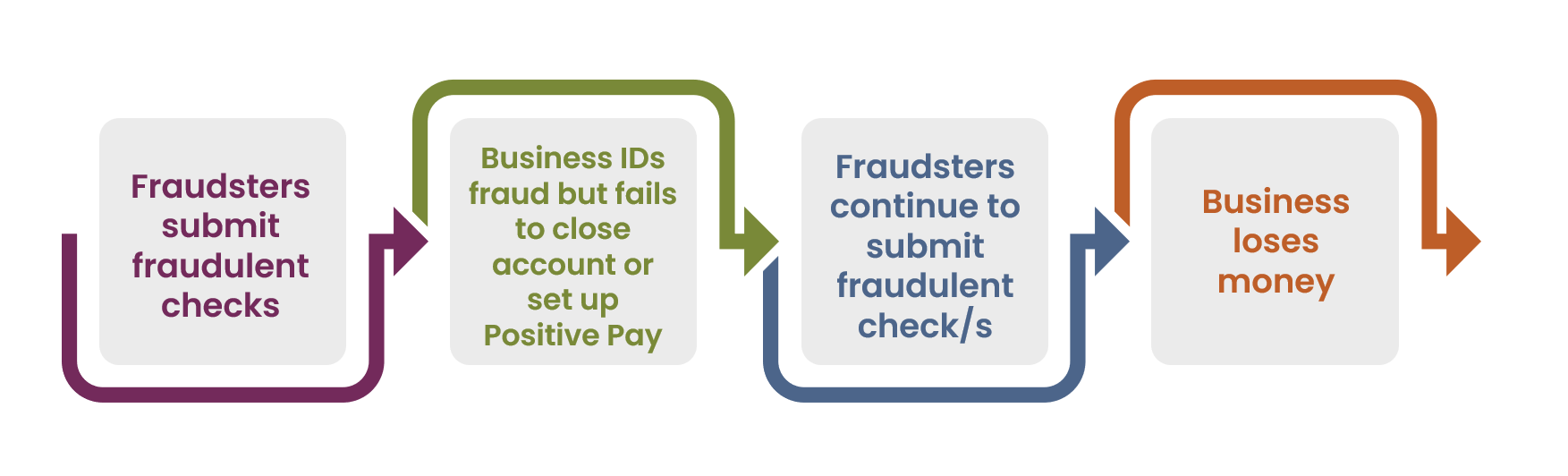

Check Fraud Example 2: "Testing the Waters" Check Fraud

- Scenario. Three counterfeit checks were presented against a business account.

- Bank's action. The bank advised business to close its account or set up Payee Positive Pay.

- Business’s inaction. The business neither closed the account nor implemented check fraud protection.

- Follow-up attack. Two months later, two more fraudulent checks present against the same business’s account.

- Timing. Fraudulent checks presented on December 24 and December 31.

- Business’s error. The business relied on a two-signer requirement, which doesn't prevent this type of fraud.

Lesson learned. Fraudsters often "test" accounts with small amounts of check fraud before launching larger attacks. After any check fraud attempt, it’s important to implement strong check fraud prevention solutions immediately like Payee Positive Pay or consider closing the account immediately and setting up a new one with Payee Positive Pay. Internal controls like dual signatories are not sufficient protection against check fraud.

Lesson learned. Fraudsters often "test" accounts with small amounts of check fraud before launching larger attacks. After any check fraud attempt, it’s important to implement strong check fraud prevention solutions immediately like Payee Positive Pay or consider closing the account immediately and setting up a new one with Payee Positive Pay. Internal controls like dual signatories are not sufficient protection against check fraud.

Prevention outcome. In this check fraud example, this business closed the compromised account and opened a new one with Payee Positive Pay.

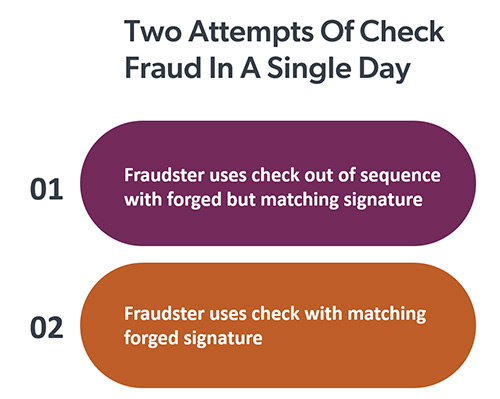

Check Fraud Example 3: The Branch Check Fraud Scheme

Scenario. Two individuals attempted to cash fraudulent checks at a bank minutes apart.

Scenario. Two individuals attempted to cash fraudulent checks at a bank minutes apart.

