As digital transactions multiply and scams grow more sophisticated, managing payment fraud risk is a critical challenge for businesses of all sizes. With the increase in electronic transactions, businesses are particularly vulnerable to many types of business payment fraud, including unauthorized automated clearinghouse (ACH) transactions, check fraud, and wire transfer scams.

This article offers actionable strategies and insights to help businesses enhance their payment fraud prevention measures and secure their financial operations.

While business owners may assume they have the same protections against liability as consumers, this is not the case. Understanding the risks and implementing proactive measures to manage payment fraud is essential for safeguarding your company's finances.

What Are Electronic Payment Fraud Risks for Businesses?

Electronic payments, such as ACH transactions, wire transfers, and debit card transactions, are common targets for fraudsters. Businesses have significantly less time than consumers to report fraud cases. The ACH dispute time frame is only 24 hours for unauthorized ACH withdrawals from a bank account compared to 60 days for personal accounts.

This discrepancy stems from different governing restrictions and ACH fraud dispute rules for business accounts. Consumer electronic transactions fall under Federal Reserve Regulation E and National Automated Clearing House Association (NACHA) rules, limiting consumer liability for unauthorized transactions disputed within a reasonable timeframe. Businesses, however, are covered by the Uniform Commercial Code (UCC) and must notify their financial institution immediately of any disputed transactions to avoid liability.

Why Are Checks the Top Target for Business Bank Account Fraud?

Despite the rise of electronic payments, checks remain the most targeted payment type for business fraud. The latest AFP Payments Fraud and Control Survey revealed that 63% of organizations experienced checking account fraud.

See examples of real checking account fraud scams and learn how to spot them.

While check usage is declining, fraudsters are still targeting checks due to a few reasons:

- Easier Manipulation: Paper checks are easier to manipulate with techniques like check washing or counterfeiting compared to digital transactions.

- Slower Detection: The "float" period between when a check is deposited and the funds are withdrawn allows fraudsters time to disappear before the theft is discovered.

- Increased Reliance on Mail: A rise in mailed checks created more opportunities for theft during mail delivery.

What Are the Best Practices for Managing Business Fraud Risk?

To proactively manage business payment fraud risk, consider implementing the following best practices:

- Use Business Payment Fraud Prevention Solutions: Partner with your bank to enroll in available business fraud mitigation services, such as ACH Debit Block, Positive Pay, Payee Positive Pay, and ACH Positive Pay. These business fraud protection tools help prevent and quickly identify fraudulent transactions.

Review Account Agreements: Thoroughly review your bank's Deposit Account Agreement, including any Commercial Client Standards of Care outlining your responsibilities for business fraud prevention.

Review Account Agreements: Thoroughly review your bank's Deposit Account Agreement, including any Commercial Client Standards of Care outlining your responsibilities for business fraud prevention.- Monitor Accounts Daily: Enroll in online business banking and check your accounts daily for unusual transactions or unauthorized ACH transfers. Set up fraud alerts for immediate notification via email or text message.

- Implement Dual Controls and Segregate Duties: Avoid giving a single employee full control over financial transactions. Implement dual controls requiring one person to initiate and another to approve payments. Assign someone outside of the payment initiation process to reconcile accounts daily.

- Secure Account Information: When setting up wire or ACH templates, lock down account information to prevent unauthorized changes. Regularly review and update authorized signers on accounts.

- Educate Employees: Provide frequent, concise business fraud prevention training to employees through emails, newsletters, or quick reminders. Encourage a top-down approach with executives emphasizing the importance of vigilance.

- Consider Insurance Coverage: Review your liability insurance policy and consider adding coverage for losses due to business account fraud.

Why Is Timely Reconciliation of Business Bank Accounts Important?

Promptly reconciling your accounts is a critical step in managing bank account fraud risk. With only a 24-hour window to report unauthorized transactions and avoid liability, businesses must stay on top of account activity. First Business Bank recommends assigning someone outside of the payment initiation process to reconcile accounts daily, ensuring an independent review and enabling quick identification of suspicious transactions and potential payment fraud.

What Are Secure Online Banking Practices to Prevent Bank Account Fraud?

What Are Secure Online Banking Practices to Prevent Bank Account Fraud?

