In the dynamic world of banking, the unexpected is often the norm. From sudden shifts in market conditions to unprecedented global events, banking executives frequently navigate waters that can turn turbulent without much warning. An effective bank liquidity and contingency funding plan is a vital component that helps to assess the sources and stability of their funding during stressed scenarios.

You could regard your bank’s liquidity and contingency funding plan as an anchor. While your day-to-day operations propel your institution forward, the bank liquidity and contingency funding plan helps you to remain steady in stormy financial seas. It's about ensuring the continued trust of your stakeholders, maintaining your institution's reputation, and preserving the stability and soundness of the financial system at large.

This article first discusses the current banking environment and then enumerates essential elements of a resilient liquidity and contingency plan that meet regulatory expectations but also stand up to real-world pressures.

Bank Failures Leading to Deposit Outflows

A deep understanding of bank liquidity and contingency funding plans isn’t complete without appreciating incidents that shaped its evolution. At the core of many financial crises lie bank failures, often resulting in significant deposit outflows. A hint of instability or news of a bank's faltering health and depositors race to withdraw their funds. The “bank run” phenomenon can transform a minor hiccup into a full-blown financial meltdown, pushing banks into a liquidity crisis almost overnight.

The 2023 collapse of Silicon Valley Bank (SVB) highlighted the importance of bank liquidity. A well-respected bank, SVB was unable to withstand a run on deposits, due in part to a high concentration of deposits from technology companies, which were particularly vulnerable to an economic downturn.

Liquidity Management In The New Deposit Landscape

Banks face a rapidly evolving situation when it comes to liquidity management. Many bank executives are reevaluating their liquidity strategies as they grapple with changing depositor behaviors and preferences.

One pressing driver is the ability of depositors to transfer funds at their discretion. Clients, empowered by technology and lured by flexibility, have almost immediate access to their funds. While this is certainly an attractive feature, it can pose liquidity management challenges for banks.

