Nearly seven in ten retirees report that giving is a significant source of happiness in retirement. This statistic underscores a broader trend among high-net-worth individuals and families: retirement planning often extends far beyond ensuring personal financial security. For many, it encompasses a deep-seated desire to leave a lasting impact on loved ones, cherished causes, and beloved communities.

Balancing philanthropic goals while maintaining retirement security can be a complex yet rewarding challenge. It requires thoughtful planning, strategic decision-making, and often, the guidance of experienced professionals. By approaching this balance with care and intention, retirees can find fulfillment in giving back while still ensuring their own financial stability.

Cymbre Van Fossen, JD, CAP®, Senior Vice President - Trust Advisor & Director of Philanthropic Services at First Business Bank, advocates for approaching this balance from a perspective of abundance.

"A common misconception is that people should assess their finances from a standpoint of lack rather than abundance," Van Fossen said. "I’ve worked with clients who have truly significant wealth and are charitably inclined but remain trapped in a ‘what if’ scenario where they worry about running out of money or not leaving enough for their children.”

She believes that thorough financial planning combined with creative charitable giving techniques overcomes this hesitancy by reassuring people that they can achieve financial security while still doing good and creating a legacy.

“When we shift our mindset from scarcity to abundance in retirement planning, we open up possibilities for achieving both financial security and meaningful philanthropy," said Van Fossen.

How Can You Align Philanthropic Goals with Retirement Security?

Balancing retirement security and philanthropic goals requires a comprehensive approach to retirement income planning.

"The first step is to thoroughly assess your retirement income sources and investment portfolio," Van Fossen said. This assessment forms the foundation for strategies to support and grow wealth throughout retirement while incorporating charitable giving.

"The first step is to thoroughly assess your retirement income sources and investment portfolio," Van Fossen said. This assessment forms the foundation for strategies to support and grow wealth throughout retirement while incorporating charitable giving.

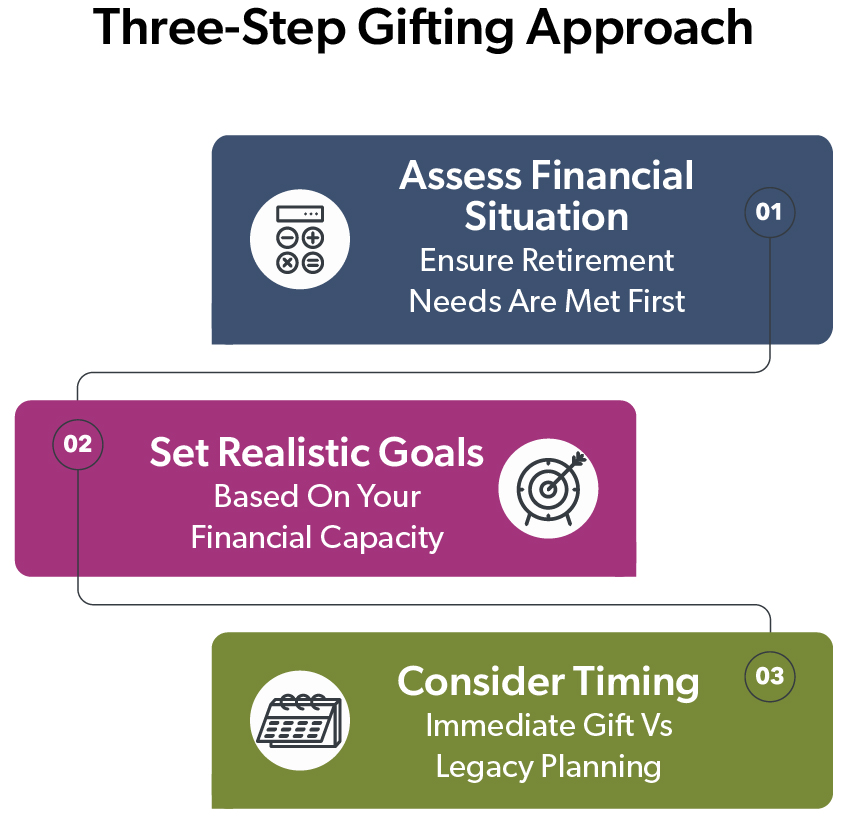

Finding the right balance between generosity and financial stability is key to successful philanthropic planning. Van Fossen recommended a three-step approach:

- Assess your financial situation regularly, ensuring your retirement needs are met first

- Set realistic gifting goals based on your financial capacity

- Consider the timing of gifts — whether immediate or as part of your legacy plan

She outlined several strategies for retirees to support causes they care about while maintaining their financial security :

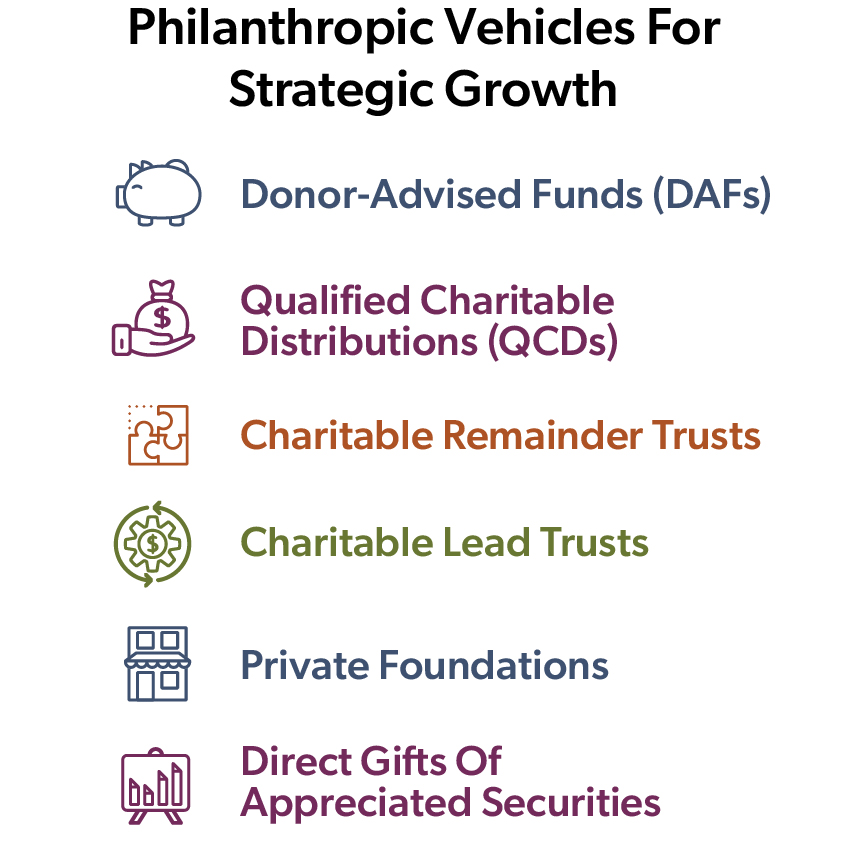

Donor-Advised Funds (DAFs): Giving to a donor-advised fund with your local community foundation may allow you to give larger amounts in a tax-savvy way. "DAFs allow you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time," she explains. "Because a community foundation is classified as a public charity, there may be tax benefits realized (such as avoiding capital gains) by donating appreciated stock rather than cash. Consider 'bunching' your gifts in a single year to get a charitable deduction in a year when you're planning to itemize your deductions."

Qualified Charitable Distributions (QCDs): "For those over 70½, who can live comfortably on other sources of income, QCDs are an excellent tool for charitable giving,” Van Fossen said. “You can donate up to $105,000 annually directly from your IRA to qualified charities, satisfying your required minimum distribution without increasing your taxable income."

Charities as beneficiaries: Consider naming charities as beneficiaries of IRAs and other retirement plan accounts: "This can make sense from both an income tax and estate tax perspective," she said. Charities will never pay income tax on distributions from retirement accounts, and that maximizes the impact of the gift, leaving more after-tax assets to go to children or other heirs. While IRAs are included in the value of your gross estate, you can claim a charitable deduction which will offset any estate taxes.