First attempt. One person tried to cash checks drawn on an out-of-area client account. The bank teller noticed the check numbers were out of sequence, the signatures didn't match, and the fraudulent checks were printed on a different check stock. The check fraud scammer fled when the bank teller offered to verify the check with the account holder.

Second attempt. Minutes later, a different person presented a $1,500 check drawn on a local client's account. The check details (serial number, stock, signature) appeared to match. The checks were cashed but were later discovered to be fraudulent.

Investigation. Business contacts local police department and files and incident report.

Lesson learned. Even in-person check transactions can be fraudulent, which highlights the need to use different payment methods along with multiple layers of protection, including using ACH (Automated Clearing House) payments, Payee Positive Pay, online banking, and daily account review. Train staff to be vigilant and verify unusual transactions.

Check Fraud Example 4: Urgent Impersonation Email Leads To Check Fraud

- Scenario. An urgent, fraudulent email appearing to come from a vendor’s owner requested a $24,500 payment for an "extremely past due" invoice.

- Action. Employee paid the invoice without proper verification.

- Discovery. Business recognized the fraud when the check cleared the account.

- Timing. The business reported the check fraud to the bank past the deadline.

- Lucky break. Due to falling on a federal holiday, the bank could still return the check. Without the holiday, the client would have lost $24,500, plus time and resources spent on investigation.

Lesson learned. In this check fraud example, strict verification procedures for payment requests would prevent this scenario. Require your employees to call back known numbers for all payment requests, especially those received via email. Train employees to recognize how business email compromise fraud works and always verify payments, especially significant or unusual payment requests.

What Are Best Practices To Help Prevent Check Fraud?

Protecting your business from check fraud requires a layered strategy, with ongoing review, training within your organization, and a set schedule for proactive technology review. These best practices can reduce check fraud incidents at your company to help protect your company's financial assets.

- Review account activity daily. Timing is everything; the sooner you catch fraud, the less likely you are to incur a loss. Review account activity for ALL accounts every day and reconcile your statements. Think of daily account reconciliation like your security system — it's the foundation to protecting your account. Daily review helps you spot check fraud earlier, when you can still stop payment on a fraudulent check.

- Use Payee Positive Pay correctly. To get the most out of Payee Positive Pay, take your time to carefully review each flagged item, including looking the check images. Don't rush through approvals, as this is where businesses sometimes fail, routinely approving checks flagged as suspicious. Once checks are paid, it is unlikely funds can be recovered.

- Consider check block. You might think that if you’re not writing any checks, you can’t be a victim of check fraud, but that’s not true. Any account, even those without check activity, is susceptible to check fraud. Check block does exactly what it says — if a check presents on your account with check block activated, it stops payment automatically.

- Triple check your work. Consider the consequences of everything you do. Rushing through tasks often results in loss of money, time, and private information. Stay alert; if something seems suspicious, be skeptical, research, and act quickly to determine if the transaction makes sense.

- Develop strong internal controls. This includes segregation of duties, dual controls for issuing checks and reconciling accounts, and setting up alerts for online banking and mobile banking. Require strict procedures to verify payment requests, including making phone calls to previously known numbers to verify payment information.

- Go electronic. Use bill pay or ACH origination to reduce the number of paper checks you issue.

- Secure your checks. Keep checks and deposit slips in a secure location and maintain their physical security.

- Train employees. Ensure your staff participates in regular, ongoing fraud education to stay on top of the latest fraud trends.

- Test your fraud health. Regularly assess your company's fraud prevention measures and update them as needed.

- Consider insurance. Transfer some of the risk of check fraud with an insurance policy that covers it and other fraud, like business email compromise and wire transfer fraud.

- Develop an incident response plan. Create a clear plan for how to respond if an employee detects check fraud — or any kind of fraud — and keep the plan up to date as scams and technologies change.

How Does My Business Report Check Fraud?

Acting quickly is critical when you suspect check fraud, as timely reporting can increase the chances of recovering funds and preventing further losses. The following resources provide multiple channels for reporting fraud, ensuring that the right authorities are notified and can take necessary action.

- Contact your financial institution immediately.

- File a police report with your local law enforcement.

- Report mail-related check fraud to the U.S. Postal Inspection Service at www.uspis.gov.

- File a complaint with the Federal Trade Commission (FTC) at www.ftc.gov/complaint.

- For online crimes, file a complaint with the Internet Crime Complaint Center (IC3) at www.ic3.gov.

No businesses are immune from check fraud, but implementing these solutions and maintaining constant vigilance can greatly reduce the risk of check fraud and other losses. By reducing the number of checks you issue, working together with your financial institution, and using fraud prevention tools, you can protect your business from check fraud.