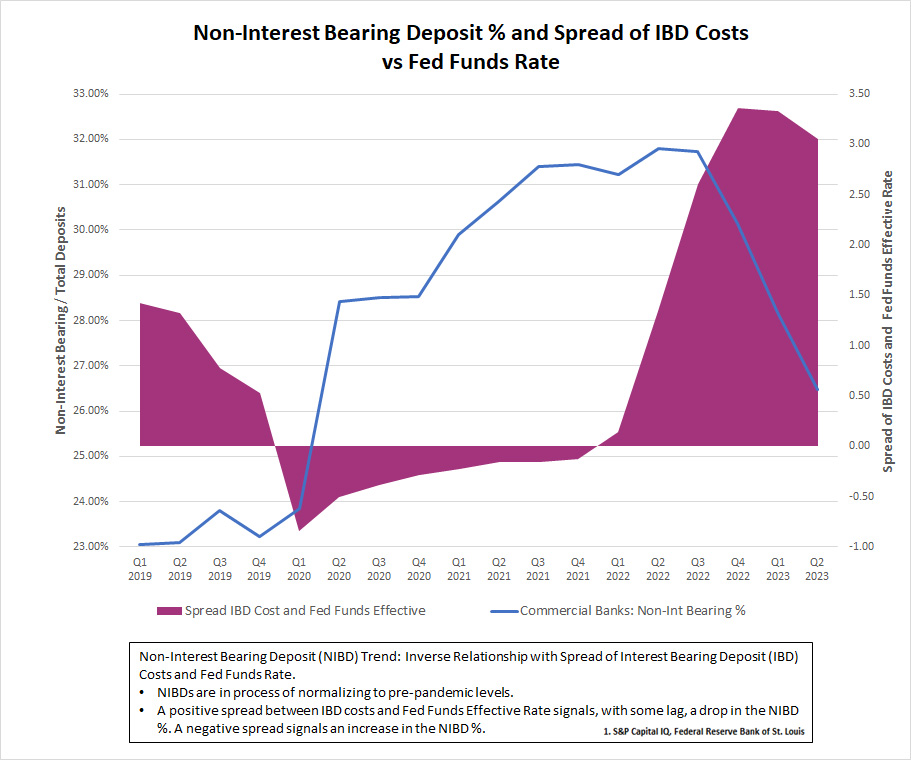

Complicating matters, the composition of deposits is undergoing a noticeable transformation, as well. Instead of parking their funds in non-interest-bearing demand deposits or money market accounts, clients are progressively seeking higher-priced deposit products. Additionally, there's a detectable drift of funds flowing out of the banking system entirely, finding their way to money market funds and other investment options. This shift means that banking executives are navigating increasingly complex terrain, balancing between offering competitive rates and ensuring liquidity stability.

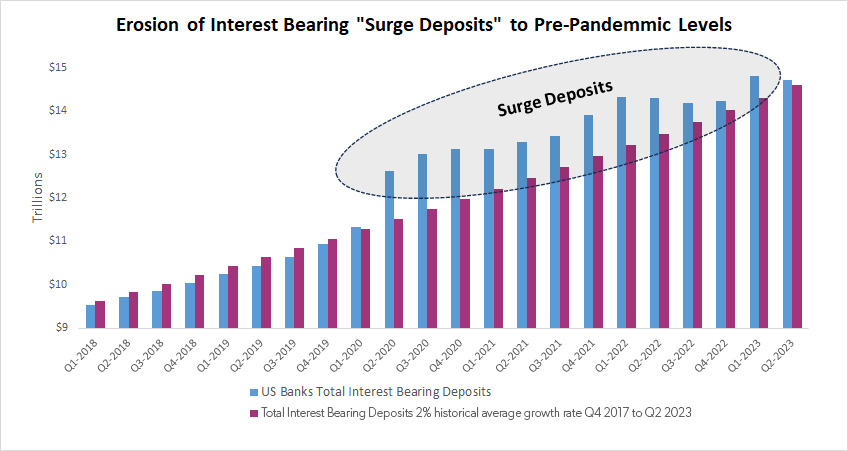

It appears deposit volumes are returning to pre-pandemic levels. This normalization is significant because it underscores the erosion of the “surge deposits” phenomenon we witness in tumultuous times. The decrease in non-interest bearing DDAs further punctuates this trend.

In the face of these evolving dynamics, bank executives need to periodically reassess and recalibrate their liquidity strategies. By staying attuned to these shifts and crafting agile and responsive liquidity plans, banks can ensure they're not just surviving but thriving in this new era of banking.

Wholesale Funding: A Source of Liquidity for Banks

In response to the deposit outflows, many bank executives are finding a silver lining in wholesale funding to bridge the funding gap. Key players in this arena include funds from the Federal Home Loan Banks (FHLB) and brokered CDs. Though often a pricier funding alternative, this approach provides banks an added layer of certainty, serving as a counterbalance to the heightened flexibility clients now enjoy with core deposits.

Furthermore, banks are strategically aligning match funding with fixed-rate loans. By matching their funding with fixed-rate loans, banks can reduce their exposure to interest rate risk and improve their liquidity position. This can help banks withstand shocks to the financial system and continue to meet their obligations to their customers, bolstering banks' financial resilience and showcasing their agility in adapting to shifting market dynamics.

Implementing and managing wholesale funding with an efficient strategy for your individual bank takes time and expertise, which is why some banks with limited resources outsource their wholesale funding strategy and management to consulting groups like First Business Bank’s Bank Consulting team. First Business Bank has an impressive track record of using wholesale funding since its founding in 1990, and your team can tap into this rare, sought-after guidance and improve efficiency, as well, by partnering with our Bank Consulting team.

Harnessing Investment Portfolio Opportunities For Enhanced Yield

Amidst the flux in banking liquidity, savvy bank executives are turning their eyes towards their investment portfolios, identifying valuable opportunities to augment their financial positions. By considering restructuring options, banks can fine-tune their portfolios and set the stage for improved future yields.