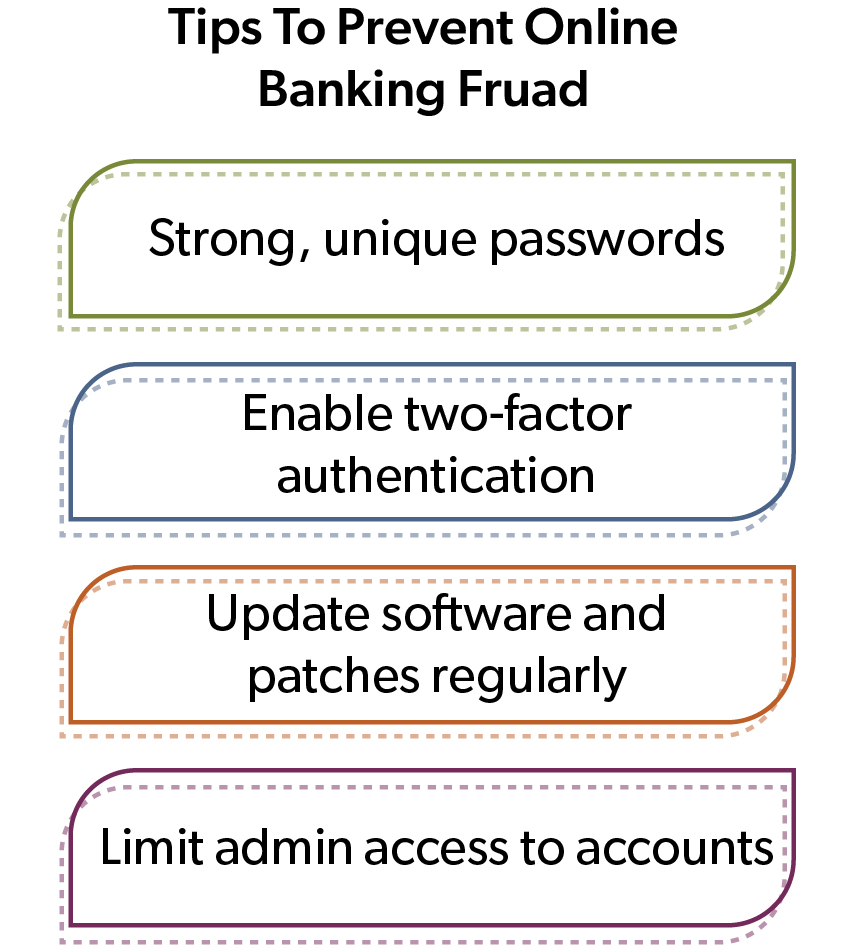

Tips to prevent online bank account fraud—use strong, unique passwords, enable two-factor authentication, update software and patches regularly, and limit admin access to accounts. Protect your online business banking accounts by using strong, unique passwords, and enabling two-factor authentication whenever possible. Regularly update and patch your systems to address vulnerabilities and limit administrative access to only those employees who require it for their roles.

How Do Vendor Management and Secure Payment Processes Prevent Business Fraud?

Thoroughly vet all vendors and implement secure payment processes to prevent business bank account fraud. Require verbal confirmation for any changes to payment instructions and verify requests through a previously known contact number before processing. Educate your accounts payable staff on these procedures and emphasize the importance of vigilance.

What Should Be Included in a Payment Fraud Incident Response Plan?

Develop a clear incident response plan outlining the steps to take if you suspect payment fraud, including key contacts, such as your bank's fraud department and local law enforcement, and set up reporting procedures. Quick action is essential for minimizing losses, so ensure all relevant staff are familiar with the plan.

How Can You Stay Informed on Payment Fraud Trends?

As payment fraud continually evolves, staying informed on emerging trends is crucial. The latest AFP Payments Fraud and Control Report notes that 71% of participating organizations say they experienced business email compromise (BEC) attacks. The FBI's Internet Crime Complaint Center (IC3) data shows the average cost of a successful BEC attack surpasses $125,000.

Fraudsters are also increasingly targeting real-time payments and exploiting the accelerated shift to digital transactions. Regularly review industry reports and participate in webinars or workshops to stay current on the latest threats.

What Are The Steps To Take If You Suspect Payment Fraud?