Charities as beneficiaries: Consider naming charities as beneficiaries of IRAs and other retirement plan accounts: "This can make sense from both an income tax and estate tax perspective," she said. Charities will never pay income tax on distributions from retirement accounts, and that maximizes the impact of the gift, leaving more after-tax assets to go to children or other heirs. While IRAs are included in the value of your gross estate, you can claim a charitable deduction which will offset any estate taxes.

Similarly, consider designating a charity as a life insurance beneficiary. "This can be accomplished easily and revoked at any time. You can name multiple beneficiaries and specify what percentage goes to each," Van Fossen said.

Charitable trusts: Charitable remainder trusts and charitable lead trusts accomplish different goals and are more or less favorable depending on the interest rate environment. The advantage to these “split-interest” trusts is they are structured to provide a benefit to both the charity and to the donor or donor’s heirs. Depending on the type of trust, benefits to the donor may include a current income tax deduction, avoidance of capital gains taxes on appreciated assets donated to the trust, or creation of an income stream for the donor or their heirs. As with other charitable gifts, there is also the potential to reduce gift and estate taxes.

Impact investing: "Consider aligning your investment portfolio with your philanthropic goals through socially responsible or impact investing," she suggested. Those interested in this approach should work closely with a qualified advisor to assess the appropriate balance between risk, investment returns, personal financial goals and projected societal benefits.

Private foundations: In addition to certain tax benefits, private foundations are well positioned to help families fine tune their philanthropic goals and legacy planning. Multiple generations can work together on grant-making and gain a deeper appreciation of the family’s mission, priorities, and values.

How Do Tax Strategies Affect Retirement Security and Charitable Giving?

Effective tax planning is essential to balance retirement security with philanthropic goals. Van Fossen recommended a multi-faceted approach, emphasizing the importance of consulting with tax professionals for personalized recommendations.

"Strategic withdrawal planning is key to minimizing retirement income tax liabilities," Van Fossen explained. "By carefully orchestrating withdrawals from various accounts, you can potentially reduce your overall tax burden and preserve more wealth for both personal use and charitable giving."

How Can Legacy and Estate Planning Protect Your Philanthropic Goals?

"A well-crafted estate plan is fundamental to securing your legacy," Van Fossen said. "There are many creative and cost-effective ways of giving that allow those with even moderate wealth to create a cohesive philanthropic plan. A good legacy plan considers your entire 'capital' – time, talent and expertise, social influence, and active engagement with the change mission."

Key elements of a robust estate plan include:

- A will that clearly outlines your asset distribution preferences

- Power of attorney documents for financial and healthcare decisions (with lifetime gifting language)

- Trusts, when appropriate, to manage asset distribution and potentially minimize taxes

- Appropriate beneficiary designations for IRAs and life insurance

“A good financial plan incorporates long-term care and other types of insurance, and plans for potential large outflows for healthcare needs,” she said. “Certain charitable giving techniques can guarantee an income stream during your lifetime, while leaving the residue to charity, and can be an important part of diversifying income sources in retirement. If your own needs are covered, consider making gifts for benefit of the next generation by paying premiums on long-term care insurance policies. If you gift long-term care insurance, the premium payment is exempt from gift taxes so long as they are made directly to the insurance carrier.”

Should You Involve Family In Your Philanthropic Goals?

Van Fossen emphasized the importance of open communication with family members about philanthropic intentions and with charities to ensure gifts are used as intended.

“Engaging your family in philanthropic decisions can create a multi-generational approach to giving," she said. "This not only ensures your values are passed down but can also enhance family bonds and teach important lessons about financial responsibility and social impact."

Finally, your philanthropic goals may change over time, as well as your financial resources. Our experts recommend reviewing your strategies and overall plan regularly. By optimizing your retirement income, tax strategies, and estate planning, you can achieve your philanthropic goals while maintaining financial stability.

With expert guidance from a team of professionals, including wealth advisors, estate planning attorneys, and tax professionals, you can create a legacy that reflects your values without compromising your retirement security. Ultimately, thoughtful planning will allow you to enjoy a comfortable retirement while making a meaningful impact through your charitable giving.