The investment portfolio principal and interest payments provide liquidity to fund the balance sheet over time, however, unrealized losses are limiting banks’ ability to sell bonds to raise liquidity. Some banks are choosing to enter into a loss/earn back transaction by monetizing the losses in the current year and reinvesting the proceeds into higher-yielding investments or loans with about a two-year income/capital earn back.

This strategic move to downsize certain portions of the investment portfolio to generate immediate liquidity requires strong capital levels to absorb the initial loss and will increase earnings in future years. In addition, when interest rates fall, the newly acquired investments will be at gains, which, again, could provide the bank liquidity in future years.

Striking A Balance Between Pricing And Liquidity

In the intricate dance of modern banking, the tension between pricing and liquidity often takes center stage. To retain volatile deposits, many institutions reevaluate and occasionally adjust their pricing strategies. This becomes particularly salient given the higher costs associated with wholesale funding.

However, there's a growing concern in the industry about the dangers of narrowly pricing loans. Recent trends suggest that some banks might be veering towards irrational pricing, prompting the essential question: Are banks sacrificing too much in terms of Net Interest Margin (NIM) in their pursuit of growth? Recognizing and navigating this balance is crucial, as it can influence both short-term profitability and long-term stability.

The Regulatory Perspective: A Renewed Emphasis on Stability

Regulatory authorities are becoming increasingly vigilant, closely monitoring the dynamic currents of the banking landscape. Their primary focus appears to be on the ebb and flow of deposit balances leaving the system, particularly the phenomena of surge deposits. An undercurrent of concern exists around the behavior risk associated with the volatility of the deposit base, which can significantly impact a bank's stability.

The regulatory pressures exerted on large banks may soon permeate down the banking hierarchy. Aspects under the spotlight include rigorous stress testing and enhanced contingency plans, the inclusion of AOCI (Accumulated Other Comprehensive Income) in regulatory capital — highlighting the market value impact of both AFS (Available-for-Sale) and HTM (Held-to-Maturity) securities — and refined liquidity metrics. The latter puts a magnifying glass over large volatile and uninsured deposits, evaluating the level of uninsured deposits against the amount covered by on-balance sheet liquidity. Staying current with regulatory inclinations is essential for sustainable operations in a progressively complex environment.

Essential Elements Of A Strong Liquidity And Contingency Funding Plan

Liquidity Planning Is A Look To The Future

Active management is the lifeblood of effective liquidity plans. They must be rigorously tested and frequently evaluated, keeping in mind the economic cycle, regulatory environment, and ensuring alignment with your company's risk tolerance. This also necessitates a robust forecasting process that helps to visualize potential balance sheet variations based on your risk profile and external conditions.

Set Clear Liquidity Guidelines And Metrics

Liquidity strategies should be in harmony with the company’s strategic plans, ALCO interest rate risk management, and capital planning. It's crucial to clearly understand the role of wholesale funding and the securities portfolio, maintain diverse funding sources, and set clear risk tolerance limits. Given the evolving regulatory environment, stay current with potential concerns and set limits accordingly.

Understand Composition And Behavior Of Deposits

Knowledge is power. Know your large, uninsured depositors inside out. Understand their perception of your institution and the broader banking landscape. Offer well-established insurance products extending federal deposit insurance above the standard limit. Consider stratifying clients by age to gain insights into behavior and loyalty. Execute a non-maturity deposit decay rate analysis, observe deposit trends across economic cycles, and pinpoint core versus surge deposit layers, integrating volatility into planning. Also, champion an active deposit committee that seamlessly collaborates with Finance, ALCO, and Risk Committee members.

Identify Early Indicators Of Liquidity Tightening

Acting proactively is essential here. Establish a heat map based on risk tolerance to detect and closely track early indicator limits. Aligning risk tolerance levels across the organization ensures buy-in and understanding from all stakeholders.