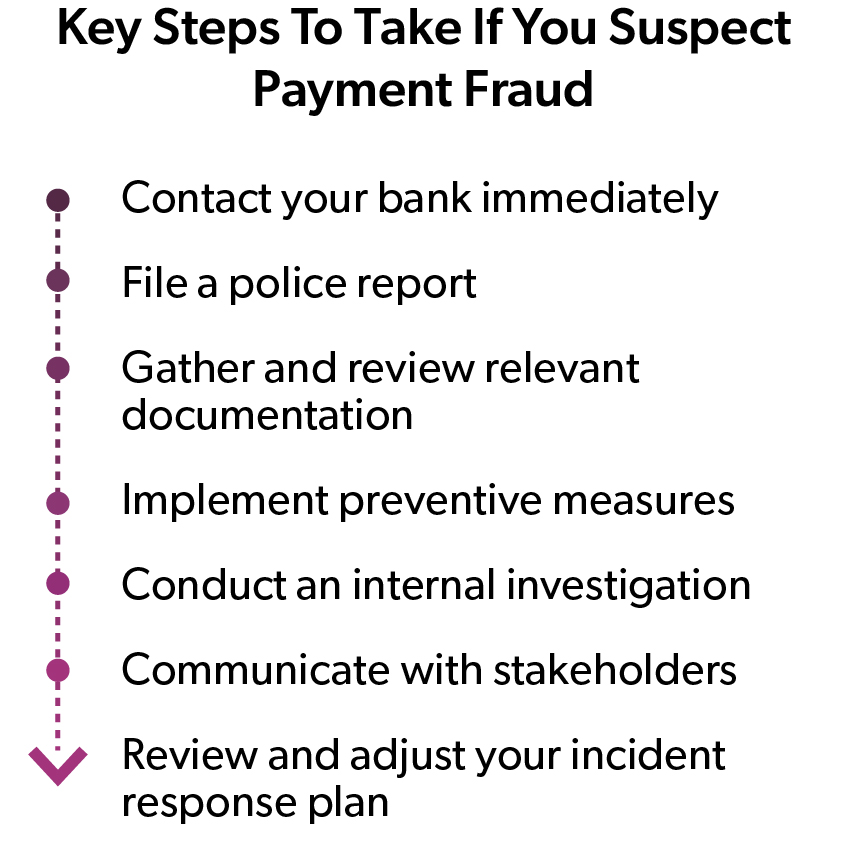

If you suspect business bank account fraud, act fast to minimize potential losses and protect your company's finances. Here are the key steps to take:

Contact Your Bank Immediately: As soon as you see suspicious activity or unauthorized transactions, reach out to your bank's fraud department. Provide all relevant information, including the affected account number, transaction details, and any supporting documentation. Timing is critical, so don't delay.

Contact Your Bank Immediately: As soon as you see suspicious activity or unauthorized transactions, reach out to your bank's fraud department. Provide all relevant information, including the affected account number, transaction details, and any supporting documentation. Timing is critical, so don't delay.- File a Police Report: In addition to notifying your bank, file a report with your local law enforcement agency. This step is crucial for documenting the incident and potentially recovering lost funds. Obtain a copy of the police report, as your bank and insurance provider may need it.

- Gather and Review Relevant Documentation: Collect all pertinent documentation related to the suspected business bank account fraud, such as account statements, invoices, and email correspondence. Review this information to identify any patterns or additional suspicious activity that may have gone unnoticed initially.

- Implement Preventive Measures: After reporting the suspected payment fraud, work with your bank to implement fraud protection for business and more preventive measures to secure your accounts. This may include enrolling in fraud prevention services like ACH Debit Block or Positive Pay, updating account signers, or establishing new security protocols within your organization.

- Conduct an Internal Investigation: Launch an internal investigation to figure out how the bank account fraud occurred and identify any gaps in your company's security measures. This may involve reviewing internal controls, auditing employee access to financial systems, and assessing vendor management practices. Based on your findings, develop and implement a plan for business fraud protection and to strengthen your defenses against future fraud attempts.

- Communicate with Stakeholders: Depending on the nature and extent of the suspected fraud, you may need to communicate with various stakeholders, such as your board of directors, shareholders, or customers. Work with your legal counsel and public relations team to develop a suitable communication strategy that transparently addresses the situation while minimizing potential reputational damage.

- Review and Adjust Your Incident Response Plan: After the payment fraud incident, review your company's incident response plan and make any necessary adjustments based on lessons learned. This may include updating contact information, revising protocols, or providing more training to employees. Regularly review and test your incident response plan to ensure it’s still effective in the face of evolving bank account fraud threats.

How Can You Partner With Your Bank To Manage Payment Fraud Risk?

Managing payment fraud risk is a collaborative effort between businesses and their banking partners. Work closely with your bank to understand the available fraud prevention services, such as ACH Debit Block, Positive Pay, and ACH Positive Pay. These fraud protection tools for business can help automate the process of identifying and preventing fraudulent transactions.

Additionally, take advantage of your bank's expertise and resources. Many institutions, like First Business Bank, offer educational materials to help clients stay informed about the latest fraud trends and best practices for managing risk.

How Can You Secure Your Business’s Future Against Payment Fraud?

Managing payment fraud requires vigilance, advanced planning, and the use of sophisticated tools and strategies. By understanding the specific risks associated with different types of payment methods and implementing a layered approach to security, businesses can significantly reduce their vulnerability to fraud. It is crucial for businesses to stay informed about the latest trends in payment fraud and continuously update their security practices and technologies. With these measures in place, businesses can protect their assets and maintain the trust of their clients and partners.

Stay vigilant, educate your employees, and create a culture of security to safeguard your business from financial harm. The cost of prevention and fraud protection for business is far less than the potential cost of a fraud incident. Take action today to strengthen your defenses against payment fraud and secure your company's financial future.