Stress Test Your Contingency Funding Plan Until It Breaks

Preparation is paramount. Build a detailed action plan that delineates stakeholders, communication lines, and roles. Clearly define the order to address liquidity shortfalls and the exact moment to activate the contingency funding plan. Design comprehensive stress scenarios escalating to a potential breaking point. Delve deep into considerations like increased loan demand, capital stress, and asset quality challenges. Understand funding restrictions that might exist during stressful periods and explore sources like the Federal Reserve Discount Window, FHLB advances, and Brokered Deposits. Lastly, always consider reputational risks associated with leveraging special government funding programs like the Paycheck Protection Program Liquidity Facility (PPPLF) or the Bank Term Funding Program (BTFP).

Creating a watertight liquidity and contingency funding plan is an intricate process, but with diligence, collaboration, and foresight, banking executives can ensure their institution is equipped to handle many unforeseen challenges of tomorrow.

Frequent Communication with ALCO, Risk Committee, and Board

Effective liquidity management requires a symphony of collaboration, informed decision-making, and active management. At the core of it all lies robust and regular communication with key internal stakeholders such as ALCO, Risk Committee, and the Board. We list some key elements below.

Holistic risk monitoring: It's essential to monitor not just liquidity risk but also other organizational risks that can have ripple effects on your liquidity and contingency funding plan. Some of those include:

- Reputational and behavior risk: Evaluate potential internal and external events that could tarnish the institution's image and stress test their impact on the balance sheet.

- Regulatory risk: With a volatile deposit base, it's paramount to deeply understand your company’s strengths and potential pitfalls. Prepare to proactively address safety and soundness with clients to mitigate this risk.

- Pricing and interest rate risk: Understand how interest rate changes could potentially impact loan and deposit pricing and, subsequently, liquidity.

- Earnings and capital risk: Keep an eye on how earnings volatility can impact capital levels and liquidity.

- Operational risk: Preempt potential liquidity crises by ensuring that all operational processes work efficiently and are streamlined.

Empowering decision makers: For the smooth execution of the liquidity and contingency funding plan, entrust the CFO or the Treasury team with the authority to act in line with policy. However, this empowerment isn't just about delegation. It necessitates:

- A detailed, well-understood policy and plan.

- In the face of a liquidity crisis, this policy and plan should act as a beacon, clearly indicating the course of action.

- To ensure swift and effective action, minimize barriers that could slow plan execution. The CFO or designated authority should have the flexibility and speed to carry out the plan when required.

While planning and strategy are crucial pillars of effective liquidity management, communication ties it all together. Regular interactions and briefings with ALCO, Risk Committee, and the Board ensure that everyone is aligned, informed, and ready to act when necessary. It's this triad of planning, communication, and execution that can steer a bank safely through the unpredictable waters of liquidity management.

Ongoing Education And Training: Essential For Bank Liquidity Management

In the dynamic world of banking, where regulations shift and economic climates oscillate, maintaining a cutting-edge liquidity and contingency funding plan demands a commitment to continuous learning and adaptation. Here are a few ideas about how to stay on top of the latest best practices:

Peer banks and CFO roundtables: These events allow an exchange of best practices, challenges, and innovative solutions, providing an invaluable perspective that can shed light on potential blind spots and introduce fresh strategies.

Regulatory webinars and workshops: Staying updated with the latest regulatory guidelines and expectations is essential. Webinars and workshops inform about the current requirements and forecast upcoming changes, ensuring that banking executives are one step ahead.

Seeking external expertise: Sometimes, an external viewpoint can be instrumental. Consultants, like our team at First Business Bank, can play a pivotal role in guiding your company in the establishment, execution, and monitoring of your liquidity and contingency funding plan. Focused expertise and an external vantage point can often provide nuances and insights that might be overlooked internally.

By actively engaging in learning opportunities and seeking external expertise, banks can ensure they're not only weathering the challenges of today but are well-prepared for those of tomorrow.

Creating an impeccable bank liquidity and contingency funding plan isn't a one-time achievement but a continual journey of adaptation, learning, and refinement. As banking professionals, our challenge is not just to react but to anticipate. By embracing the strategies and insights highlighted in this article and seeking expertise where needed, institutions can chart a course towards stability and success in any financial climate. Let's navigate these waters together, leveraging knowledge and collaboration to build a robust and future-ready banking world.

Publish date: September 21, 2023